The large-cap index officially closed in correction territory on Thursday, marking the fastest peak-to-correction decline since March 2020.

Another day, another tariff-driven selloff on Wall Street.

The sharp downturn in the U.S. stock market accelerated on Thursday, pushing the S&P 500 into correction territory as investors grew increasingly concerned about a deepening global trade war and its potential impact on the economy. The index dropped 1.4% to close at 5,521.52, officially entering correction territory—defined as a 10% decline from its recent peak—after falling more than 10% from its February 19 high of 6,144.15.

This correction unfolded rapidly, taking just 16 trading days for the S&P 500 to decline from its peak, making it the fastest such drop since the six-day plunge at the onset of the COVID-19 pandemic in March 2020, according to Dow Jones Market Data.

What Happens After a Market Correction?

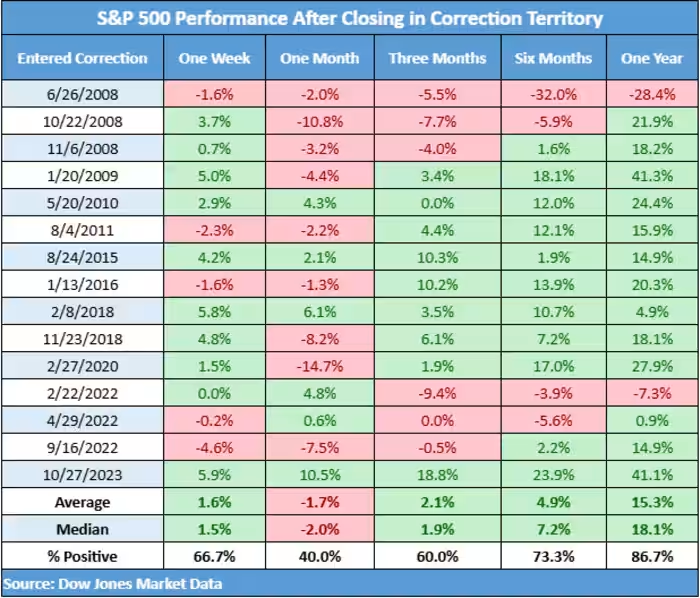

Historical data suggests that stocks typically struggle in the short term after entering correction territory but tend to recover over time. Since 2008, the S&P 500 has, on average, declined by 1.7% in the month following a correction. However, the index has historically rebounded over longer periods, gaining an average of 2.1% over three months, nearly 5% over six months, and an impressive 15.3% a year after first closing in correction territory, according to Dow Jones Market Data.

Tariffs and Market Volatility

Thursday’s selloff coincided with escalating trade tensions. President Donald Trump ramped up tariff threats against the European Union, calling it a “hostile and abusive taxing and tariffing authority” and warning of a 200% tariff on EU alcohol imports. Meanwhile, Canada has entered a retaliatory tariff dispute with the U.S. Canadian Finance Minister Dominic LeBlanc and Ontario Premier Doug Ford met with U.S. Commerce Secretary Howard Lutnick to address growing trade frictions, spurred by new U.S. tariffs on steel and aluminum and prior threats of a 25% tariff on all Canadian goods.

The uncertainty surrounding Trump’s tariff policies and retaliatory measures from key trading partners have fueled risk-off sentiment, increasing market volatility and raising fears of an economic slowdown.

Assessing the Market Drawdown

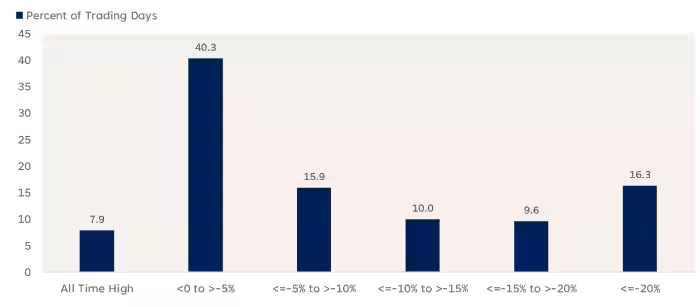

Despite the recent selloff, market experts suggest that such drawdowns are not unusual. Adam Turnquist, chief technical strategist at LPL Financial, pointed out that since 1950, 92% of trading days have experienced some level of drawdown from the S&P 500’s peaks. Declines of less than 5% have been the most common, occurring about 40% of the time, while pullbacks of 5% to 15% have occurred in over a quarter of all trading days.

“While this correction is sharp, it’s not out of the ordinary,” Turnquist noted. He also highlighted that swift drawdowns often create oversold conditions, though lingering market weakness, lack of institutional participation, and defensive rotations suggest caution in buying the dip.

Market Close and Outlook

On Thursday, U.S. stocks finished lower, with the Nasdaq Composite falling nearly 2% and the Dow Jones Industrial Average dropping over 530 points, or 1.3%, according to FactSet data. As investors navigate ongoing trade uncertainties, the focus remains on whether the market can stabilize and find support in the coming weeks.