Remember to Roll Over Your Futures Contracts

If you trade the E-mini S&P 500 Futures, remember that you will need to roll over to the next contract period (December, 2013) by September 20, 2013. On September 20, 2013, the current contract period expires. Note that it is possible to switch over earlier – you can visit the CME’s website and compare the […]

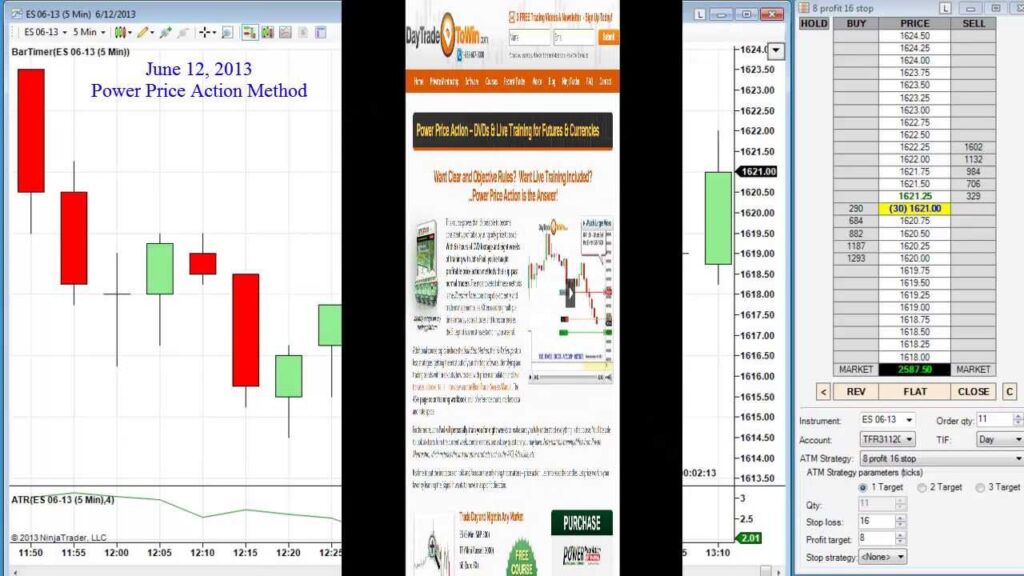

Live Price Action Webinar Sponsored by NinjaTrader

Watch the video above to learn a few handy day trading strategies you can use right away. This hour+ long webinar sponsored by NinjaTrader demonstrates the versatility and effectiveness of price action trading. This video places emphasis on our Power Price Action trading course and why you should be using its methods. First, John Paul […]

Price Action Pullback Trades on E-mini S&P

» Get the Atlas Line « In this video, John Paul shows us an Atlas Line trade and also how to deal with oversold market conditions. John Paul says that after a big move occurs, the market will pause and take a “breath.” During this recovery phase, price may chop back and forth and leave […]

Atlas Line Used with Power Price Action Blueprint Method

» Get the Atlas Line « When you have two separate strategies telling you to go either long or short, you feel more confident in taking the trade. In this video, John Paul shows how a technique called the Blueprint Trade (taught in the Power Price Action DVD course) coincides with a Long signal produced […]

+2 E-mini Points Using the Power Price Action Blueprint Trade

» Get Power Price Action « In this video, John Paul takes a Blueprint Trade, the main strategy taught in the Power Price Action course. Since the strategy is based entirely on price action, only time and price movement are considered for recognizing the entries and calculating the profit target and stop loss. The Bar […]

Atlas Line Performance Shown in Equity Curve

Ron Wichgers, an Atlas Line trader and trading instructor from the Netherlands, recently shared with us his thoughts on analyzing trading system performance. Using the Atlas Line data from our recent trades page from Jan. 1, 2013 through May 31, 2013, he’s created the graph below. Based on his professional trading experience, he’s also provided […]

Live Trade Taken for 3 Points During Today’s Atlas Line Webinar

» Get the Atlas Line « At about 5:30 into the video, you can see John Paul enter a live trade in front of the attendees. The Atlas Line said to go long at 10:00 a.m. Using his live account, he bought the market at 1630.50. The ATR was at 3.48, so John Paul’s profit […]

2 Points in Under 2 Minutes While Trading the E-mini

» Get the Atlas Line « On June 5, 2013, the Atlas Line produced a short signal at 1626.50 on the close of the candle at 9:55 a.m. US/Eastern. Remember, the rule is two closes above or below the line for an entry signal. You can see how there was a doji that precedes the […]

Using Atlas Line for 3.25 Points on E-mini S&P

» Get the Atlas Line « On June 3, 2013, the Atlas Line produced a Short signal around 11:00 a.m. Note that the actual text for the Atlas Line always plots a few bars back from the actual entry. So the price and time for the entry is really 1626 because you enter when there […]

Roadmap Trade Good for 7 Ticks on E-mini S&P

» Learn the Roadmap in Group Mentorship « At DayTradetoWin, we often get asked, “What is the Roadmap trade?” We can’t tell you exactly what it is, as it’s taught in the Mentorship Program only. We can tell you that it’s based on a specific price pattern that occurs quite often when the market is […]