Early trading in equity futures on Monday indicates that Wall Street is poised to build upon last week’s robust rally. Despite the recent volatility driven by concerns over rising bond yields conflicting with expectations of strong corporate earnings, particularly within the tech sector, market sentiment appears resilient.

Following a slight dip of over 5% in the week commencing April 15th, the Nasdaq 100, populated by prominent technology giants, rebounded by approximately 4% last week. This marked the most significant weekly gain for the broader market since early November.

This ability to bounce back, colloquially referred to as “bouncebackability,” suggests a positive outlook for the market, indicating investors’ capacity to absorb setbacks and eagerly seize opportunities to buy the dip.

However, short-term traders should proceed with caution. Bespoke Investment Group’s analysis of such recoveries reveals a less optimistic outlook for this week’s market activity.

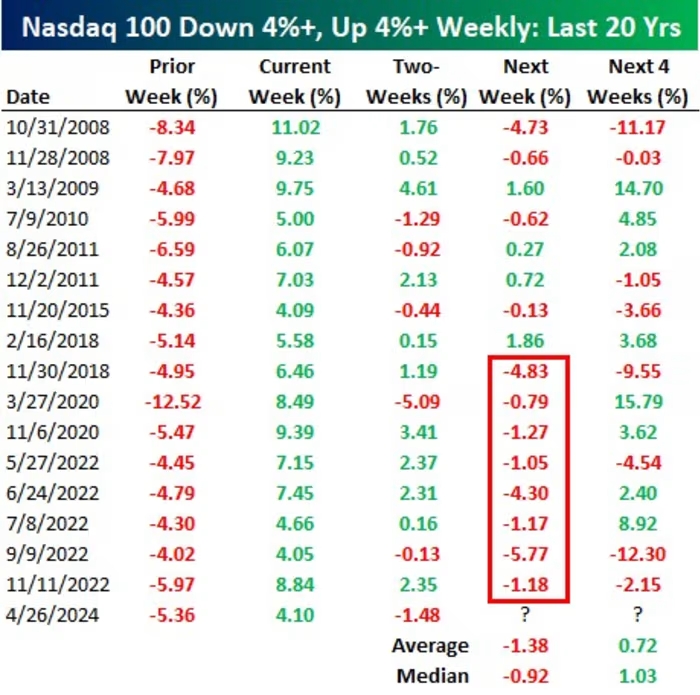

Examining data since the mid-1980s, there have been 40 two-week periods where the Nasdaq 100 experienced a decline of four percent or more in one week followed by a rise of four percent or more the next. While such occurrences may initially appear promising, historical trends indicate otherwise.

In the past 20 years, excluding last week, this pattern has been observed 16 times. Yet, the subsequent week has typically seen the Nasdaq 100 averaging a decline of 1.38%, with the past eight occurrences since late 2018 ending in declines.

This raises questions about the sustainability of market rebounds and whether they truly reflect strength or hint at underlying weakness. The significant fluctuations witnessed, such as Nvidia’s substantial fluctuations, may instill unease rather than confidence.

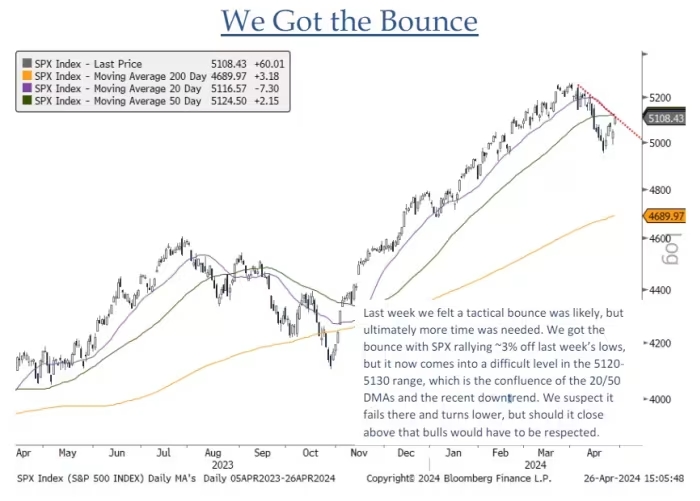

Looking at the S&P 500 index, technical strategist Jonathan Krinsky of BTIG notes the challenging terrain ahead around the 5,120-5,130 range, marked by the convergence of key moving averages and recent downtrends.

While Krinsky tends to lean bearish, Tom Lee, head of research at Fundstrat, provides a more optimistic perspective. Lee believes that the recent rally underscores the resilience of the “buy the dip” mentality, signaling further potential gains as the market enters May. His colleague Mark Newton predicts a move towards S&P 500 5,212, potentially setting sights on 5,400 for bullish investors.