U.S. stock futures inched higher at the beginning of Monday’s session, with optimism surrounding the Federal Reserve’s potential pause in raising borrowing costs supporting market sentiment.

Market Performance:

- S&P 500 futures (ES00, 0.19%) rose by 7 points, marking a 0.2% increase to 4383.

- Dow Jones Industrial Average futures (YM00, 0.08%) added 35 points, a 0.1% rise to 34162.

- Nasdaq 100 futures (NQ00, 0.22%) climbed 31 points, signaling a 0.2% uptick to 15210.

Previous Market Moves:

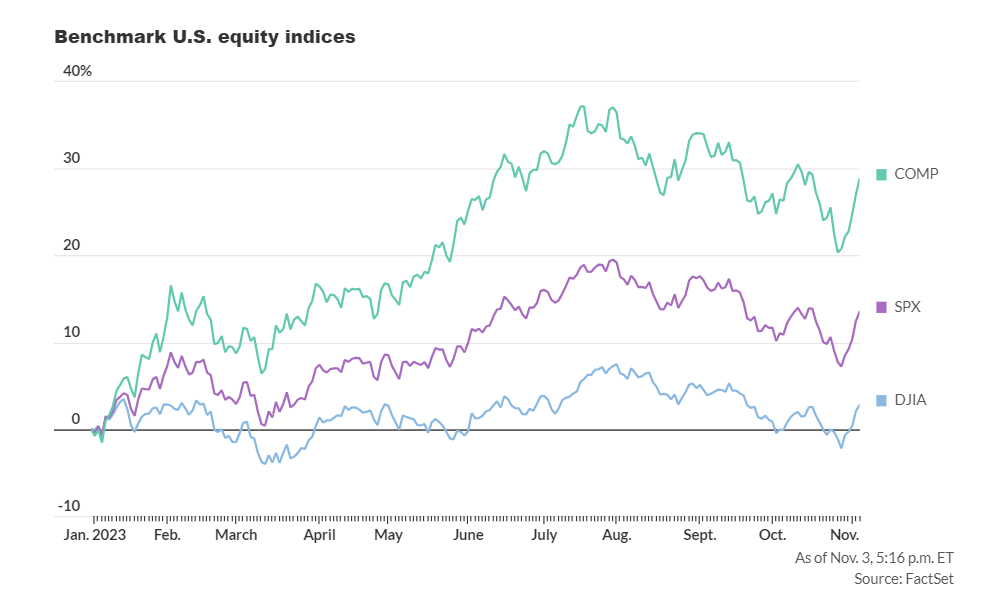

Last Friday, the Dow Jones Industrial Average (DJIA) surged by 222 points, equivalent to a 0.66% rise to 34061. The S&P 500 (SPX) increased by 41 points, reflecting a 0.94% gain to 4358, while the Nasdaq Composite (COMP) gained 184 points, indicating a 1.38% increase to 13478.

Market Drivers: The futures market suggests that stocks are likely to continue their recent rally on Monday, albeit with modest additional gains. Last week, the S&P 500 achieved a robust 5.85% increase, marking its most significant weekly gain in nearly a year. This surge was attributed to remarks made by Federal Reserve Chairman Jay Powell, coupled with signs of a cooling labor market that led to a substantial drop in bond yields. Market expectations grew that the U.S. central bank was concluding its interest rate hikes for this cycle.

Market Outlook: While the benchmark 10-year U.S. Treasury yield had dropped below 4.5% on Friday after reaching a 16-year high above 5%, it has now rebounded to 4.59%, slightly tempering the newfound optimism in the equity market early on Monday.

Stephen Innes, managing partner at SPI Asset Management, noted that equity market movements are primarily influenced by Treasury bonds. The sustainability of the recent rebound in bonds will be crucial. The upcoming bond auctions this week and the release of the Consumer Price Index (CPI) later in the month could significantly impact the possibility of another rate hike.

The week begins with minimal economic data, with the only notable release being the Federal Reserve’s senior loan officer survey for October at 2 p.m. Eastern time. Additionally, Federal Reserve Governor Lisa Cook is scheduled to speak at Duke University at 11 a.m.

Earnings reports from NXP Semiconductors, Vertex Pharmaceuticals, and Tripadvisor are expected after Monday’s closing bell, while Uber and Walt Disney are anticipated later in the week.

Earnings Insights: According to John Butters, senior earnings analyst at Factset, 81% of S&P 500 companies have reported results, with 82% delivering a positive earnings per share surprise and 62% posting a positive revenue surprise.