Morgan Stanley has recently brought attention to a risk associated with stock buybacks that is often overlooked. Technology stocks experienced their worst day in nearly two years, and hedge-fund manager Bill Ackman received more bad news.

But first, let’s delve into a critical analysis by Michael Mauboussin, head of consilient research at Morgan Stanley Investment Management’s Counterpoint Global and adjunct professor at Columbia Business School, and his colleague Dan Callahan.

Mauboussin and Callahan examined equity issuance and retirement, highlighting that companies often simultaneously buy and sell their own stock. They engage in stock buybacks while issuing shares to acquire other companies, make investments, or compensate employees through stock-based compensation.

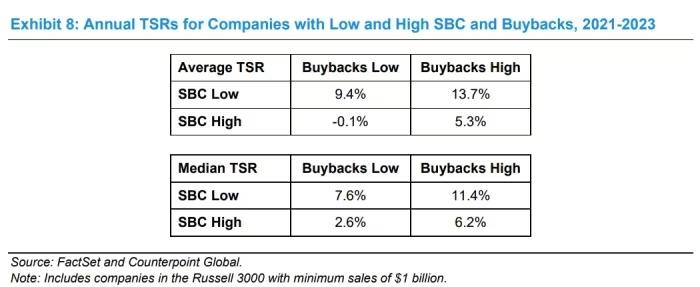

The duo focused on companies in the Russell 3000 with at least $1 billion in sales, analyzing data from 1,350 stocks between 2021 and 2023. They found that companies which aggressively bought back their stock while using stock-based compensation sparingly outperformed the market.

Even companies that were not aggressive with buybacks kept pace as long as they didn’t heavily compensate employees with stock.

They acknowledge that other factors like company fundamentals and interest rates also influence returns. However, they stress the importance of understanding the impact of equity issuance on returns for making informed capital allocation decisions.