The primary benchmark in the stock market hasn’t achieved a record close for almost two years. The journey for stock-market enthusiasts has been notably unusual and unusually protracted. After nearly two years, the S&P 500 is only a few points away from reaching record territory.

On Tuesday, the S&P 500, the prominent U.S. large-cap benchmark, climbed by 20.12 points, equivalent to 0.4%, concluding the day at 4,774.75. This leaves the index less than 0.5% shy of its record close at 4,796.56, established on January 3, 2022.

Since the last record close, which occurred 497 trading days ago, this marks the longest stretch without a record since the period between October 9, 2007, and March 28, 2013, encompassing 1,375 trading days, according to Dow Jones Market Data.

The recent market history involved a downturn into a bear market last year as the Federal Reserve aggressively increased interest rates to curb inflation, which was reaching levels not seen in four decades. Equities suffered as Treasury yields rose in response to the Fed’s tighter monetary policy.

Bonds, by some measures, experienced their worst year on record, creating a challenging situation for investors who typically rely on the offsetting dynamics of stocks and bonds.

Stocks hit bottom in October 2022, recovered some lost ground by the end of the year, and started 2023 on an upward trajectory as the Fed slowed the pace of rate increases. The S&P 500 emerged from its bear market in June, rising more than 20% from its bear-market low in the previous October, before experiencing a setback in late July.

Despite meeting the criteria for the start of a new bull market, some market observers argue that returning to all-time highs is essential to confirm the beginning of a new bullish phase.

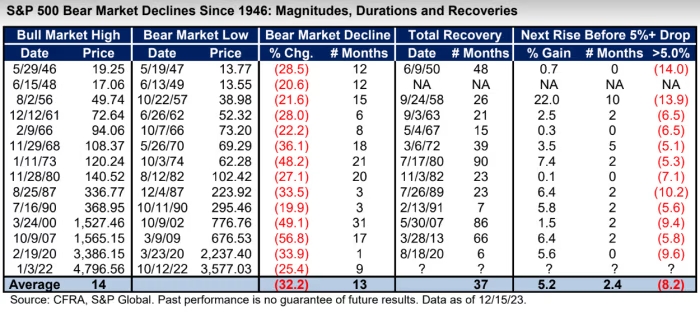

If the S&P 500 were to reach record territory soon, the nearly 24-month gap between records would be shorter than the average observed in the 14 bear markets since the end of World War II, according to Sam Stovall, chief investment strategist at CFRA. On average, it has taken 37 months for the S&P 500 to fully recover its losses following a bear market slide.

The recent rally has been peculiar, characterized by its narrowness, with the so-called Magnificent Seven mega-cap tech stocks dominating gains in 2023. Despite broader participation more recently, the S&P 500 has surged by 24.4% in 2023.

The index’s gains, weighted by market capitalization, have been primarily driven by big tech names, as indicated by an 11% year-to-date gain for an equal-weight measure of the S&P 500.

In contrast, the Dow Jones Industrial Average has achieved a series of record closes this month, closing Tuesday at 37,545.33, just a few points below its record finish of 37,557.92 set on December 19. The blue-chip gauge is up 13.3% so far in 2023.

The narrowly led rally for the S&P 500 signifies an unconventional start to a bull market, leading some traders and technicians to question the sustainability of the rally.

A new record close for the S&P 500 would likely provide some comfort to bulls. Stovall highlights that, historically, after recovering its bear-market losses, the S&P 500 tends to climb by an average of 5.2% over the next 2.4 months before experiencing another decline of 5% or more, averaging 8.2%.

While there’s no guarantee that history will repeat itself, based on historical averages, the S&P 500 could rise an additional 5% from its new all-time high before facing another decline of more than 5%. However, Stovall cautions that this post-all-time high advance might be brief, given that the market stumbled almost immediately after recovering its prior bear-market loss on four occasions.