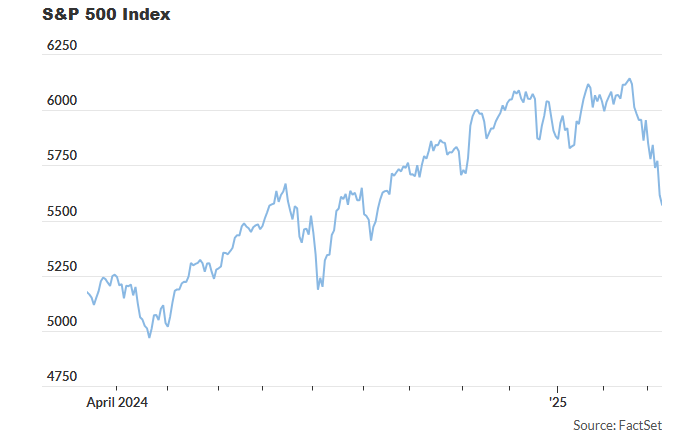

On Tuesday, the S&P 500 (SPX) fell 0.8% to close at 5,572.07, following a volatile trading session, according to FactSet data. A correction, defined as a 10% drop from a recent peak, would place the index at 5,529.74, per Dow Jones Market Data.

Morgan Stanley’s Andrew Slimmon does not believe the Trump administration’s intent is to push the economy into a recession, despite growing concerns over tariffs.

The U.S. stock market continues to grapple with negative sentiment surrounding President Donald Trump’s tariffs. The S&P 500 is attempting to recover from a significant slump that brought it close to correction territory.

“There’s a lot of focus on the worst-case scenario with tariffs,” said Andrew Slimmon, a senior portfolio manager for U.S. equities at Morgan Stanley Investment Management, in a phone interview. “I’m not convinced they will be as inflationary or as damaging to the economy as some fear.”

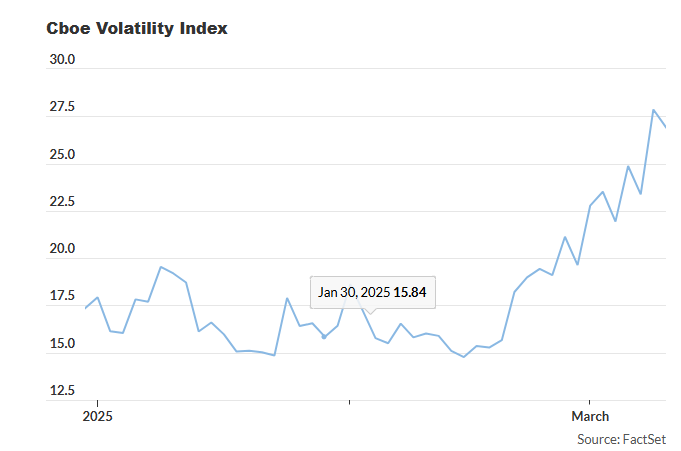

Market volatility has been rising as investors assess the potential impact of new and proposed tariffs from the White House. Many fear these measures could escalate trade tensions, weaken the U.S. economy, and drive inflation higher.

President Trump announced on Truth Social that the U.S. will impose an additional 25% tariff on all steel and aluminum imports from Canada, bringing the total to 50%. He attributed the move to Ontario’s 25% surcharge on electricity exports to the U.S. However, later in the day, Trump walked back the 50% tariff after Ontario Premier Doug Ford rescinded the electricity surcharge. The administration will now maintain a 25% tariff on Canadian steel and aluminum, consistent with other U.S. trading partners.

The market has experienced heightened uncertainty as investors react to tariff-related developments and their implications for the economy. “There is no question that there is uncertainty,” Slimmon noted. “But I don’t think the administration’s goal is to push the economy into a recession.”

As the market awaits reciprocal tariffs set to take effect on April 2, Slimmon believes it may be challenging for stocks to stage a significant rally before then. “Sentiment has turned very negative on tariffs,” he said.

Despite the turbulence, Slimmon sees buying opportunities amid the selloff. “When the market reacts negatively to Washington, that’s when investors should focus on fundamentals,” he said. “I still expect the market to be higher by year-end, though gains may be in the single digits.”

The S&P 500 has stumbled this year after climbing 23.3% in 2024 and 24.2% in 2023, according to FactSet. As of Tuesday, the index is down 5.3% year-to-date.

Tom Essaye, founder of Sevens Report, noted in a Tuesday report that “if concerns about a policy-driven slowdown don’t materialize, the market may be approaching a ‘fair value’ range that could attract buying—assuming investors can handle the volatility.”

The Cboe Volatility Index (VIX), a measure of market anxiety, has surged 55% in 2025 to nearly 27, according to FactSet data.

Slimmon highlighted that speculative stocks have suffered the most in the recent decline, with momentum stocks hit particularly hard. He sees value in select areas, including major Wall Street banks and certain Big Tech stocks that have taken a hit. “Some semiconductor stocks look more attractive today than they did three weeks ago,” he added.

Big Tech has struggled this year, with Nvidia Corp. (NVDA) down 19% in 2025. The iShares Semiconductor ETF (SOXX), which tracks semiconductor stocks, has fallen nearly 11% year-to-date. Meanwhile, the Roundhill Magnificent Seven ETF (MAGS), which holds seven leading tech stocks, has dropped 14.5%.

With concerns over slowing economic growth, traders in the federal-funds futures market are pricing in as many as three interest rate cuts by the Federal Reserve before year-end, per the CME FedWatch Tool. Slimmon does not foresee a U.S. recession this year and believes the Fed may act as a counterbalance to investor fears regarding the administration’s fiscal policies.

Monday’s sharp selloff rattled investors. The S&P 500’s 2.7% decline was “not an outright sell signal, but it does suggest that we shouldn’t dismiss it as mere market noise,” said Nicholas Colas, co-founder of DataTrek Research, in a note Tuesday.