The recent turbulence in the U.S. stock market has reminded investors of the volatility that had been absent during a long period of calm, potentially signaling a significant shift in market sentiment, according to Jason Goepfert, founder and senior research analyst at SentimenTrader.

Over the past two weeks, the S&P 500 index experienced significant intraday swings, moving at least 1% for eight consecutive sessions, driven by concerns over a weakening U.S. economy and the unwinding of a Japanese yen carry trade.

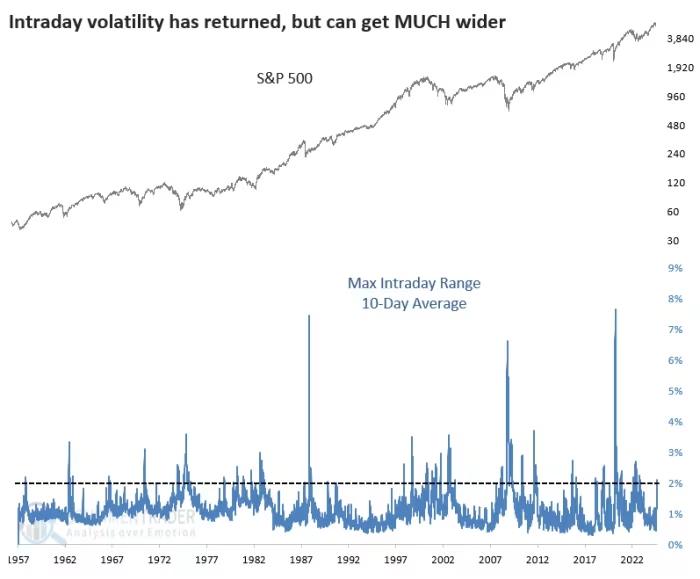

The index’s intraday range averaged over 2% during the last 10 trading sessions, marking one of the most volatile periods in the past decade.

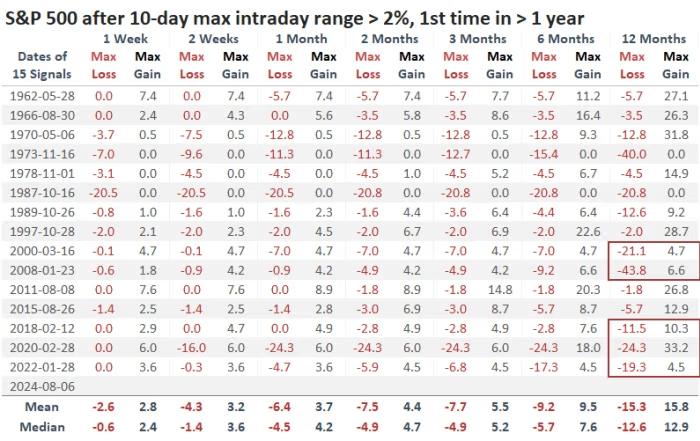

Goepfert noted that this level of volatility is rare, with the S&P 500’s 10-day intraday range surpassing 2% only a few times in history. This recent spike in market swings ended a record 430-session streak without such volatility, suggesting a potential shift in investor sentiment.

Historically, sharp increases in intraday volatility often led to a temporary market shakeout, followed by a resumption of the uptrend. However, Goepfert highlighted that over the past 25 years, these spikes have sometimes resulted in more risk than reward for investors in the following year.

He cautioned that if the S&P 500 continues to hit lower lows, investors may need to prepare for a shift toward defensive stocks.

As of Monday afternoon, U.S. stocks were mostly lower, with the S&P 500 down 0.1%, the Dow Jones Industrial Average losing 0.5%, and the Nasdaq Composite rising 0.2%, according to FactSet data.