You are aware that it is important to diversify to avoid putting all your resources or investments in one place. However, it is often simple to mistakenly believe that you have achieved substantial diversification when, in reality, you have not.

In this article, I will demonstrate how smart diversification can enhance your potential long-term outcomes and simultaneously minimize volatility. Don’t worry, implementing this strategy doesn’t require excessive effort.

Why diversify at all?

Every individual investment, whether it is a stock or a fund, inevitably experiences times of growth and decline. The moments of growth can evoke a sense of intelligence, accomplishment, and good fortune, while the periods of decline can leave us feeling perplexed, unlucky, and potentially as if we have failed.

Having an asset that is increasing in value can be beneficial in compensating for the decline of another asset.

Prudent diversification

Smart investors understand that preserving their wealth is just as crucial as increasing it.

The most dependable method to achieve this is by possessing both bonds and equities. However, the details of this topic are not covered in this article. You can acquire the necessary knowledge from my recent article on this subject.

Once you have managed your overall risk effectively, you are likely to experience the most advantageous long-term outcomes by diversifying your investments in equities.

Timid diversification

When considering diversification, a common first thought is to have a larger number of stocks rather than just a small quantity. This is a positive and effective approach.

However, having a larger quantity of those stocks may not provide significant benefits if they are all very similar.

Certainly, possessing every single one of the 500 stocks listed in the S&P 500 SPX minimizes the likelihood of being severely impacted by any individual company’s calamity. Nonetheless, the index is largely influenced by the stocks of immense corporations that possess considerably high value. It is common for these stocks to experience similar fluctuations in price.

Powerful diversification

Diversifying your investments across various groups of stocks, each with their own unique characteristics and expected performance, is the most effective method to enhance your returns over the long run.

I do not suggest investing in sector funds, however, they do serve as a straightforward illustration.

Airline stocks tend to exhibit distinct behavior compared to retail stocks. Similarly, oil stocks demonstrate dissimilar trends compared to technology stocks, and this pattern extends to banking stocks and beyond.

If you possess only a single sector, you will be subject to unpredictable forces that possess significant power. However, if you possess multiple sectors, it is highly probable that a few of them will consistently perform well, thereby enhancing the returns from the ones that are experiencing difficulties.

Understanding diversification can be easily achieved through the aforementioned method. However, an even more effective strategy for diversification is to distribute investments across different types of assets.

The four main types of assets in the United States are large-cap stocks with a mix of growth and value, large-cap stocks that are considered undervalued, small-cap stocks with a mix of growth and value, and small-cap stocks that are considered undervalued.

Index funds and exchange-traded funds are readily accessible at low costs.

I would like to draw your focus towards a vibrant table that depicts some of the impactful projects accomplished by the Merriman Financial Education Foundation.

The paragraph presents a display of yearly returns for four different asset classes starting from 1928. It also showcases the combined performance of these four asset classes as a whole, depicted in pink. The performance of the S&P 500 is represented in green.

If you think that relying solely on the S&P is sufficient, take a look at the chart and observe the frequency with which those green boxes ended up at the bottom. This indicates that the index was surpassed by all three alternative types of assets.

Occasionally, those duration extended and extended. The S&P 500 experienced a period of decline for six consecutive years commencing in 1940, followed by five consecutive years starting in 1964 and again in 1975, and seven continuous years from 2000. Additionally, there were 16 other separate years where owning the S&P 500 proved to be the least favorable option among these four asset classes. In total, there were 39 individual years where the S&P 500 performed the worst.

During the early years of the 21st century, the S&P 500, which had previously performed well in the 1990s, experienced three consecutive years of financial loss. As a result, numerous investors became disheartened and completely withdrew from the market. If you look at the highlighted sections at the beginning of each year, you won’t find any sequence of five or more positive years. Looking at the data depicted in the chart over a span of 92 years, it is evident that the S&P 500 was the best performer 26 times and the worst performer 39 times. This is certainly a disappointing outcome.

In order for investors to continue participating in the market and achieve profitable results over time, they require a sense of reassurance and mental stability, which can be likened to a seamless journey.

However, during the time frame depicted on this graph, the S&P 500 experienced 34 instances of changing from a positive return to a negative return, or vice versa.

This is definitely not a formula for having a peaceful state of mind.

Given that it is impossible to possess an investment that will consistently outperform others, I would like to propose an option that, by its nature, can never be the least favorable. This alternative will provide stability and yield long-term profitability, without subjecting you to constant fluctuations.

The graph displays a pink-colored combination of four different asset classes as an investment.

The combination of those four funds ranked in the average range for 72 out of the 92 years between 1928 and 2019. This resulted in a significantly lower level of fluctuation. Furthermore, from 1928 onwards, it achieved better returns than the S&P 500.

If you believe that all sections of the American stock market typically experience gains and losses simultaneously, you may be surprised to learn that there were a total of 17 years in which the difference in performance between the best and worst asset classes exceeded 30 percentage points. To illustrate this,

- In 1967, there was a 55.1 percentage point difference between two values.

- In 2001, there was a 40.2 percentage point gap.

- In 2003, there was a 37.4 percentage point difference.

I strongly believe in the importance of expanding investments beyond the S&P 500 by including small-cap value stocks. The provided graph demonstrates one of the reasons for this belief: most years witness a significant difference of 30 percentage points or more between the best and worst performing stocks, with small-cap value stocks consistently outperforming the S&P 500.

I acknowledge that not everyone is interested in investing in small-cap value stocks. However, I strongly believe that the combination of these stocks, along with three other asset classes, offers a great alternative to solely investing in the S&P 500. This combination not only provides a more stable investment journey for investors, therefore lowering the risk involved, but also generates higher returns.

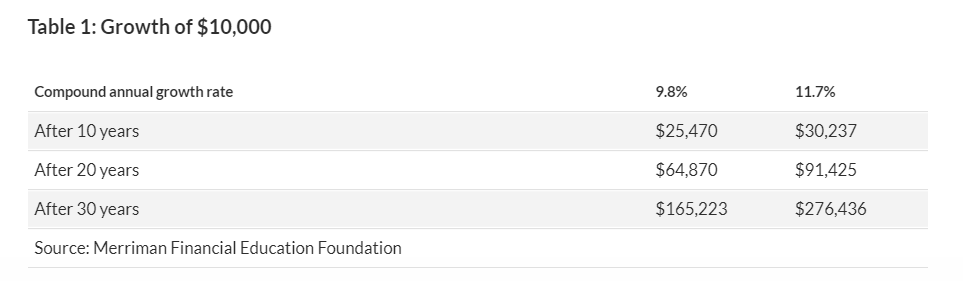

The compound annual growth rate of this four-fund combination has been 11.7% since 1928, which is 1.9 percentage points higher than the 9.8% growth rate of the S&P 500.

If that doesn’t seem significant, take a look at the figures presented in the table below.

During a span of 30 years, the increase resulted in a gain of 67.3%.

Interested in learning more? In a previous article this year, I discussed seven uncomplicated equity portfolios that have consistently outperformed the S&P 500 for over five decades.