Investors Shouldn’t Fear Record Highs, but Risks Remain

For the first time in nearly four weeks, the S&P 500 reached a new closing high on Tuesday. Investors who have stayed on the sidelines over the past few years may now be asking: Is it too late to join the rally?

After two years of substantial gains, it’s natural for investors to consider the risks of entering the market now versus waiting for a pullback. As the saying goes, “trees don’t grow to the sky”—meaning markets don’t rise indefinitely without interruptions.

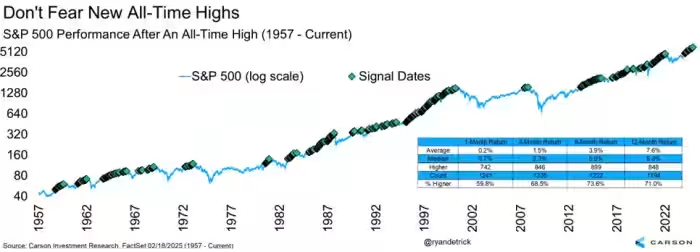

New stock-market highs can significantly influence investor sentiment. However, history suggests that they are not unusual. According to Ryan Detrick, chief market strategist at Carson Group, the S&P 500 has reached a new record high, on average, every three weeks since the index’s modern formation in 1957.

That doesn’t mean stocks are immune to downturns. While bear markets do occur, they have historically been infrequent, and investors who remain on the sidelines often miss out on long-term gains.

“Should you buy when stocks are at all-time highs? That’s a common question,” Detrick noted in a post on X. “My take: Don’t be afraid of new highs. The S&P 500 has been up a year later 71% of the time after reaching an all-time high, with a median return of 8.3%—essentially normal returns.”

Of course, this isn’t always the case. On January 3, 2022, the S&P 500 hit a record high of 4,796.56 before plunging 25% in the subsequent bear market. It took over two years for the index to recover and surpass its previous peak.

However, such declines are the exception, not the rule. Historically, stocks tend to rise over time, particularly since the post-2008 financial crisis recovery.

Emerging Risks to Consider

Despite the market’s resilience, investors should remain mindful of potential risks. Several challenges have surfaced recently, creating uncertainty at a time when U.S. large-cap valuations are historically high. Additionally, seasonal trends indicate that the first quarter of a new presidential term is often among the weakest in the four-year cycle, according to Detrick.

Among the emerging concerns:

- Artificial Intelligence Competition: China’s DeepSeek AI program has raised questions about the U.S.’s dominance in artificial intelligence, a key driver of tech-sector growth.

- Trade Policy Uncertainty: President Donald Trump’s unpredictable trade policies have introduced headline risk, causing market volatility.

- Labor Market Concerns: Government job cuts mandated by the new administration have revived discussions about the U.S. labor market’s stability.

- Federal Reserve Policy: The Fed has paused its planned interest-rate cuts, prompting speculation about its future policy direction.

- Market Superstitions: While seemingly unrelated, historical trends suggest that Philadelphia sports victories—such as the Eagles’ recent Super Bowl win—have often coincided with economic or financial turbulence.

So far, investors have largely brushed off these risks. However, that doesn’t mean market sentiment can’t shift abruptly.

Market Leadership and Broader Participation

While the so-called “Magnificent Seven” megacap tech stocks have struggled as a group in early 2025, other stocks have stepped up, broadening the market rally. This diversification theoretically reduces vulnerability to single-stock risks, such as Nvidia Corp.’s sharp 17% decline in late January, which caused the S&P 500 to fall nearly 1.5%, even as most other index components rose.

The S&P 500’s advance has slowed in 2025, but broader participation suggests a healthier rally. Year to date, the index is up 4.2% as of midday Wednesday. The Invesco S&P 500 Equal Weight ETF (RSP), which provides a better measure of the average S&P 500 stock’s performance, has gained 4%, according to FactSet.

Looking Back and Moving Forward

Exactly five years ago, on February 19, 2020, the S&P 500 hit a record before markets were upended by the COVID-19 pandemic. Since then, the index has climbed more than 80%, according to FactSet data. By the end of summer 2020, it had fully recovered from the pandemic-driven selloff.

As of Wednesday’s trading session, the S&P 500 was down 6 points, or 0.1%, at 6,122. The Nasdaq Composite declined 53 points, or 0.3%, to 19,990, while the Dow Jones Industrial Average dropped 144 points, or 0.3%, to 44,413.

While new highs can be unsettling, history suggests they are a normal part of market cycles. Investors who weigh risks carefully and maintain a long-term perspective are often rewarded over time.