Taiwan Dollar Surge Could Signal Looming U.S. Dollar Meltdown, Analyst Warns

A sharp rally in the Taiwan dollar may be an early warning of a broader and more chaotic downturn in the U.S. dollar, according to longtime currency strategist Stephen Jen.

Currency markets have seen significant volatility in recent days, raising concerns among investors. Jen, CEO and co-CIO of Eurizon SLJ Capital, has been cautioning since late 2022 that the greenback is at risk of a sudden and disorderly decline — an “avalanche,” as he calls it. Now, he believes that moment may be near.

In a report shared with MarketWatch on Wednesday, Jen and co-author Joana Freire pointed to the Taiwan dollar’s recent spike — along with gains in other Asian currencies — as a possible precursor to a broader selloff in the dollar.

“We believe the risk of investors being blindsided by a non-linear selloff in the dollar continues to grow,” they wrote. “The Taiwan dollar’s sharp move last week is one example. We expect more to come.”

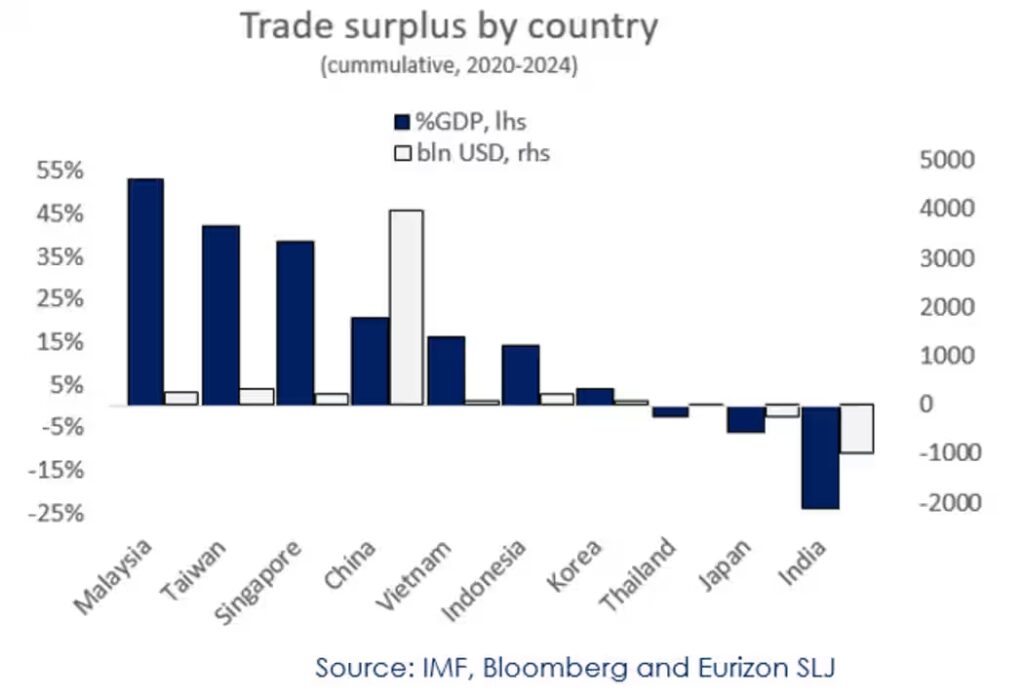

The pair attributes the risk to evolving geopolitical dynamics, shrinking interest-rate differentials, and the substantial dollar reserves amassed by major U.S. trading partners since the start of the COVID-19 pandemic. Jen estimates that countries such as China, Taiwan, Malaysia, Vietnam, and others now collectively hold more than $2.5 trillion in dollar-denominated assets — with an annual increase of approximately $500 billion. A significant portion of these assets is invested in highly liquid money-market instruments, which frequently fall outside conventional measures of investment flows.

The chart accompanying their report shows that nations like Malaysia, Taiwan, Singapore, China, and Vietnam have racked up large trade surpluses with the U.S. since 2020. If exporters from these countries start reducing their dollar holdings, it could put substantial downward pressure on the currency. Jen believes this risk is amplified by a widespread belief that the it is overvalued — a perception that could trigger mass selling if the dollar begins to slide.

“The overhang of liquid dollar assets is too large,” Jen and Freire warned. “If the dollar weakens, the Fed cuts rates, and China rebounds, this could set off the avalanche.”

While the Federal Reserve was not expected to cut rates at the conclusion of its latest policy meeting, markets are pricing in roughly 75 basis points of easing in 2025.

Another emerging concern is that a potential second term for Donald Trump could lead to policies that prompt foreign central banks to reduce their dollar reserves. While central bank dollar holdings have been in decline for years, there’s little evidence so far that foreign investors are actively offloading U.S. bonds.

Jen sees China as the biggest current risk. The People’s Bank of China has tightly managed the yuan in 2024, maintaining stability even as the dollar has weakened against most other major currencies. The ICE U.S. Dollar Index (DXY) has dropped more than 8% this year and was recently hovering near a three-year low at 99.45.

Jen and Freire caution that any combination of resumed Fed rate cuts or renewed accusations of currency manipulation — such as those levied against China during Trump’s first term — could prompt Beijing to let the yuan strengthen, setting off broader dollar weakness.

But like a real avalanche, predicting the trigger is difficult. “For now,” Jen said, “we watch and wait.”

Jen, formerly head of currency research at Morgan Stanley and known for popularizing the “dollar smile” theory, noted that the greenback typically rises either in times of strong U.S. growth or global distress.

Yet in just two days through Monday, the U.S. dollar lost more than 9% against the Taiwan dollar — the largest such move on record since at least 2007, according to Dow Jones Market Data. Other Asian currencies, including the South Korean won, also posted significant gains, though less extreme.

By Wednesday, the Taiwan dollar and others had retreated from their highs, but the episode has reignited speculation about foreign investors potentially offloading dollar assets.

Still, not all analysts are convinced. A Barclays team downplayed the significance of the Taiwan dollar’s rally and advised clients to “fade” the move. They argued that Taiwanese insurers are unlikely to sell U.S. dollar assets at a loss, just as they avoided doing so in 2022 when rising U.S. interest rates weighed on bond prices.

Back then, the strength helped offset portfolio losses in local-currency terms. Today, the situation is more complicated.

While Treasury yields surged Friday, economists say the move was likely driven by a strong April jobs report, not Taiwanese selling. That said, Deutsche Bank analysts have found some evidence of outflows — a new tracker showed Taiwan ETFs sold U.S. fixed-income assets on Monday.