The benchmark S&P 500 stock index closed Tuesday at its lowest level since November 4, erasing all gains made since President Donald Trump’s November 5 election victory. The sharp decline was driven by mounting concerns that the administration’s sweeping tariff measures could stifle economic growth.

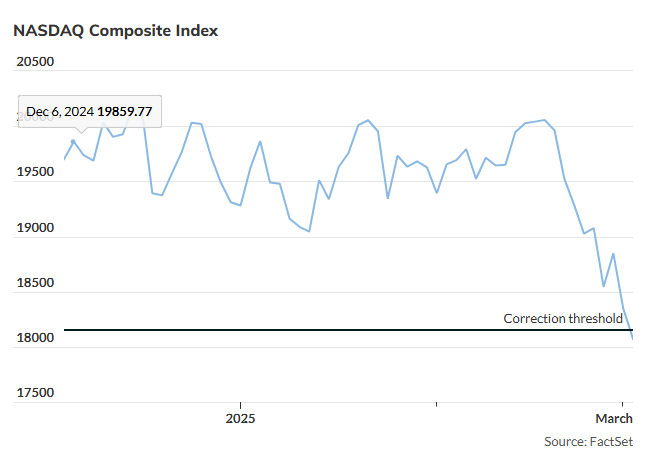

The Nasdaq Composite, known for its heavy weighting in technology stocks, briefly dipped into correction territory—defined as a 10% drop from a recent peak—before staging a partial recovery. The index ended the day down 0.4% at 18,285.16, its lowest closing level since November 4, after reaching an intraday low of 17,956.60.

“Tariffs are likely to add upward pressure on inflation and act as a headwind to economic growth at the margin, creating an unfavorable environment for risk assets broadly,” said Josh Jamner, senior investment analyst at ClearBridge Investments, in a note.

On Tuesday, the U.S. imposed 25% tariffs on imports from China and Mexico, along with an additional 10% tariff on Chinese goods, adding to the 10% tariff implemented last month. In response, China and Canada announced retaliatory tariffs, while Mexico indicated it would unveil its response by Sunday.

Following the market close, Commerce Secretary Howard Lutnick suggested in a television interview that President Trump might be open to compromise with Canada and Mexico, potentially lowering tariff rates as soon as Wednesday.

For the Nasdaq, a close below 18,156.50 would confirm a correction, representing a 10% decline from its record close of 20,173.89 on December 16. A further decline of 20% would signal a bear market. Despite Monday’s close below the 200-day moving average of 18,376.37—a key technical indicator for long-term trends—the Nasdaq managed to climb back above that level on Tuesday.

The Dow Jones Industrial Average ended the day down 670.25 points, or 1.6%, at 42,520.99, after dropping as much as 843 points intraday. A close below 40,512.64 would confirm a correction from its record high of 45,014.04 set on December 4.

Meanwhile, the S&P 500 closed 71.57 points lower, or 1.2%, at 5,778.15—its lowest finish since November 4. A decline below 5,529.74 would mark a correction from its February 19 record close of 6,144.15. The index approached its 200-day moving average of 5,725 during Tuesday’s session, a level it hadn’t tested since November 2023. Jonathan Krinsky, chief market technician at BTIG, suggested that the index could see a short-term bounce at this level but cautioned that a more prolonged bottoming process could unfold.

“The key question is not whether we bounce at the 200-day moving average, but what happens afterward,” Krinsky wrote. “Investors are used to ‘V-shaped’ recoveries, but we must be prepared for the possibility of a ‘W-shaped’ bottom with a bounce followed by a re-test later this month.”

Concerns over escalating trade tensions are weighing on market sentiment, raising fears of a significant economic slowdown or even a potential recession.

Nancy Tengler, chief executive and chief investment officer at Laffer Tengler Investments, noted that the market appears to be entering a correction.

“Corrections are always painful when you’re in the middle of them, and I believe that’s where we are now,” Tengler wrote. She added that corrections typically occur once every 12 months and are often triggered by catalysts that seem dire at the time.

“This time, the catalyst is tariffs,” Tengler said. “It’s crucial to assess not just the tariffs themselves, but how long they might last. If they prove to be short-lived, this could present a buying opportunity for long-term investors.”