Interest-rate uncertainty caused the S&P 500 to fluctuate within a narrow trading range for a month.

On Friday, the S&P 500 achieved its first record close in over two years, establishing a new intraday record after remaining within a tight trading range for almost a month. The benchmark index concluded the day at 4,839.81, surpassing the previous record close of 4,796.56 set on Jan. 3, 2022. It also reached an intraday high of 4,842.07, exceeding the prior intraday record of 4,818.62 from Jan. 4, 2022, according to FactSet data.

This movement occurred amid a turbulent start to the year for stocks, attributed by analysts to a resurgence in Treasury yields and uncertainty surrounding a potential March interest-rate cut by the Federal Reserve.

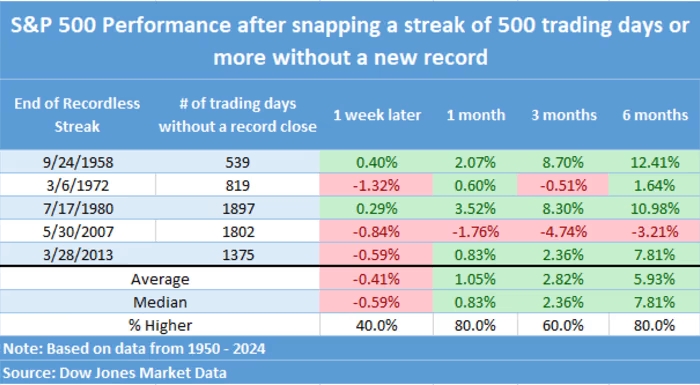

Friday’s breakthrough marked the end of a 512-trading-day stretch without a fresh record closing high for the S&P 500, concluding the longest such period since the 1,375-trading-day streak from October 2007 to March 2013, as per Dow Jones Market Data.

The new year began with U.S. stocks on a downward trajectory, retreating from near-record highs due to solid economic data and Federal Reserve officials pushing back against expectations of aggressive rate cuts, creating uncertainty about the 2024 monetary policy. This, in turn, propelled longer-term Treasury yields to their highest levels since December.

Throughout January, the S&P 500 remained within a short-term trading range established since mid-December, fluctuating between intraday levels of approximately 4,700 on the downside and slightly above 4,800 on the upside. Despite this, the S&P 500 failed to close above its previous record-high of 4,796.56 during this period, based on FactSet data.

According to Steve Sosnick, chief strategist at Interactive Brokers, trading ranges are normal when approaching record highs, as resistance is expected. However, a solid recovery on Thursday, driven by an optimistic 2024 outlook from chip maker Taiwan Semiconductor Manufacturing Co., resulted in megacap technology stocks leading the S&P 500 and the Nasdaq Composite to erase all their 2024 losses.

Record highs for the S&P 500 are anticipated to attract more market participants, as optimism about artificial intelligence and fourth-quarter earnings outweigh concerns about the Fed’s rate-cutting pace. Traders tend to focus on narratives that align with the prevailing market sentiment.

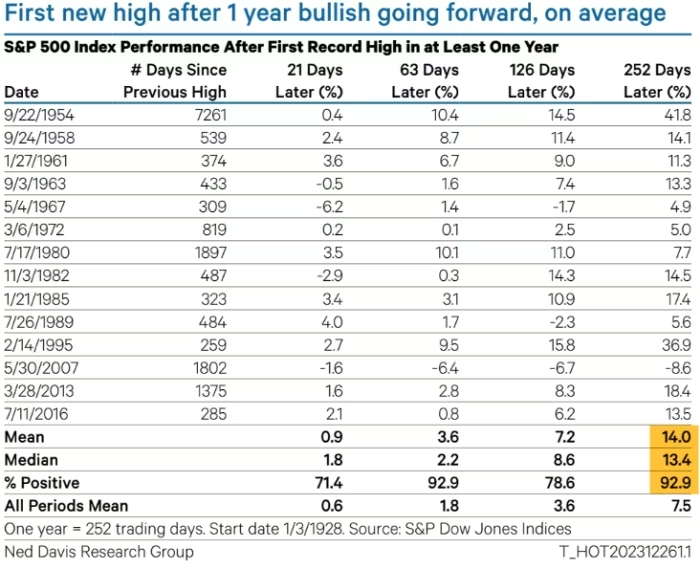

While some technical indicators suggest a potential pullback or correction, historical data indicates positive returns a year after returning to record territory following a gap of at least a year. Despite uncertainties, U.S. stocks surged on Friday, with the Dow Jones Industrial Average closing at a record high of 37,863.80, its second of the year, and the Nasdaq Composite advancing 1.7%. For the week, the S&P 500 rose 1.2%, the Dow industrials gained 0.7%, and the Nasdaq Composite surged 2.3%, according to FactSet data.