In the beginning of Tuesday, the stock futures in the United States were slightly stronger. Traders were cautious and hesitant to make significant investments due to the upcoming October CPI report, as it could influence the Federal Reserve’s next actions.

How are stock-index futures trading

- The S&P 500 futures, represented by ES00, increased by 8 points or 0.2% to reach 4433.

- The futures for the Dow Jones Industrial Average, YM00, increased by 40 points, or 0.1%, reaching a total of 34425.

- The Nasdaq 100 futures, NQ00, increased by 43 points or 0.3% to reach 15590.

The Dow Jones Industrial Average increased by 55 points, or 0.16%, reaching 34338 on Monday. Conversely, the S&P 500 decreased by 4 points, or 0.08%, to 4412, while the Nasdaq Composite dropped by 30 points, or 0.22%, to 13768.

What’s driving markets

Investors are being cautious in their trading activity due to their hesitation in making risky decisions before the release of the U.S. inflation data at 8:30 a.m. Eastern time.

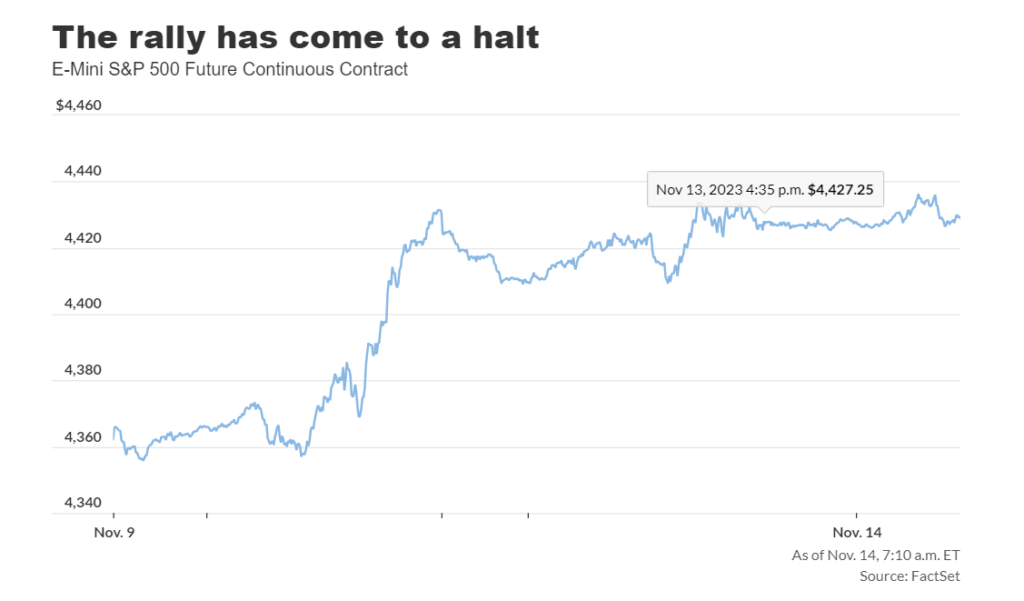

Following a slight decrease in the S&P 500 by less than 0.1% on Monday, the changes in stock futures at the start of the new session are also negligible. The value of the dollar remains relatively stable, and there has been a small decrease in Treasury yields by a few basis points.

Jim Reid, an analyst at Deutsche Bank, stated that the markets have been very unexciting in the past day without much activity in bonds and equities. Investors are eagerly awaiting the release of the U.S. CPI data.

As the rate of inflation has decreased this year, investors have become more optimistic that the Federal Reserve will no longer continue to increase interest rates. As a result, bond markets have experienced a surge, leading to a significant decrease in implied borrowing expenses from the highest levels in 16 years, and resulting in a rise in major stock indices. As of now, the S&P 500 has increased by 14.9% in the year 2023.

Therefore, those who are optimistic about the stock market will want to see solid evidence of this storyline in the report on inflation.

It is predicted that the consumer price index will have increased by 3.3% from October of last year, which is slower compared to the 3.7% growth recorded in September. The decrease is due to lower energy prices, which could result in a month-on-month growth of only 0.1%, down from 0.4%.

Nevertheless, it is anticipated that the essential indicators, which exclude unpredictable factors such as food and energy, will maintain a consistent level, showing an annual increase of 4.1% and a monthly measurement of 0.3%, the same as in September.

Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, stated that if the inflation rate matches or is lower than expected, it will strengthen the belief that the Federal Reserve will not increase interest rates and will increase the expectations of rate cuts for next year.

The current market rates indicate a 14% possibility that the central bank will raise interest rates by 25 basis points at its December meeting, bringing the range to 5.50%-5.75%.

Deutsche’s Reid points out that if these predictions are accurate, it would be the third month in a row where core CPI increases by at least 0.3%. This goes against the Federal Reserve’s goal of maintaining 2% annual inflation, so it is highly likely that the Fed would seek to implement stricter policies once again.

On Tuesday, there will be statements from various Federal Reserve officials. At 8:30 a.m., Richmond Fed President Thomas Barkin will discuss the economic outlook. At 10 a.m., Fed Vice Chair for Supervision Michael Barr will testify to a Senate panel. Lastly, at 12:45 p.m., Chicago Fed President Austan Goolsbee will talk about the economic and policy outlook.

The earnings highlight for Tuesday is the release of Home Depot’s results, scheduled to be announced before the opening of trading on Wall Street.