As a fresh quarter commences, there’s a slight slowdown in stock momentum compared to premarket activity. After marking its 22nd record high, the S&P 500 wrapped up the first quarter, hinting that a pause might be in the cards.

Investors are parsing through remarks from Fed Chair Jerome Powell, who recently stated that he didn’t find any surprises in the central bank’s preferred inflation measure and didn’t see an urgency to lower rates. More insights from Powell are anticipated later this week, alongside crucial data like job figures.

Are major investors overlooking a potentially lucrative asset category presently? That’s the implication of our call of the day, sourced from a Sunday blog post by the Mosaic Asset Company, which underscores a “bullish case for commodities.”

Interestingly, gold prices soared to new heights on Monday.

The context is that “rate cuts are anticipated while the economy steers clear of recession.” While this scenario bodes well for stocks, various commodities have also garnered positive attention, according to Mosaic.

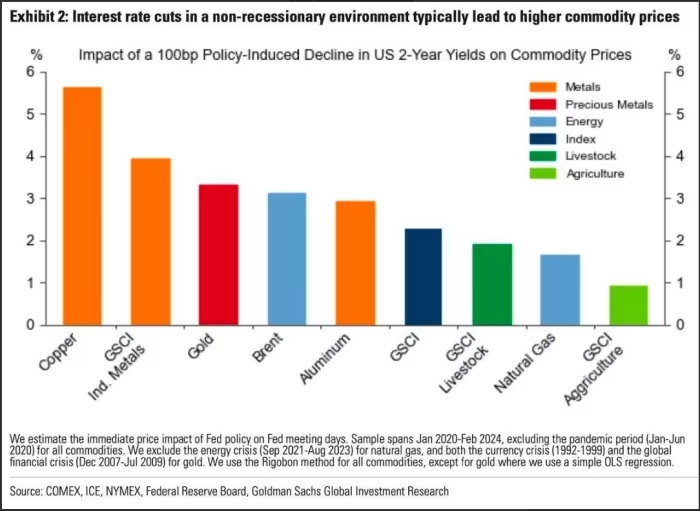

Their illustrated data reveals how different commodities have fared in non-recessionary periods when the 2-year yield is on a downward trajectory, with notable gains for copper, industrial metals, oil, and gold:

Moreover, Mosaic suggests that the commodity trade is further supported by the tepid interest shown by professional investors. “Commodities have significantly trailed behind, with the overall decline in prices reflected in the S&P GSCI commodity index since mid-2022, leaving fund managers with little incentive to pursue performance.”

Referring to Bank of America’s recent survey of fund managers, Mosaic points out that institutional portfolios are currently the least exposed to commodities relative to bonds since the financial crisis of 2008. They indicate that such herd behavior can swiftly reverse if commodities begin to rebound.

“Institutional investors, while evaluating their portfolio allocation, might become a driving force behind commodity demand if momentum gains traction. This is particularly true considering that commodities are currently at historically discounted levels compared to equities,” states Mosaic.

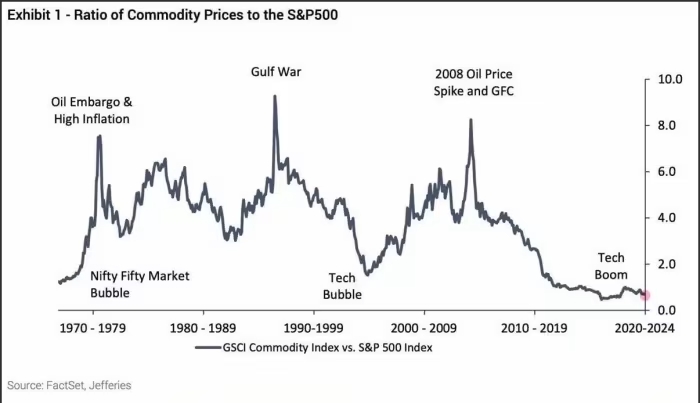

They highlight that the commodities-to-stock price ratio is nearing historic lows, a situation that has previously triggered a “significant mean-reversion in favor of commodities.” Their subsequent graph illustrates this ratio dating back to 1970 — a rising trend indicating commodities outperforming stocks, and a declining trend signaling the opposite:

“Although the current ratio has lingered at low levels for much of the past decade, the environment is turning favorable for commodities to excel from these depressed levels,” they remark. Taking all these factors into account, there appears to be an enticing risk/reward prospect.