Investor Sentiment Shifts from Euphoria to Uncertainty on Wall Street

The mood on Wall Street is shifting. Once characterized by optimism following President Donald Trump’s election victory, investor sentiment has taken a turn toward uncertainty. Key market indicators reflect this change, highlighting growing concerns about the U.S. economic outlook.

Market Sentiment Declines

Since the beginning of 2025, signs of a more cautious market environment have emerged. The clearest signal came on Tuesday when the S&P 500 (SPX) fell for a fourth consecutive day. If the index closes in the red, it will mark its longest losing streak since early January, according to FactSet data.

High-growth momentum stocks, such as Palantir Technologies Inc. (PLTR), have been particularly hard-hit, raising concerns about elevated valuations and their impact on investor confidence. Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, recently noted that market sentiment appeared to be deteriorating, a view echoed by other analysts.

“I think the market’s mood is slipping, and you can point to a lot of legitimate reasons why,” said Callie Cox, chief market strategist at Ritholtz Wealth Management, in an interview with MarketWatch.

Factors Driving Uncertainty

Several factors are contributing to this shift in sentiment. The initial enthusiasm over Trump’s promised deregulation and tax cuts has been overshadowed by concerns that tariffs and stricter immigration policies could stifle economic growth while pushing up prices. These fears have rekindled worries about stagflation.

Even prominent investors, such as New York Mets owner Steve Cohen, founder of Point72 Asset Management, have reportedly cautioned that a market correction could be imminent. Meanwhile, the Conference Board’s consumer-confidence survey dropped to an eight-month low on Tuesday, exacerbating market jitters.

Key Indicators Reflect Growing Caution

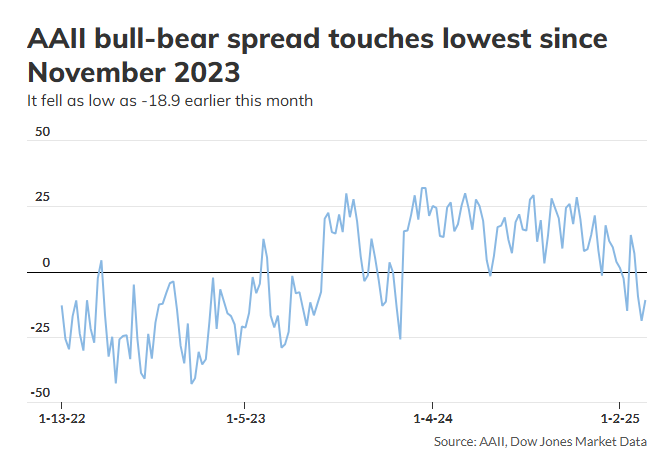

1. Bull-Bear Spread Declines

The American Association of Individual Investors’ weekly sentiment survey shows a sharp rise in bearish outlooks. Earlier this month, bearish responses outnumbered bullish ones by nearly 19 percentage points—the widest margin since November 2023.

Some analysts, including Fundstrat’s Tom Lee, argue that extreme bearish sentiment could be a contrarian bullish signal. Historically, markets have rallied after passing through periods of extreme pessimism. However, unlike November 2023—when stocks were recovering from a 10% correction—the S&P 500 remains near record highs, suggesting a different market dynamic this time.

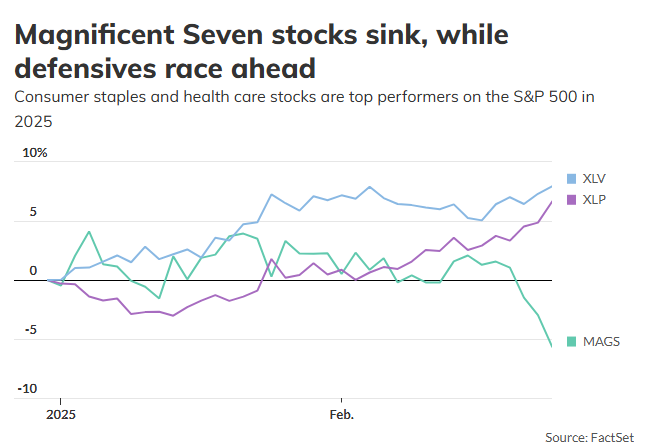

2. Defensive Stocks Lead the Market

Investors are shifting towards defensive stocks. Healthcare and consumer staples have been the top-performing sectors in 2025, according to FactSet data. Meanwhile, the Roundhill Magnificent Seven ETF (MAGS), which tracks leading megacap tech stocks, is on track to enter correction territory.

“I think it’s important to point out that defensive stocks are leading the S&P 500 higher this year, which probably tells you something about how positioning is changing,” Cox noted.

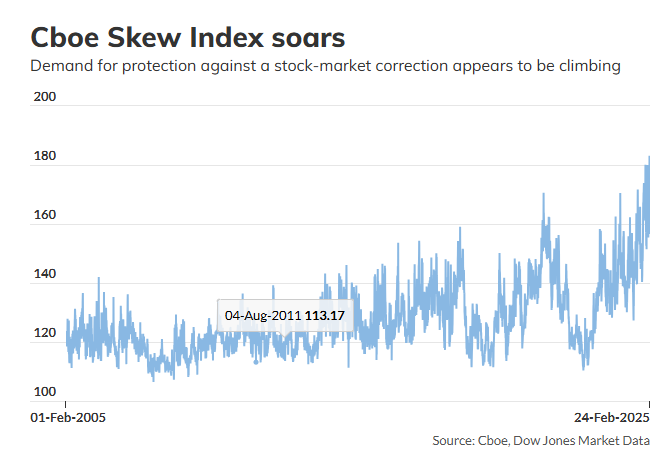

3. Demand for Hedging Surges

The options market suggests traders are increasingly hedging against downside risks. The Cboe Skew Index, which measures demand for out-of-the-money put options, surged above 183 last week—its highest level since at least 2005, according to Cboe data.

