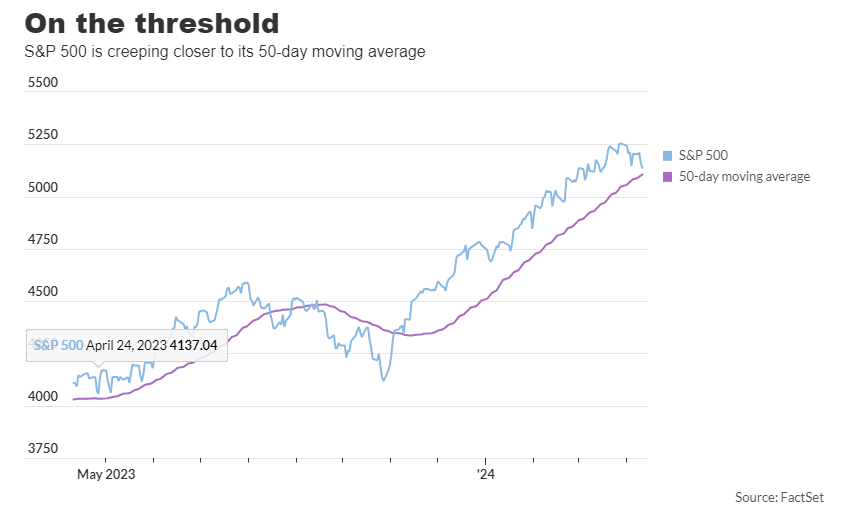

The S&P 500 came within 33 points of its 50-day moving average on Thursday, marking the closest approach to this key trendline since November 13th. This proximity hints at a pivotal moment for the stock market rally, as recent turbulence has brought the index within striking distance of an important technical threshold for the first time in five months.

A potential breach of this threshold could signify further downside for stocks, potentially triggering a reversal of some of the rapid gains that propelled the S&P 500 more than 25% higher between late October and Wednesday’s close.

Craig Johnson, chief market technician at Piper Sandler Technical Research, suggests that while some might view a modest pullback as healthy, the absence of any significant correction for five months raises concerns.

The rally, initially fueled by expectations of aggressive Federal Reserve interest rate cuts in 2024, now faces skepticism amidst hotter-than-expected inflation data.

The narrowing gap between the S&P 500 and its 50-day moving average reflects the pace of the rally, which has seen the index trading well above this average for an extended period—the longest streak since 1998.

Despite Thursday’s partial recovery, with major indexes like the S&P 500 and Nasdaq Composite rebounding, the Dow Jones Industrial Average remains on track for a fourth week of losses in the past five. Various technical indicators, including the 14-day relative strength index, suggest a loss of momentum for the S&P 500, although it still hovers around 1% below its recent record high.

Looking ahead, market technicians are closely monitoring the S&P 500’s movement relative to its 50-day moving average, which currently stands at 5,105.73. A break below this level could signal further downside, with 4,990 identified as the next support level—a retracement of approximately 23% from the index’s recent rally peak.

Katie Stockton of Fairlead Strategies notes that such moving averages often align with significant support or resistance levels in the market.