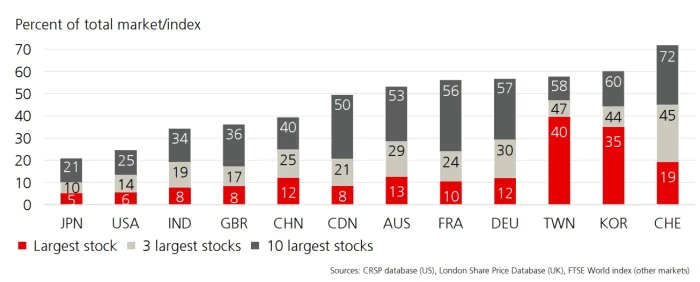

Despite the widespread discussion of the dominance of a select few companies like the Magnificent Seven driving stock-market gains, the reality is quite different: the U.S. market is among the least concentrated globally.

According to the latest insights from the global investment returns yearbook, authored by Paul Marsh and Mike Staunton of London Business School and Elroy Dimson of Cambridge University, now published at UBS following Credit Suisse’s demise, the U.S. ranks as the second-least concentrated market among the world’s top 12.

However, this doesn’t necessarily imply long-term stability. During a discussion with journalists, the authors emphasized the inherent uncertainty in predicting the market’s future.

Dimson remarked, “The future is very uncertain, always,” while Marsh highlighted the difference between the current market and the dot-com era, noting that today’s market leaders are profitable, albeit with concerns about valuation rather than fundamental quality.

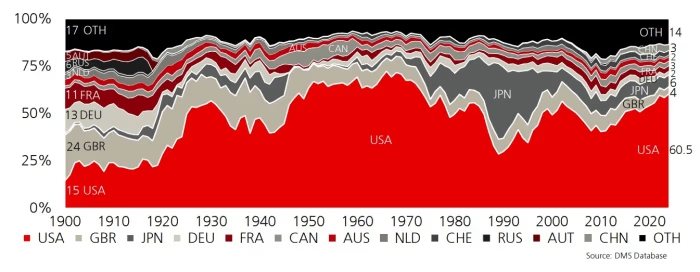

Although the U.S. maintains its dominance in global stock markets, comprising 61% of total market capitalization as of last year’s end, its historical performance may not be replicated in the future.

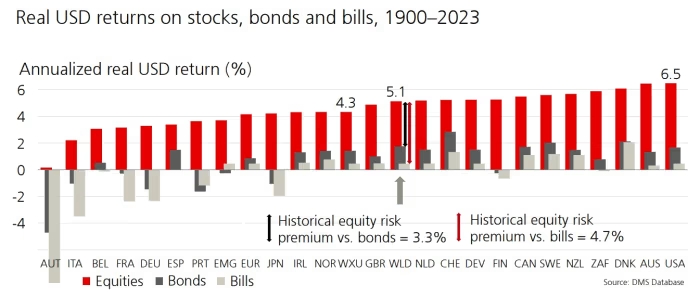

Over the past 124 years, U.S. stocks have yielded an inflation-adjusted return of 6.5%, outperforming global stocks by 1.4%. Yet, the authors caution against expecting similar returns in the future, attributing much of the past success to generational luck rather than sustainable trends.

Looking ahead, they anticipate lower returns for Generation Z compared to previous generations, estimating annual real returns of 4.5% on stocks, 2% on bonds, and 3.5% on a 60/40 portfolio. While this falls short of the returns experienced by baby boomers, it aligns with the stock-market performance observed by millennials.