Selling stocks that have underperformed throughout the year may not be the best move just yet, as they often experience a significant rebound in January. This phenomenon is a result of two sources of artificial selling pressure that affect these underperformers, and these pressures are unrelated to a company’s fundamentals or earnings potential.

The influence of these pressures wanes by December 31st, paving the way for a strong resurgence of these stocks in January.

One source of this selling pressure is “end-of-year window dressing,” where portfolio managers offload their poorly performing stocks to avoid the embarrassment of including them in their year-end reports.

The other source is “tax-loss selling,” where investors sell stocks that have incurred losses to offset some of the capital gains taxes they will be liable for in the following year.

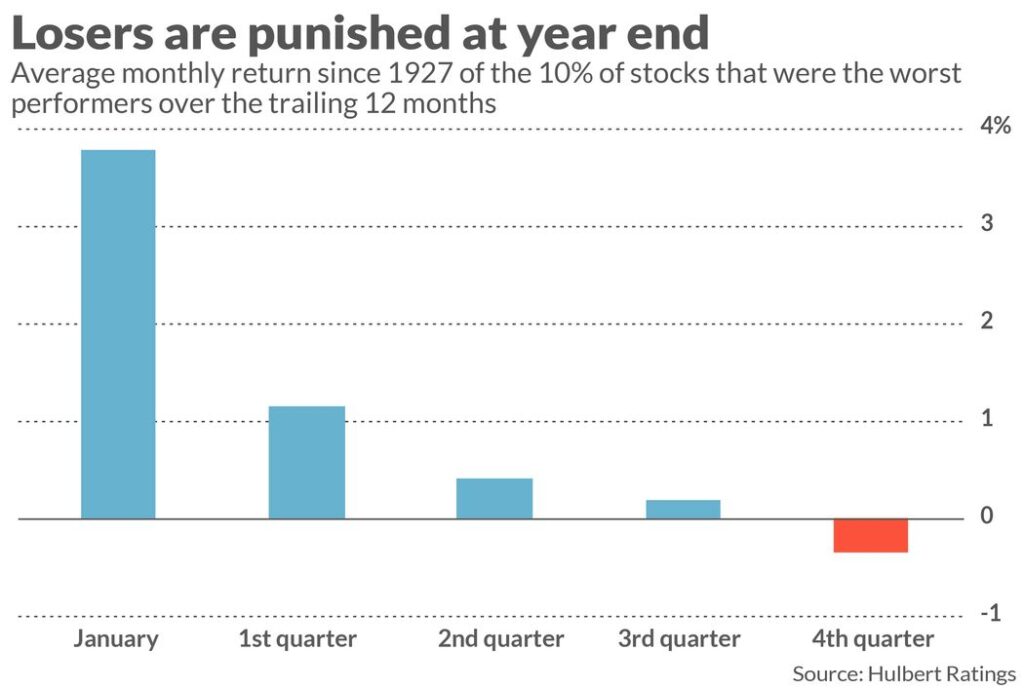

The chart below, based on data dating back to 1927 (courtesy of Dartmouth College’s Ken French), vividly illustrates this January bounce-back trend. It tracks the performance of a hypothetical portfolio that monthly invests in the 10% of stocks with the worst trailing-year returns.

Notably, the most robust average returns occur in January, while the weakest returns happen at the end of the year.