The S&P 500’s impressive rally may encounter a setback due to Tesla’s disappointing performance, leading to a decline in its premarket shares.

Investors await updates from other tech giants in the Magnificent Seven, including Microsoft (MSFT), Alphabet (GOOGL), and Apple (AAPL), next week. Despite this, the tech stock group has shown a robust start to the year.

Questions arise about the valuation of U.S. stocks, considering the attractive 4%-plus yield offered by 10-year Treasurys. Joachim Klement, head of strategy at Liberum Capital in London, defends stocks in the current scenario.

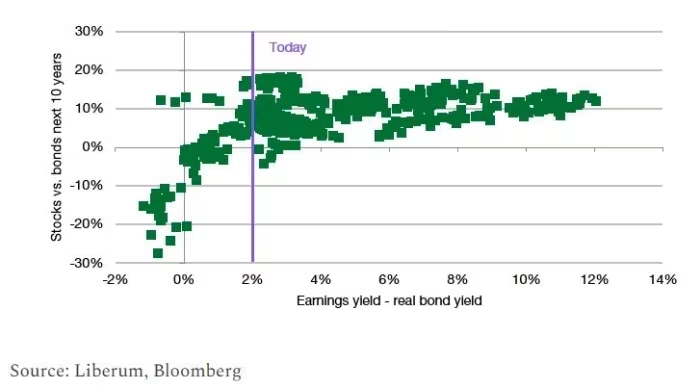

While acknowledging concerns about stock valuations, Klement conducts a “sense-check” using the Fed model, a widely-used tool for market-timing. This model compares earnings yields for equities against real bond yields for government bonds, using real bond yields that remain unaffected by inflation.

Contrary to the expectation that stocks may be overvalued, Klement employs the Fed model to analyze relative returns for U.S. stocks versus bonds. The conclusion, based on historical relationships, suggests an anticipated outperformance of stocks over bonds by approximately 4.5% per year for the next decade.

It’s worth noting that not everyone subscribes to the Fed model as the ideal method for valuing stocks, citing instances where it failed to predict significant downturns, such as the 2008 recession.