The market took a tumble a day before Valentine’s, prompting speculation of an exaggerated reaction. However, stock futures suggest bargain hunters are already sniffing around. Chris Weston, Pepperstone’s head of research, notes that the market was caught unprepared, with few safeguards in place and an overly optimistic stance on risk.

He highlights the frustration for those betting against risk, as sell-offs like this often lack sustained momentum. The Federal Reserve’s preferred inflation metrics are still pending, set for release on February 29.

Tom Lee, head of research at Fundstrat, a prominent bull on Wall Street, deems Tuesday’s stock plunge an overreaction, predicting it won’t gain traction. Lee, who accurately turned bullish in 2023 when others were bearish, believes this downturn will be temporary, though he warns investors to brace for a challenging first half of the year.

Lee’s bullish stance is supported by several factors. Firstly, he observes that markets typically don’t falter on positive news, as was the case with Tuesday’s Consumer Price Index (CPI) data. He also notes that despite inflation concerns, the downward trend hasn’t halted.

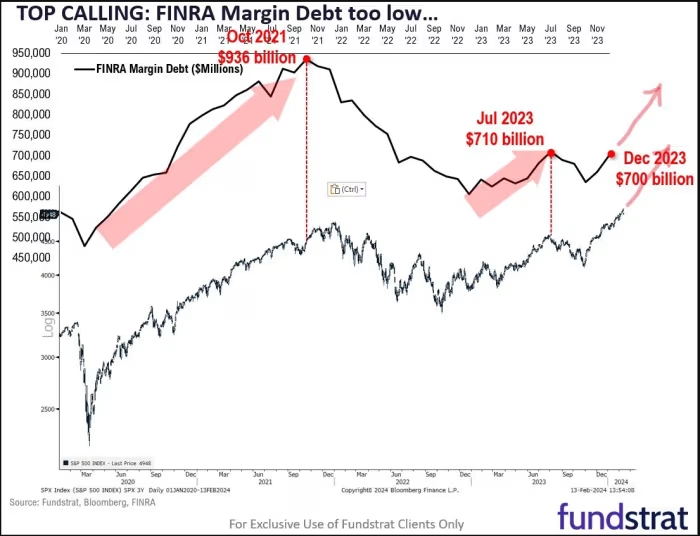

Secondly, Lee points to ample “dry powder” on the sidelines, suggesting that buying power has yet to peak. He compares the current level of NYSE margin debt to previous market tops, indicating room for further borrowing before a downturn.

Furthermore, the presence of significant cash reserves, as mentioned by a BlackRock executive in November, supports the notion that the market hasn’t reached its zenith. Lee emphasizes that skepticism remains prevalent, which typically doesn’t coincide with a market peak.

Lee anticipates that a significant macroeconomic event triggering a stock sell-off could signal the peak. In the meantime, he advises investors to focus on small-cap stocks, particularly through the iShares Russell 2000 ETF, which he believes will rebound as the market stabilizes.

The Russell 2000 index suffered the most on Tuesday, experiencing its largest single-day decline since June 2022, yet Lee remains optimistic about its prospects once the market regains its footing.