Understanding the Markets Using Price Action

Oscillators, channels, stochastics, moving averages – if you’ve ever tried using indicators, these names are familiar. Using these types of indicators can lead to shortsighted trading. It’s easy to say that a particular configuration of indicators was successful for a period of many days. However, indicators are often linked to fixed parameters that do not […]

Dec. Contract Rollover on Thursday, Sept. 13, 2012

If you trade CME Futures (like the E-Mini or the Euro currency), remember to roll over to the December 2012 contract contract this Thursday, September 13. In NinjaTrader, you will need to switch the contract from the current setting (probably “06-12”) to “12-12” in the Instrument Manager. If you need exact instructions, visit the FAQ page. […]

August 2012 Atlas Line Trades

Yes, it’s a little early to get August’s full report, so we’ll calculate the results for the last 30 days (July 25, 2012 to August 24, 2012). These stats were compiled using data from the Recent Trades page. The results do not account for slippage, brokerage fees, trading platform fees, etc. Atlas Line Trades for […]

Today’s NinjaTrader Event – Tips for Every Trader

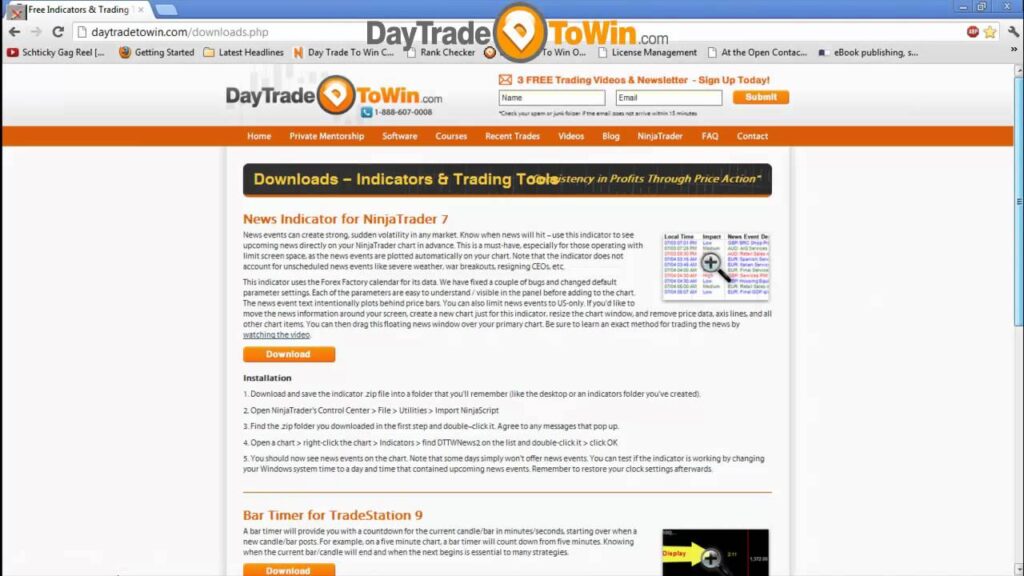

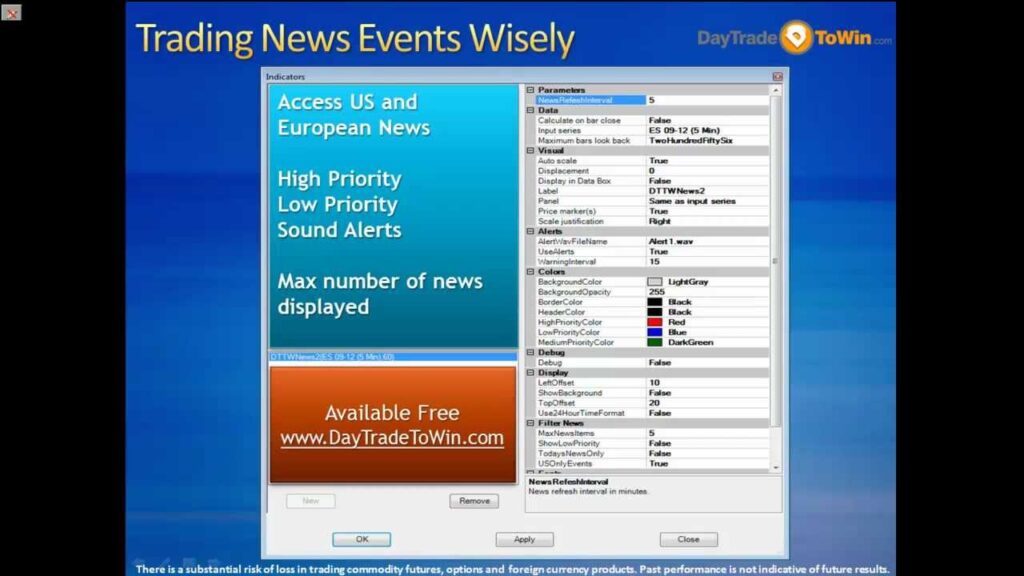

John Paul conducted a webinar today for NinjaTrader, our partner. Topics discussed include: • How to use the ATR (Average True Range – included with NinjaTrader) • How to trade news events (using yesterday’s news events as a prime example) • How to use our free news indicator • Currency trading vs. E-Mini trading • […]

Today’s Live Webinar Recording – Understanding the Markets

Quite a few people were requesting the recording of today’s webinar. Here it is! It’s recorded in John Paul’s view, so you can see the chat box for easy discussion reference. In this live webinar, John Paul shared his live charts and talked about: • HFT and manipulation • Effects on the market caused by […]

Atlas Line Trades for July and TradingPub Webinar

Here’s a recap of July 2012’s Atlas Line trades. These stats were compiled using data from the Recent Trades page. The results do not account for slippage, brokerage fees, trading platform fees, etc. Atlas Line Trades for July 2012 Total # of trades = 65 Total # of days traded = 20 Total net profit […]

Last 3 Months of Atlas Line Trades

It’s time for a recap of John Paul’s Atlas Line trades for the last three months! These stats were compiled using data from the Recent Trades page. All trades were taken between 9:30 a.m. and 1:00 p.m. US/Eastern. Note that your trading experience may differ based on your data feed and Atlas Line configuration. The […]

New Website Launched

Within the last week, you may have noticed a new look throughout the website. After a couple months of planning and design, the new Day Trade to Win website is much improved. With a focus on content and the success of our students / clients, we’ve revamped nearly every page. A few pointers for navigating […]

Atlas Line Performance on May 22, 2012

Do you know when to go long and short? The Atlas Line tells you the direction you should trade along with entry prices. The May 22, 2012 ES (E-Mini) price activity perfectly demonstrated why the Atlas Line is leagues above other trading tools. Notice the early Long signal and multiple entries taken in the Long […]

Atlas Line Performance on May 21, 2012

Purchase the Atlas Line Here’s a live trading video on the ES (E-Mini) for May 21, 2012. John Paul enters the market long at 1310.75 according to the Atlas Line software’s advice – a Strength signal. His profit target is 1 point (4 ticks), as determined by the ATR (Average True Range). In the included […]