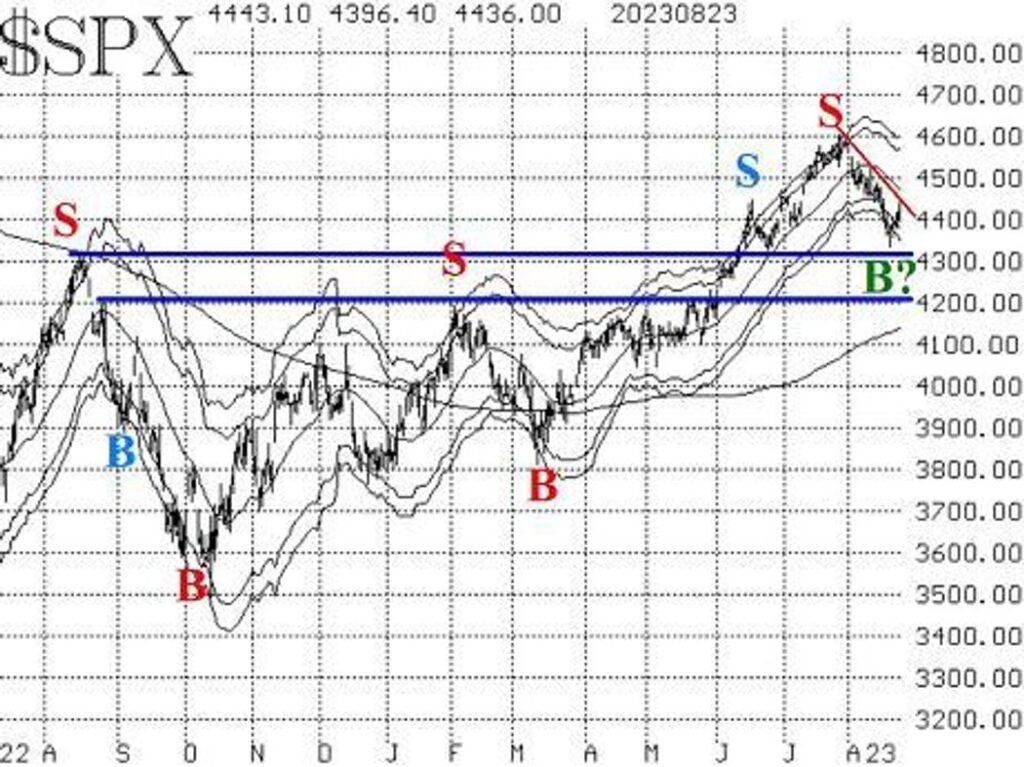

The S&P 500 Index (SPX) soared to nearly 4600 in late July, but has since embarked on a downward trend. Recently, it faced its first major test of support around 4330, and this support demonstrated resilience. In light of this, the bull market still maintains its footing on the SPX chart. While another support level exists at 4200, it’s the 4330 support that carries significance to sustain a “core” bullish stance.

Despite several oversold conditions, the ongoing rally could be an oversold one. Typically, these rallies tend to reach or slightly surpass the declining 20-day Moving Average before faltering. With NVIDIA’s robust earnings on Wednesday, it’s likely that SPX will surpass its declining 20-day Moving Average on Thursday.

In the recent pullback, SPX ventured below its -4σ “modified Bollinger Band” (mBB), fulfilling the McMillan Volatility Band (MVB) sell signal from late July (indicated by a red “S” on the SPX chart). Additionally, dropping below the -4σ Band could potentially set the stage for a new MVB buy signal. A “classic” mBB buy signal emerged in SPX’s recent activity. However, these signals often yielded too many false alarms in the past. Hence, we await confirmation via follow-through that creates the MVB buy signal, which might transpire shortly.

