The Nov. 5 U.S. presidential election remains unpredictable, with polls suggesting a tight race for the White House and significant potential for either party to take control of the House. In the Senate, Republicans hold a slim advantage, as outlined in UBS Group’s recent ElectionWatch analysis.

Given this volatility, investors should brace for varied outcomes, including the possibility of a contested election, reminiscent of the 2000 race between George W. Bush and Al Gore, which led to a protracted recount halted by the Supreme Court. Historically, U.S. stocks have climbed over time regardless of which party leads in Washington, but portfolio manager Jay Hatfield of Infrastructure Capital emphasizes that the stakes are especially high this time.

“This isn’t your garden-variety election,” Hatfield told MarketWatch. “The impact on markets could be massive, given the sharply contrasting policies from each party.”

Potential Impacts on Key Market Areas

Stocks

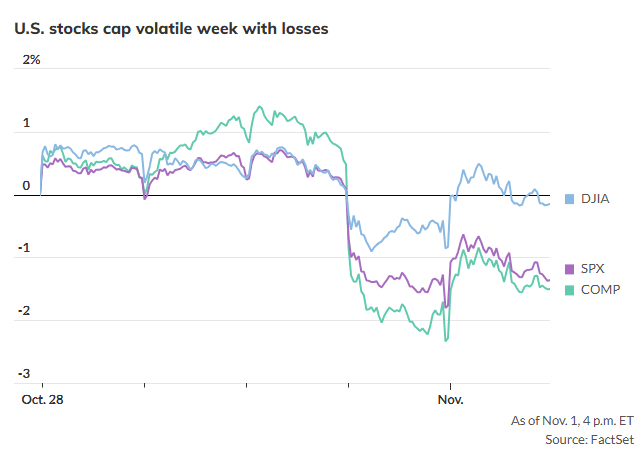

With days until the election, stocks remain somewhat indifferent about a Trump or Harris victory, focusing more on recent corporate earnings and labor-market data as indicators of the economic outlook and potential Fed moves. Despite this steady backdrop, concerns linger about delayed election results, which could dampen investors’ risk appetite.

Sectors

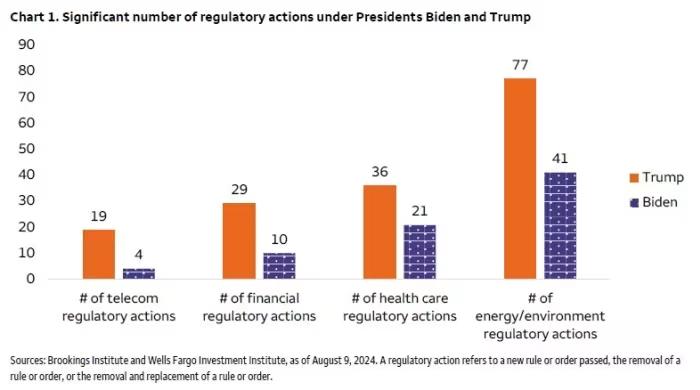

Sector performance may hinge on policy differences. A Trump win could benefit traditional energy sectors like oil, while Harris’s platform could boost renewable energy stocks.

Bonds

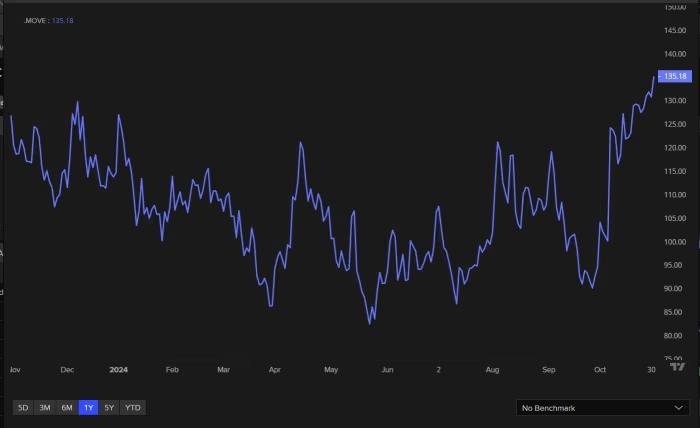

A post-election selloff could increase bond yields, particularly if deficit concerns grow, impacting both bonds and stock volatility.

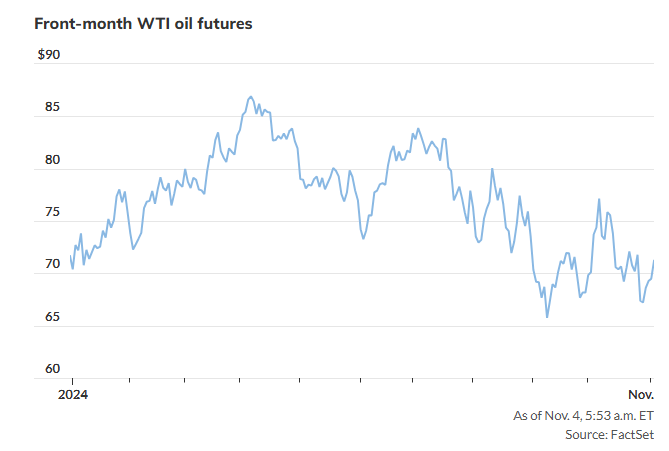

Oil

Oil prices are sensitive to Middle East geopolitics but also to the candidates’ energy policies, with Trump advocating for increased U.S. drilling, while Harris may prioritize green energy.

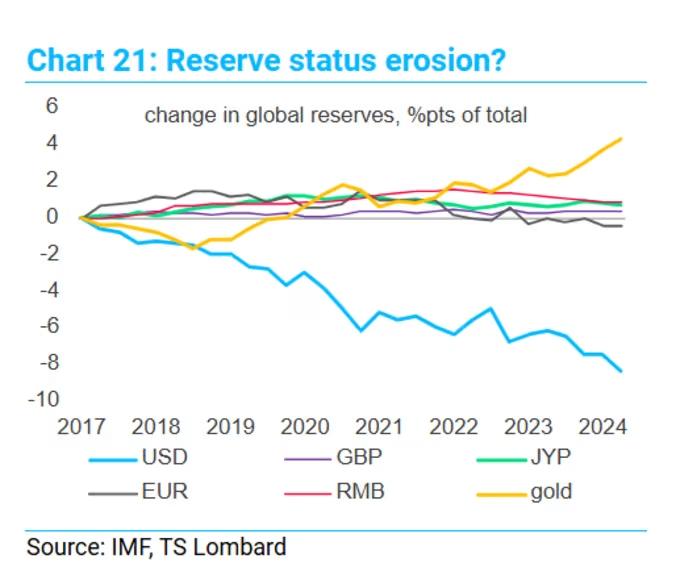

Gold and U.S. Dollar

Gold has surged as investors seek safe havens amid election uncertainty. The U.S. dollar is on a pre-election rise, fueled by market speculation about potential Trump policies.

Investors will be watching for swings in these areas as the election outcome unfolds.