Robinhood Markets Inc. experienced a significant surge in equity trading volumes during February, with a remarkable 36% increase compared to the previous month. This surge propelled the company’s stock to soar during Wednesday’s after-hours trading session.

In February, the online-trading platform witnessed a staggering $80.9 billion in trading volumes, marking a substantial uptick from January’s figures. Options contracts trading volumes also saw a notable uptick, rising by 12% to $119.1 million, while cryptocurrency trading volumes increased by 10% to $6.5 billion.

The total assets under custody for the month reached $118.7 billion, showcasing a robust 16% surge compared to Robinhood’s January levels. Moreover, the company recorded net deposits of $3.6 billion.

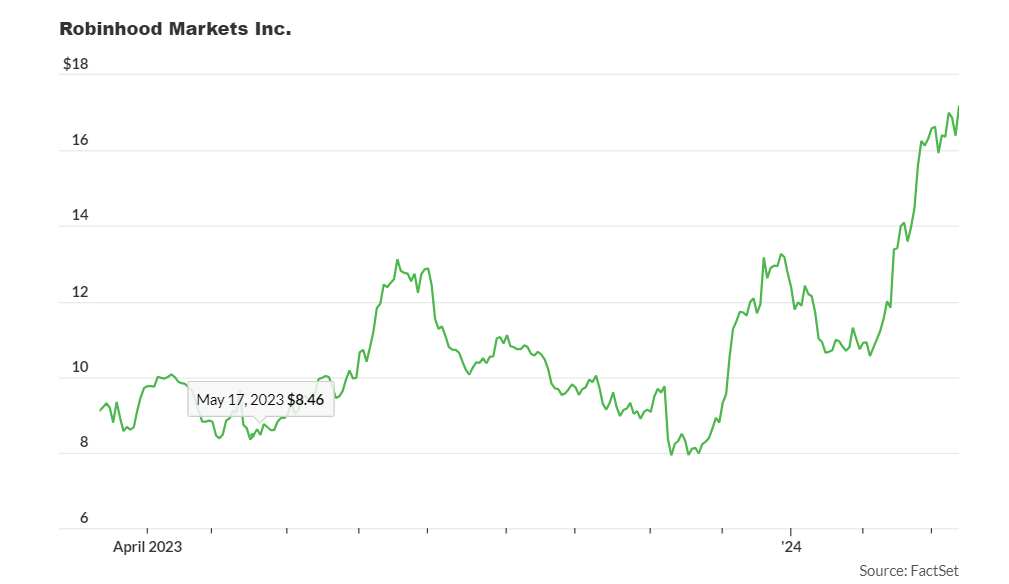

Following this impressive performance, Robinhood’s shares surged by 10% in after-hours trading on Wednesday, contributing to a remarkable 91% increase over the past 12 months.

Robinhood has been capitalizing on the resurgence of interest in retail trading, as evidenced by its recent quarterly earnings report, which highlighted an increase in monthly active users and transaction-based revenue.

Chief Financial Officer Jason Warnick expressed optimism about Robinhood’s market potential during a JMP Securities conference earlier this month. He emphasized the significant opportunities presented by the growing strength of retail traders, increased earnings power, and wealth transfer over the next decade, affirming Robinhood’s strong positioning to cater to this evolving customer base.