Sectors that typically surge toward the end of bull markets are now falling behind. Despite last week’s volatile trading sessions, the primary trend in the U.S. stock market remains upward. This conclusion is supported by the sector relative-strength rankings, despite recent market fluctuations.

My optimistic outlook is based on an analysis of sector performance during the final stages of bull markets. However, recent market behavior deviates from historical norms: sectors that usually thrive in the late stages of bull markets are struggling, while traditionally weaker sectors are unexpectedly leading.

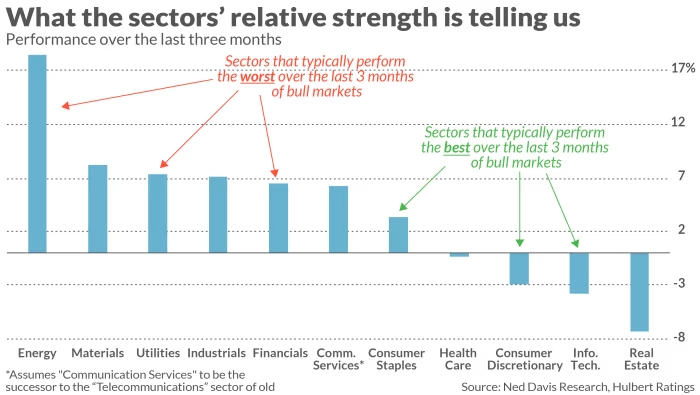

This deviation is evident in the accompanying chart, highlighting the disparity between recent sector relative-strength and historical trends. Although this divergence doesn’t definitively affirm the continuation of the bull market, it suggests that prematurely dismissing it may be unwise.

The recent rally in the S&P 500 at the beginning of this week indicates that many investors share this sentiment, despite six consecutive sessions of decline last week.

Twice within the past year, I’ve assessed the market using sector relative-strength rankings. In early April 2023, amidst widespread skepticism toward the nascent bull market, I contended that the rankings signaled the emergence of a new bull market rather than a correction in a bear market. Since then, the S&P 500 has surged by over 22% on a total-return basis.

Similarly, in mid-August 2023, when the S&P 500 was 5% below its recent peak, I argued against interpreting the weakness as the end of the bull market. Since then, the S&P 500 has risen by 15% on a total-return basis.

To gauge the extent of the current deviation from the historical pattern for bull market endings, it’s instructive to examine the rank correlation coefficient between the two. This statistic, ranging from a theoretical maximum of 1.0 (indicating identical rankings) to minus-1.0 (indicating perfect inverse rankings), currently stands at minus-0.70, one of the lowest readings in recent decades.

In contrast, last August, the correlation coefficient was minus-0.01, and in April 2023, it was plus-0.31. Evidently, sector relative-strength readings are increasingly diverging from the typical pattern observed at the end of bull markets.

In summary, premature reports of the bull market’s demise may be unwarranted.