This year, the iconic 60:40 portfolio is staging a remarkable comeback, performing exactly as anticipated. This classic allocation, favored by retirees and near-retirees, splits investments with 60% in stocks and 40% in bonds. While it faced adversity last year with one of the worst U.S. calendar-year losses in history, it’s made an impressive rebound.

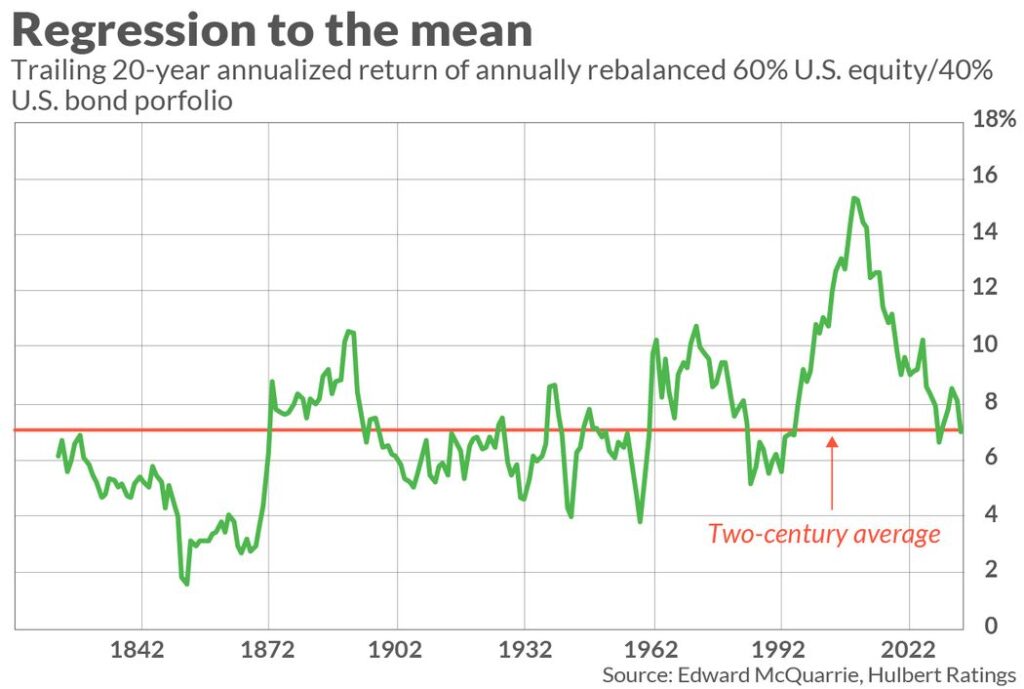

This revival wasn’t due to any intricate market-timing prediction but rather the principle of “regression to the mean.” This concept, often referred to as the “most powerful force in financial physics,” suggests that after experiencing an extreme return, the portfolio’s subsequent performance tends to revert closer to its long-term average.

Through October 18, a portfolio allocated 60% to the Vanguard Total Stock Market Index ETF (VTI) and 40% to the Vanguard Long-Term Treasury Index Fund (VGLT) has shown a year-to-date gain of 2.9%, equivalent to a 3.8% annualized gain, in stark contrast to the 23.5% loss it experienced in 2022.

This return to the mean is consistent with historical data, where a yearly-rebalanced 60:40 portfolio has averaged a 7.1% annualized return. This year’s 3.8% annualized return aligns more closely with this long-term average compared to the significant loss from the previous year.

As shown in the accompanying chart, the trailing 20-year return of the 60:40 portfolio closely mirrors its long-term average. This dispels concerns from critics who argue that it’s coming off a period of unusually high returns, suggesting lower future returns. This argument held weight 15 years ago when the trailing-20-year return was at a record high, but not anymore.

Reflecting on the past three years, when interest rates were at historic lows, it’s evident that many would have steered clear of bonds and possibly reduced equity exposure due to the common belief that rising interest rates are detrimental to stocks. However, despite interest rates climbing, the stock market has delivered a robust annualized three-year gain of 7.9%.

This equity return outperforms alternative assets you might have considered three years ago, such as gold bullion and hedge funds. In essence, the 60:40 portfolio would have kept you invested in a better-performing asset class.

While there’s no certainty in financial markets, it’s a strong bet that the 60:40 portfolio will continue to perform well if interest rates significantly decline in the future. This is because a decrease in rates is traditionally considered favorable for stocks, although historical evidence shows it doesn’t always play out that way. In the event of an unexpected stock market decline, a 60:40 portfolio can mitigate losses, if not produce gains.

The 60:40 portfolio serves as an insurance policy that often cushions the blows of an equity bear market. Three years ago, when interest rates were extremely low, this insurance component was minimal. However, with interest rates currently at 16-year highs, the bond portion of the 60:40 portfolio has substantial potential to offset equity losses.

Typically, obtaining such insurance would come at a significant cost, but over the past three years, the 60:40 portfolio not only provided protection but also generated returns. It’s as if we’ve been paid to have this insurance in place.

Dismissing the 60:40 portfolio now would mean discarding this valuable insurance, which, in most scenarios, has proven to be a wise choice.