Early on Thursday, U.S. stock index futures saw a modest uptick, influenced by a dip in Treasury yields and a relaxation of tensions in Asian markets.

Current Trading Status:

- S&P 500 futures (ES00, +0.38%) increased by 4 points or 0.1% to reach 4775.

- Dow Jones Industrial Average futures (YM00, -0.07%) experienced a slight decline of 20 points, less than 0.1%, settling at 37438.

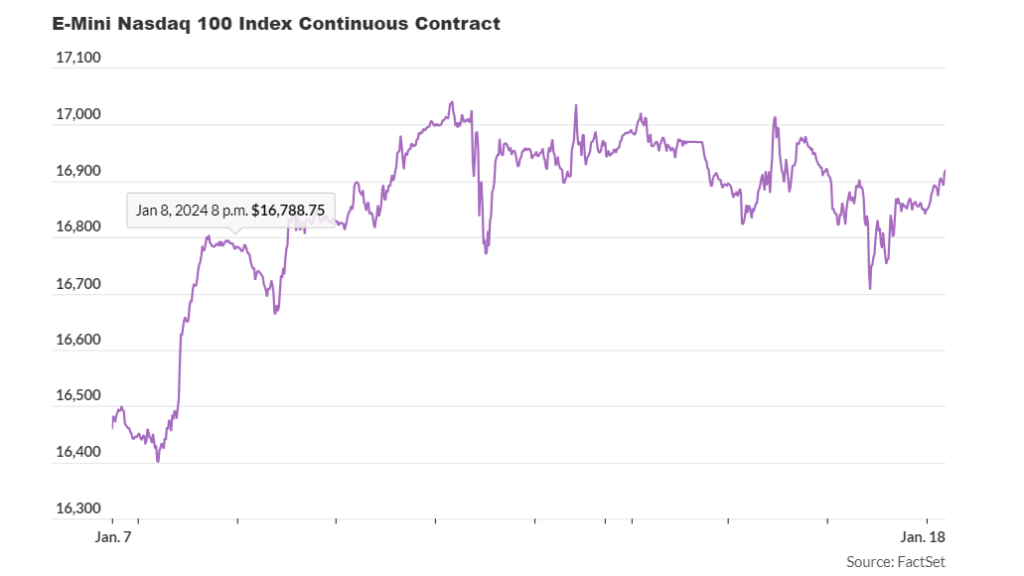

- Nasdaq-100 futures (NQ00, +0.79%) showed a gain of 48 points, equivalent to 0.3%, reaching 16918.

On the prior day, the Dow Jones Industrial Average (DJIA) fell by 94 points or 0.25% to 37267. The S&P 500 (SPX) declined by 27 points or 0.56% to 4739, while the Nasdaq Composite (COMP) dropped by 89 points or 0.59% to 14856.

Market Influences:

Market dynamics are still closely tied to movements in the bond market. Encouragingly for equity enthusiasts, Treasury yields are on a slight downward trend, providing stability to index futures.

The S&P 500 has faced volatility in the early part of the year, stepping back from recent highs as investors adjusted expectations regarding potential interest rate cuts in the coming months. This adjustment has resulted in increased implied borrowing costs.

The 10-year Treasury yield (BX:TMUBMUSD10Y) rose over 30 basis points from its December 27 low of 3.8% by midweek. This increase was driven by central bank officials pushing back against rate-cut expectations and a surge in response to robust U.S. retail sales data.

The strong correlation between bond and equity markets that emerged in 2024 is notable. However, historical patterns suggest that this tight relationship won’t persist indefinitely. Currently, both markets experienced a sell-off as investors scaled back expectations for imminent rate cuts.

Traders are recalibrating their expectations for a 25 basis point rate cut by the Federal Reserve at its March meeting, with the probability decreasing from 73.3% a week ago to 63%.

U.S. futures found support from improved performance in Asian markets. Hong Kong’s Hang Seng (HSI) rebounded by 0.75%, recovering from a 3.7% plunge on Wednesday. The Shanghai Composite (SHCOMP) also regained stability with a 0.4% gain.

Taiwan Semiconductor Manufacturing Company (2330, +1.20%) exceeded analyst forecasts, potentially offering support to the Nasdaq Composite index in the U.S.

Earnings Season Update: The ongoing mixed earnings season includes reports from Fastenal (FAST, -0.61%), First Horizon (FHN, -0.23%), and KeyCorp (KEY, -0.57%) before the opening bell. After the close, PPG Industries (PPG, -0.47%), J.B. Hunt Transport Services (JBHT, +0.40%), and First National Bank (FNB, -0.61%) are set to report.

Scheduled U.S. economic updates for Thursday include weekly initial jobless claims, the January Philadelphia Fed manufacturing survey, and December housing starts and building permits, all at 8:30 a.m. Eastern.

Atlanta Fed President Raphael Bostic is slated to speak on the economic outlook at 7:30 a.m. and again at 11:30 a.m.