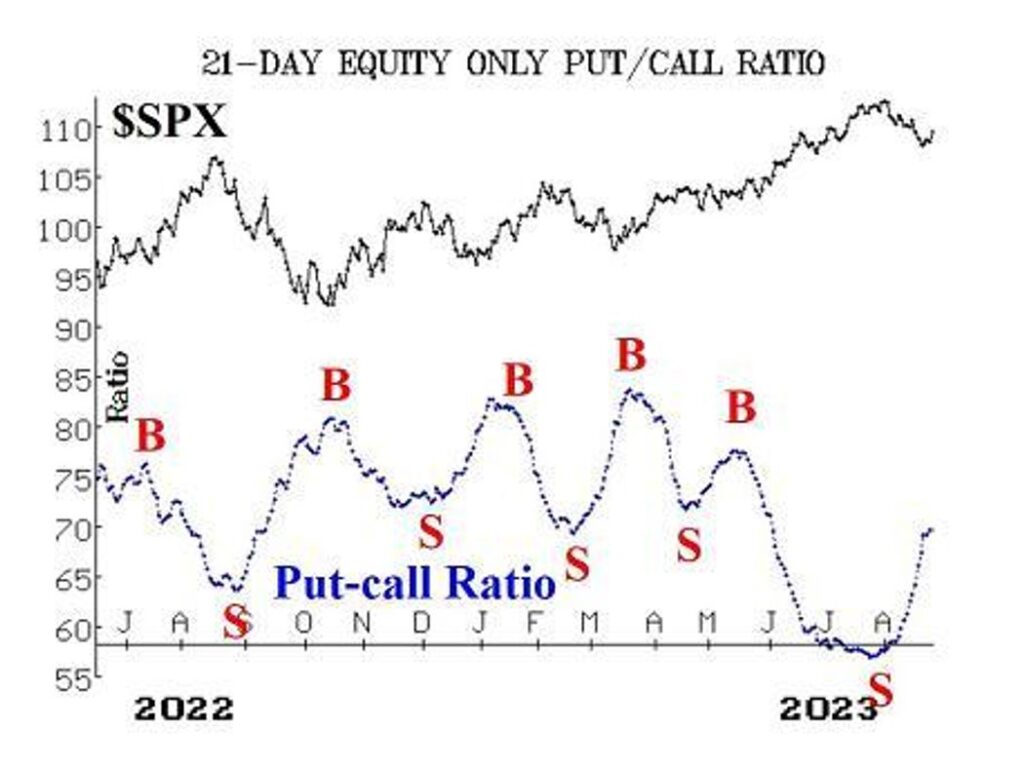

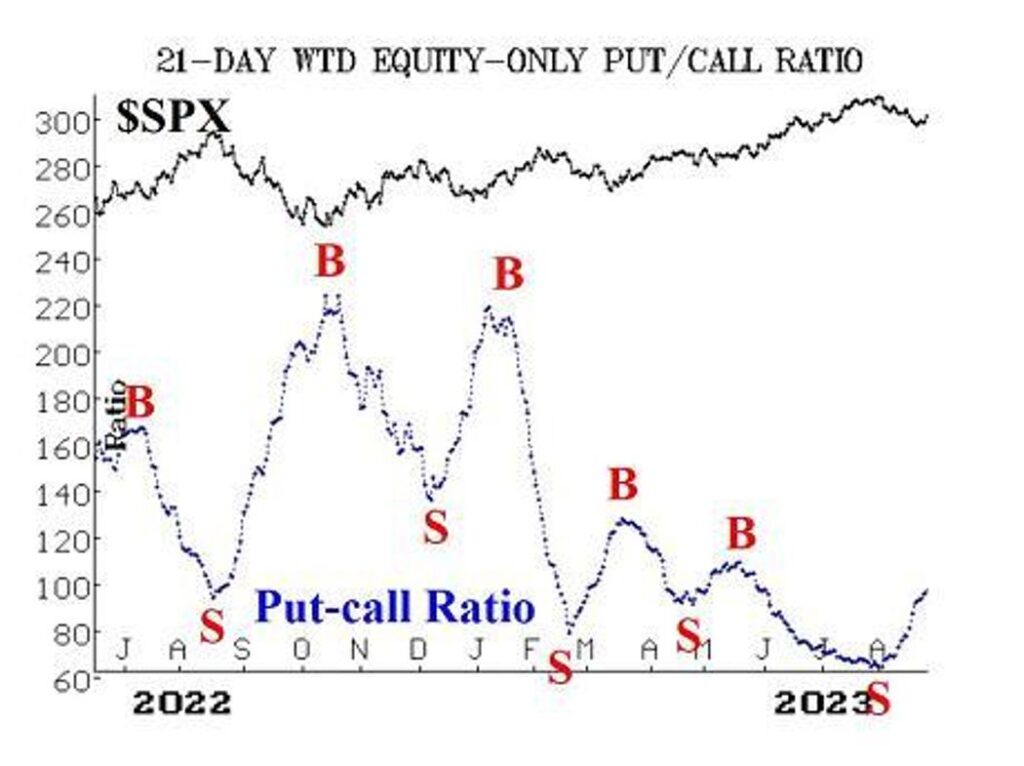

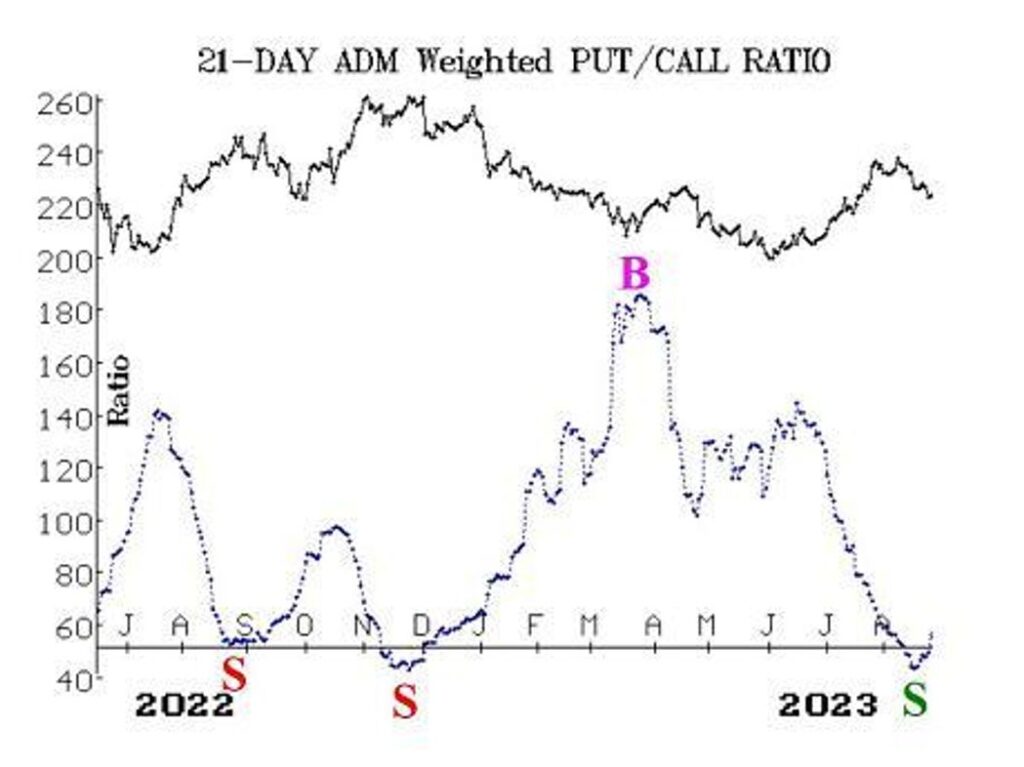

Equity-only put-call ratios continue to ascend, maintaining their sell signals until they reverse and begin declining. Substantial put buying remains a prominent feature even during market rallies, driving these ratios upwards.

The breadth of the market remained weak through August, causing breadth oscillators to persist with sell signals. While they’ve become deeply oversold, it necessitates a minimum of two days of positive breadth to transition them out of this condition onto a buy signal – an occurrence yet to materialize.

Over the past eight trading days, New 52-week Lows on the NYSE have outpaced New Highs. This resulted in the termination of the long-standing buy signal from this indicator. However, it currently remains neutral. A sell signal would necessitate New Lows exceeding 100 issues for two consecutive days. Despite the recent rise in New Lows, it hasn’t been substantial enough to trigger a sell signal.

