Dow Plummets Nearly 900 Points as S&P 500 Edges Closer to Correction

U.S. stock markets suffered a significant blow on Monday, marking their worst trading day of 2025. Investor concerns over a potential U.S. recession intensified after the Trump administration failed to ease fears, raising the likelihood of continued selloffs and even a bear market for the Nasdaq Composite Index.

The Nasdaq Composite took the hardest hit, dropping 727.90 points, or 4%, to close at 17,468.32—its lowest level since September 11, 2024. This decline marked the steepest percentage drop since September 13, 2022. Having already entered correction territory last week—a 10% drop from a recent high—the index now sits 13.4% below its record close of 20,173.89, set on December 16.

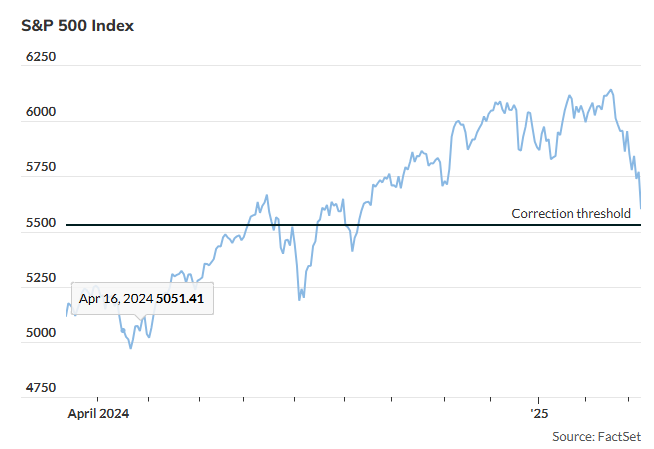

The Dow Jones Industrial Average also faced steep losses, tumbling 890.01 points, or 2.1%, to end at 41,911.71, after plunging as much as 1,189 points during the session. Meanwhile, the S&P 500 shed 155.64 points, or 2.7%, to finish at 5,614.56, putting it 8.6% below its record close of 6,144.15 from February 19.

Market analysts predict more turbulence ahead. “This could continue,” said Peter Cardillo, chief market economist at Spartan Capital Securities. He warned that with the Nasdaq in correction territory and the S&P 500 on the brink of one, further selloffs may persist until market exhaustion occurs. “Is it too early to talk of a bear market? The risk for the Nasdaq is certainly elevated,” he added.

Over the weekend, President Donald Trump attempted to downplay the economic impact of his administration’s tariff policies during an interview on Fox News. While acknowledging the possibility of a recession in 2025, Trump described the current economic conditions as a “period of transition.” White House economic adviser Kevin Hassett echoed efforts to quell recession fears in a CNBC interview on Monday, but the market’s reaction suggested otherwise.

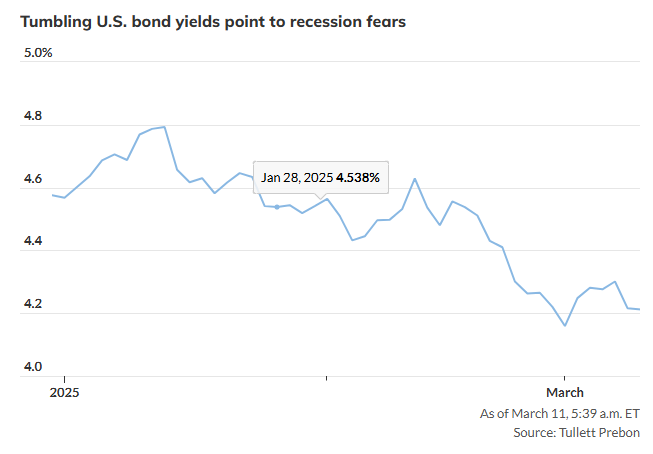

“The market speaks for itself,” Cardillo remarked, noting that bond markets were flashing warning signals of a potential recession. Treasury yields, which move inversely to bond prices, continued their downward trajectory, reflecting expectations that the Federal Reserve might need to cut interest rates to stabilize the economy.

Tom Essaye, founder of Sevens Report Research, attributed the selloff to heightened uncertainty over tariffs, the looming debt ceiling battle, and discussions on extending Trump-era tax cuts. He warned that uncertainty could cause businesses and consumers to pause spending, leading to economic stagnation and declining corporate earnings.

While fears dominate investor sentiment, Essaye noted that “it’s fear driving this market, not actual bad data.” Corporate earnings remain stable, and analysts have yet to make significant downward revisions to forecasts. However, the S&P 500’s high valuation—trading at over 21 times expected earnings—makes it vulnerable to further declines.

The 10-year Treasury yield, now at 4.212%, has dropped from its recent 4.8% peak as inflation worries take a back seat to economic slowdown concerns. Fed Chair Jerome Powell previously described the economy as being in “fine shape,” but growing trade disputes have shifted the outlook. This uncertainty has fueled speculation that the Federal Reserve may reconsider its cautious stance on rate cuts for 2025.

“The market swung from exuberance to despair in just a few weeks,” observed Gennadiy Goldberg, head of U.S. rates strategy at TD Securities USA.

Investors now face multiple layers of uncertainty—not just over Trump’s trade policies and broader economic strategy, but also the possibility of a government shutdown if Congress fails to reach a budget deal by Friday.

“The bond market is increasingly worried about slowing growth momentum, exacerbated by trade and fiscal uncertainty,” Goldberg added.

With volatility gripping Wall Street, all eyes are on economic data releases and Federal Reserve policy decisions in the coming weeks, as investors brace for what could be a prolonged period of market instability.