The Dow’s underperformance can be attributed partly to its nature as a price-weighted index. Unlike the S&P 500 and Nasdaq Composite, which are weighted by market capitalization, the Dow gives more influence to higher-priced stocks like UnitedHealth Group, impacting its overall performance more than tech giants like Apple and Microsoft.

In 2024, the Dow Jones Industrial Average lags significantly behind other major indexes, with the S&P 500 outperforming it by 12.65 percentage points as of Tuesday. This gap is near historic levels, echoing the 12.8 percentage-point difference recorded last year.

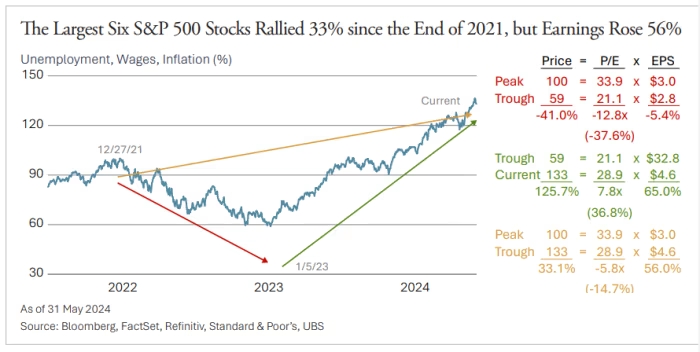

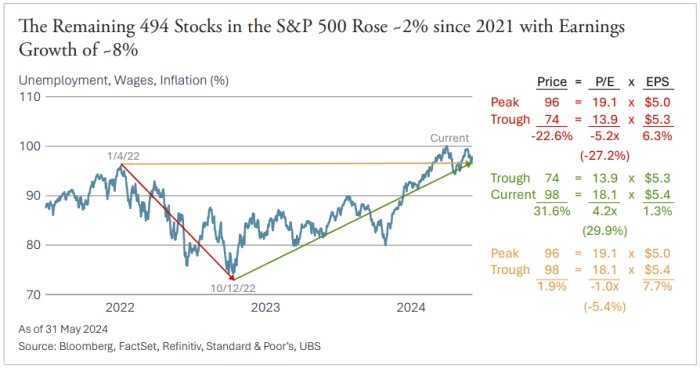

The S&P 500’s gains, driven largely by megacap tech stocks, highlight the discrepancy. From October 2022 to June 2024, the S&P 500 saw a 55% total return, with 60% of that coming from just 10 stocks, noted Ronald Temple of Lazard Asset Management. Despite expectations for a broader rally in 2024, the market remains tech-centric.

The divergence isn’t limited to the Dow and S&P 500; even the S&P 500’s equal-weight version trails the regular index, up only 3.9% compared to 16.9% for the standard index. This performance spread is reminiscent of the dot-com bubble peak in 2000, as pointed out by Bespoke Investment Group analysts.

Skeptics suggest that a rotation away from megacap stocks could help lagging sectors catch up, potentially stabilizing or lifting the broader market.