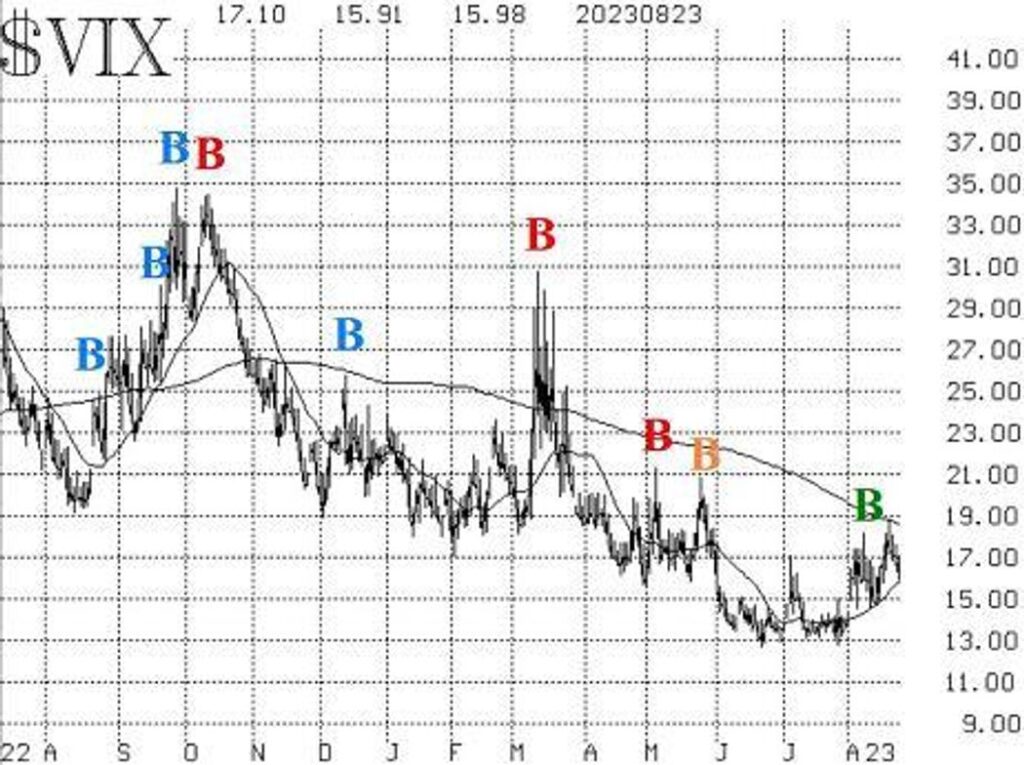

These indicators, dubbed “market internals,” align with SPX’s decline, reflecting a predominantly negative sentiment. Meanwhile, volatility metrics have largely remained subdued, reflecting a bullish outlook for stocks. The “spike peak” buy signal from VIX that emerged a few weeks ago remains in place. Moreover, the intermediate-term trend of the VIX buy signal persists. However, it would be nullified if VIX closes above its declining 200-day Moving Average – a level it briefly touched this week.

Lastly, volatility derivatives retain their bullish disposition, as the term structures of VIX futures and CBOE Volatility Indices maintain upward slopes. Additionally, VIX futures are trading at substantial premiums relative to VIX.

Therefore, we’re holding onto a low-delta “core” bullish position as long as SPX remains above 4330, while making trade decisions based on other indicators.

SPX has advanced beyond its -3σ Band, triggering a “classic” modified Bollinger Band buy signal. However, for a McMillan Volatility Band (MVB) buy signal to form, SPX needs to reach 4459 or higher.

If SPX reaches 4459 at any point, consider buying 1 SPY Oct (20th) at-the-money call and selling 1 SPY Oct (20th) call with a striking price 18 points higher.

We’re using a bull spread due to the relatively higher cost of these October options. This signal will hold unless SPX closes below its -4σ Band, which would negate the signal. The trade aims for SPX to touch the +4σ Band.

New Recommendation: Archer-Daniels-Midland (ADM)

A recent weighted put-call ratio sell signal has emerged for ADM. Since the stock fell below support, we’re acting on this signal.

Buy 3 ADM Oct (20th) 82.5 puts to align with the market.

ADM: 81.16 Oct (20th) 82.5 put: 3.00 bid, offered at 3.20

Follow-up action: All stops are mental closing stops unless otherwise noted.

Our SPY spreads follow a “standard” rolling procedure: in any vertical bull or bear spread, if the underlying hits the short strike, roll the entire spread. This means rolling up for a call bull spread or rolling down for a bear put spread. Maintain the same expiration and retain the distance between strikes unless otherwise instructed.

- Long 0 KOPN: The 800-share stock position was stopped out on August 11th.

- Long 2 SPY Sept (15th) 456 calls: This is our “core” bullish position, rolled multiple times with a 6-point in-the-money threshold.

- Long 10 VTRS Sept (15th) 10 calls: Roll up and out to VTRS Sept (15th) 11 calls. Stop remains at 10.75.

- Long 8 CRON Sept (15th) 2 calls: Keep these calls without a stop while takeover rumors unfold.

- Long 6 ORIC Sept (15th) 7.5 calls: The stock is strong, setting a new yearly high. Stop remains at 8.10.

- Long 2 EW Sept (15th) 77.5 puts: Retain these puts as long as the weighted put-call ratio remains on a sell signal.

- Long 4 SPY Sept (29th) 480 calls: This position aligns with the CVB buy signal. Initially, hold SPY calls with a striking price matching SPY’s all-time high.

- Long 5 EEM Oct (20th) 41 calls: Sell these calls as the EEM weighted put-call ratio is no longer on a buy signal.

- Long 1 SPY Sept (15th) 448 put and Short 1 SPY Sept (15th) 418 put: Bought according to equity-only put-call ratio sell signals. Exit this trade if either equity-only put-call ratio shifts to a new buy signal.

- Long 2 NTAP Oct (20th) 80 puts: Hold this position while the weighted put-call ratio for NTAP remains on a sell signal.

- Long 2 EQR Oct (20th) 65 puts: Acquired when EQR closed below 64.50 on Aug 15th. Retain these as long as the weighted put-call ratio for EQR remains on a sell signal.

- Long 3 X Sept (15th) 31 calls: Keep while takeover rumors play out.

- Long 2 PSX Sept (15th) 115 calls: Hold during activist investor rumors.

- All stops are mental closing stops unless otherwise noted.