The benchmark for technology stocks falls for the fifth consecutive session, marking its longest period of continuous losses since October 2022.

On Thursday, the majority of U.S. stocks ended the day with lower values. The Nasdaq Composite, which primarily consists of technology stocks, experienced its fifth consecutive session of declines, while the S&P 500 had its fourth consecutive day of losses. The cause of this downturn was a recent release of labor-market data, which raised worries about the Federal Reserve’s plan for tightening monetary policy in 2024.

How stocks traded

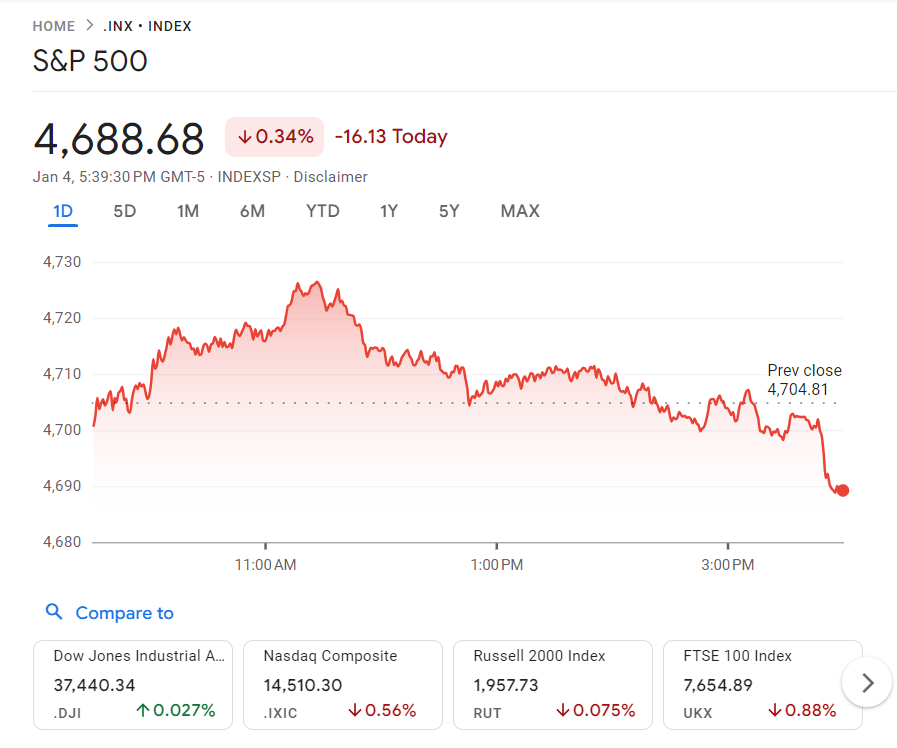

- According to Dow Jones Market Data, the S&P 500 SPX declined by 16.13 points or 0.3%, concluding at 4,688.68. This marks the fourth consecutive session of the large-cap benchmark index falling, which is the longest losing streak in over two months.

- The Dow Jones Industrial Average DJIA increased by 10.15 points, resulting in a negligible change, to reach a value of 37,440.34.

- On Thursday, the Nasdaq Composite (COMP) declined by 0.6%, dropping 81.91 points to close at a value of 14,510.30. This marks the fifth consecutive day of losses for the technology-focused index, which hasn’t experienced such a prolonged decline since October 12, 2022.

On Wednesday, the S&P 500 experienced its third consecutive drop as stocks in the U.S. continued to face difficulties at the beginning of 2024. The significant stock market index decreased by approximately 1% during the period known as the ‘Santa Claus rally,’ which occurs between late December and early January. This decline marks the worst performance of its kind since early 2016.

What drove markets

U.S. stocks ended the year 2023 on a high note with nine consecutive weeks of winning, but they have experienced a challenging start in the new year. However, the Dow industrials managed to secure a slight increase on Thursday, helping to recover from losses earlier in the week.

According to Dow Jones Market Data, the Nasdaq Composite had its longest period of consecutive losses in more than a year, even though it briefly showed some improvement in the morning session.

The selloff has been attributed to increased tensions in the Middle East, apprehension about stocks and bonds being overly purchased, and concerns that the Federal Reserve might not lower borrowing costs as anticipated.

In fact, the minutes from the December meeting of the Federal Reserve, which were made public on Wednesday, revealed that officials were pleased to see a decrease in inflation. However, they also voiced concerns and hesitations about the course of action for monetary policy in the year 2024.

James St. Aubin, the head investment officer at Sierra Mutual Funds, rejected the idea that the minutes had a significant influence on investors’ views of the Federal Reserve. According to him, there was nothing in the minutes that altered the market’s perception.

The majority of financial markets anticipate that the central bank will decrease interest rates by a quarter-point five to seven times throughout the year, in contrast to the three cuts that policymakers indicated last month.

According to the CME FedWatch Tool, on Thursday, traders of fed-funds futures predicted a 93.3% likelihood of the Federal Reserve keeping its benchmark interest rate unchanged at 5.25% to 5.5% during its upcoming meeting on Jan. 30-31. Additionally, the probability of a rate cut of at least 25 basis points by March decreased from 90.3% a week ago to 62.1%.

Brad Conger, the deputy chief investment officer at Hirtle Callaghan & Co, referred to the Fed’s projected interest-rate cuts as “quite cautious.” He stated that although the market anticipated up to seven cuts by 2024, “five or six” would still be reasonable due to the compelling economic data reflecting disinflation in the past few months. Conger shared this perspective with MarketWatch on Thursday.

Conger stated that he does not believe that the market’s assumptions of Federal Reserve rate cuts are overstated.

St. Aubin speculated that the reason for the selloff could be related to tax purposes. He explained that there doesn’t seem to be any specific reason for it, except that it might be a common time for people to sell their assets after the new year for tax purposes.

There seems to be an abundance of news coming up in the next few weeks that could have a significant impact on the market, such as the beginning of the earnings-reporting period for the last quarter of 2023.

However, the most immediate concern is the U.S. labor market, as the government will release the nonfarm payrolls report on Friday at 8 a.m. Eastern.

Investors have already been provided with a set of labor-market information this week. The private-payrolls data from ADP, which was released on Thursday, indicated that American businesses added an impressive 164,000 new jobs in December. At the same time, data from the U.S. government revealed that the number of individuals who filed for unemployment benefits during the last week of 2023 decreased significantly to 202,000, reaching its lowest point in almost three months.

According to the most recent data available in November, a report revealed that the amount of available job opportunities had decreased to its lowest point in 32 months, reaching 8.8 million.

Companies in focus

- Mobileye Global Inc. experienced a significant decline of 24.6% on Thursday due to a revenue warning from the company behind self-driving technology. Moreover, Bank of America downgraded the Israel-based company to an underperform rating.

- Shares of Walgreens Boots Alliance dropped by 5.1% after the company released its first-quarter earnings. Although the earnings exceeded expectations, the drugstore chain decided to reduce its quarterly dividend by 48%.

- Apple Inc’s shares experienced a 1.3% decline following a downgrading from Wall Street. Piper Sandler, a financial firm, changed its rating on the tech company from overweight to neutral due to apprehensions about its value and the challenges present in the smartphone industry.