Bespoke notes that March typically brings a middling performance for U.S. stocks, with gains that don’t stand out compared to other months. While February saw U.S. stocks securing a winning streak, there’s now speculation about whether investors might opt to cash in on those gains at the start of March.

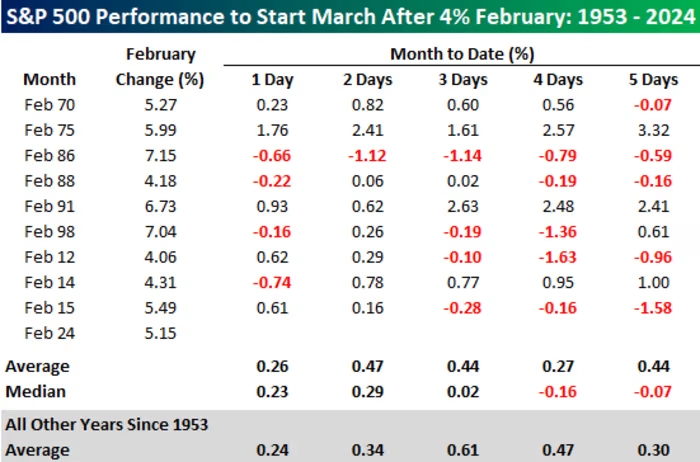

Looking back, history reveals a mixed bag in terms of stock performance following a February rally of over 4% in the S&P 500. Bespoke Investment Group suggests that seeing some initial weakness in the first few trading days of March wouldn’t be surprising.

Analyzing data since 1953, Bespoke finds that in nine previous instances where the S&P 500 rallied over 4% in February, the first day of March tended to yield modest gains, with the index closing higher just over half the time.

The second day of March typically showed more consistent positive returns, with gains in eight out of nine instances.

However, the trend tends to reverse afterward. Both the fourth and fifth trading days of March have historically seen a slight decline in performance compared to other March months, according to Bespoke’s analysis.

While these patterns aren’t definitive, Bespoke suggests that some weakness at the start of March wouldn’t be unexpected.

As March begins, U.S. stocks opened in a subdued manner, with the Nasdaq Composite continuing to outperform, having settled at a record high in the previous session.

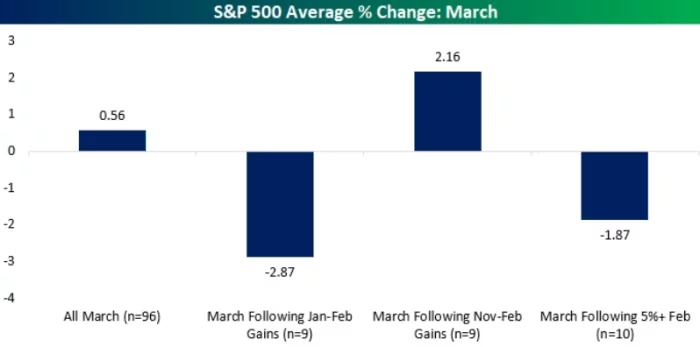

Looking at historical trends, March’s performance for the S&P 500 has been fairly average since 1928, with gains that don’t particularly stand out. However, when March follows strong performances in January and February, the results tend to be weak.

In such instances since 1928, the S&P 500 has suffered significant monthly declines, according to Bespoke’s data.