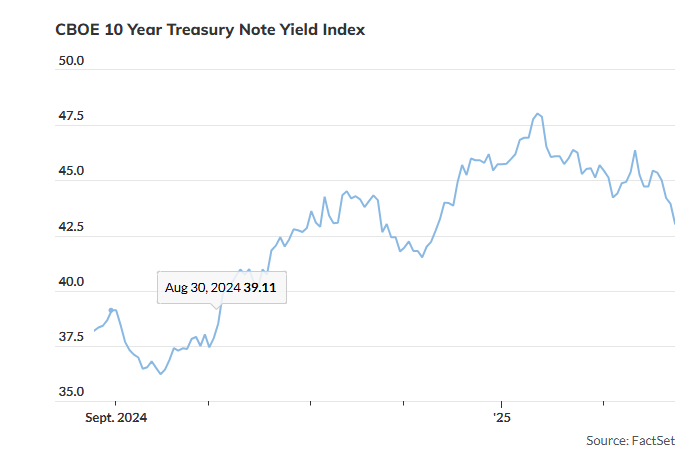

4. Bond Market Signals Concern

Bonds are rallying, but not for positive reasons. Instead of reflecting confidence that inflation will decline, the drop in the 10-year Treasury yield to its lowest level of 2025 suggests rising fears about economic stagnation. The Trump administration’s decision to lay off thousands of government employees has only intensified concerns.

“Yields in the bond market are tumbling as they smell recession in the air,” said Chris Rupkey, chief economist at FwdBonds.

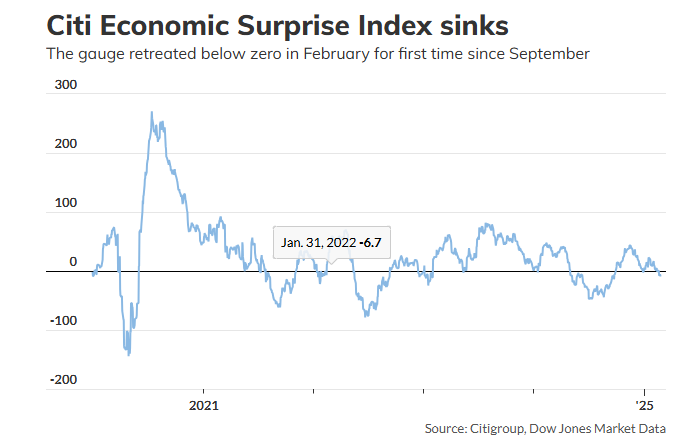

5. Economic Reports Disappoint

The Citi U.S. Economic Surprise Index has been consistently negative for the first time since September. A weaker-than-expected services-sector report, coupled with declining consumer confidence, has added to investor unease.

Charlie McElligott, a cross-asset strategist at Nomura, warned that markets remain highly sensitive to economic surprises. If current trends continue, stocks could face another sharp downturn similar to the August 5 selloff, when a U.S. growth scare triggered a global market rout.

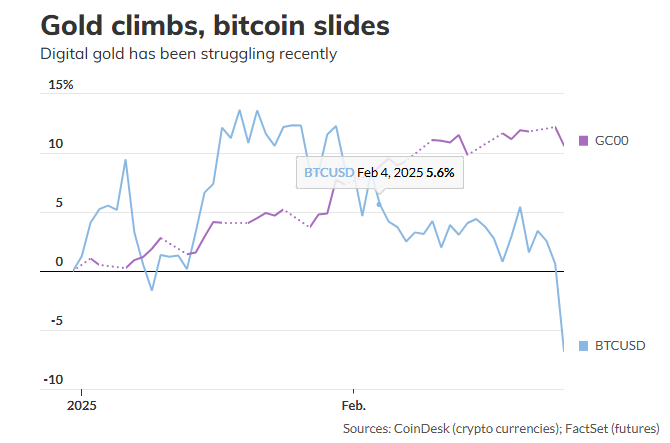

6. Bitcoin vs. Gold: A Diverging Trend

Bitcoin’s status as “digital gold” is being called into question as it moves in the opposite direction of the physical commodity. While gold futures recently approached record highs near $3,000 per ounce, Bitcoin has slipped below $87,000, its lowest level since November.

Wall Street analysts, including Stifel’s Barry Bannister, have noted that Bitcoin behaves more like a speculative growth asset than a safe-haven investment, further highlighting the shift in risk appetite.

Market Protection Strategies Increase

Despite the growing caution, some indicators remain relatively stable. The Conference Board’s CEO Confidence Survey showed improvement, suggesting corporate executives remain optimistic. Additionally, futures traders appear to be reducing their bets against the S&P 500, according to Commodity Futures Trading Commission data.

However, the Cboe Volatility Index (VIX), often referred to as Wall Street “fear gauge,” briefly topped 20 on Tuesday. Although still below its January peak, the move signals rising market anxiety.

“People are adding protection, and I think it makes sense,” said Danny Kirsch, head of options trading at Piper Sandler.

Conclusion

As uncertainty grows, investors are adjusting their strategies, moving away from riskier assets and increasing their exposure to defensive stocks and hedging instruments. While some believe this cautious sentiment could set the stage for a future rally, others warn that the market may be entering a more prolonged period of volatility. The coming weeks will be crucial in determining whether this shift represents a temporary pullback or the start of a more significant market correction.