Strategists Say to Focus on Less-Risky Quality Cyclicals as S&P 500 Stalls

With the S&P 500 appearing “stuck” in its current range, Morgan Stanley strategists are urging investors to shift their focus toward high-quality cyclical stocks that have already priced in a slowdown in earnings and the broader economy.

Led by Mike Wilson, the Morgan Stanley team noted that the S&P 500 is struggling to break out of the 5,000 to 5,500 range. They see the next resistance level between 5,600 and 5,650 but don’t anticipate a sustained breakout until key developments occur — namely, a significant reduction in U.S. tariffs on China (currently around 145%), clear signals of interest-rate cuts from the Federal Reserve, a drop in the 10-year Treasury yield below 4.0%, and a decisive rebound in corporate earnings revisions.

This week could be pivotal, with important data releases ahead. Wilson and his team pointed to the April nonfarm payrolls report and the ISM manufacturing data due Thursday. A sharp swing in the ISM reading — expected between 46 and 48 — could drive market movement. While investors have priced in a modest slowdown, they have not yet factored in the possibility of a labor cycle downturn or mild recession, the strategists warned. They emphasized the need for several months of labor market stability before risks would meaningfully decline.

For now, Wilson recommends a cautious but opportunistic approach: maintaining some exposure to defensive sectors while selectively investing in high-quality cyclicals that have already adjusted for a slower macro and earnings environment.

Morgan Stanley defines “quality” companies as those with strong management, consistently high long-term returns, and solid balance sheets. “Cyclicals” are businesses more sensitive to the ups and downs of the economy.

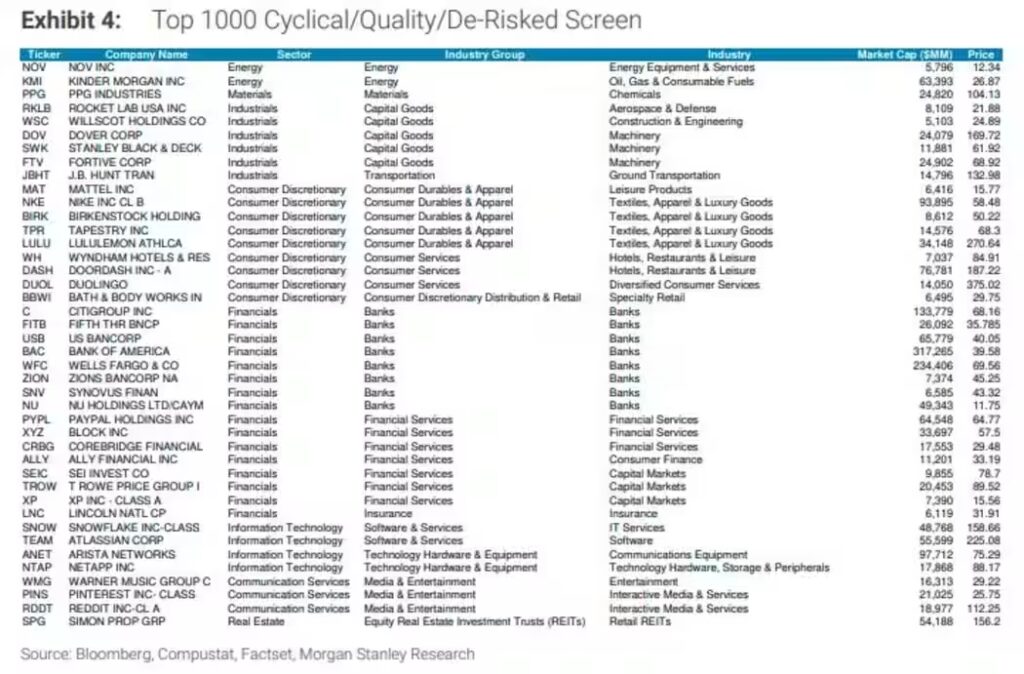

They screened the top 1000 stocks by market cap, looking for those rated overweight or equal weight by Morgan Stanley, considered cyclical based on sector assessments, and showing signs of being oversold but less risky according to metrics like PMI expectations, forward earnings growth versus consensus, and historical recession performance.

The top five stocks from this new screen include:

- NOV (Oilfield services)

- Kinder Morgan (Energy infrastructure)

- PPG Industries (Paints and coatings)

- Rocket Lab (Space and aerospace)

- WillScot Mobile Mini Holdings (Mobile storage solutions)

Other notable names include Mattel and Nike, as well as several banks.

Wilson’s team currently prefers U.S. equities over international, noting that a weaker dollar should favor U.S. earnings revisions compared to Europe and Japan. They believe that less volatile earnings and a quality tilt make U.S. stocks more attractive in today’s late-cycle market environment.