Use code: HOT25 (Expires 07-07-2024)

Micro E-mini Futures Trading Strategies

What are Micro E-mini futures?

In May 2019, CME Group launched the new Micro E-mini futures contracts.

The Micro E-minis include:

- S&P 500 = MES

- NASDAQ-100 = MNQ

- Russell 2000 = M2K

- Dow Jones Industrial Average = MYM

What's so great about Micro E-mini futures?

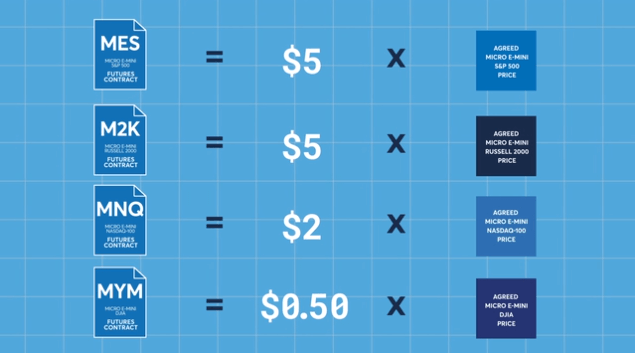

More people can now day trade because of greater affordability (i.e. lower cost and margins). Micro futures are less expensive to trade than regular futures. In fact, they are 1/10th the size of their respective “regular-sized” counterparts (i.e. ES, NT, RTY, and YM). For example, a regular E-mini futures contract (ES) is worth $50 USD * the agreed upon E-mini futures price. In comparison, the MES is only $5 USD * the agreed Micro E-mini futures price. These “multiplier” values vary among the markets.

Like the regular ES, each MES tick equals 0.25. In other words, the smallest price can move up or down at any time is by 0.25. Therefore, the price axis in a ES and MES day trading chart is composed of 0.25 tick increments. However, there is a difference between the MES and the regular ES. Do you remember the 1/10th scale mentioned previously? Here is where it comes into play. A one-tick MES move equals $1.25 (each E-mini tick is worth $12.50, in comparison). By common definition, four ticks equals one point. This is true for the ES, MES and similar markets. Therefore, each MES point equals $5 ($1.25 * 4 = $5). Likewise, $5 (one MES point) * 10 (recall the 1/10th Mini scale) = $50 (one ES point).

Like their larger siblings, the Micros trade Sunday through Friday and use a quarterly (March, June, September, December) expiration schedule. Remember to roll over your Micro futures contracts just like regular futures!

So, what can you do with Micro E-mini futures?

- Control a greater number of contracts with reduced cost. Perhaps you could only afford to trade with one or two ES contracts before. Now, you may be able to diversify by trading multiple Micro contracts for the same cost as one ES contract.

- With more positions, use the AutoPilot Trading System when starting out. You could exit at different targets. Consider a “trailing a stop” and consider staying in winning trades longer.

- Remember, trading stocks often requires wealth: a $25,000 account size. Regular E-mini brokers often required $3,000 or more. Micro E-mini futures accounts may require as little as $400.

How do you trade the new Micro markets?

To open an MES chart in NinjaTrader 8:

- Go to the NinjaTrader Control Center > New (menu button at the top of the Control Center window) > Chart.

- In the upper-left next to Instrument, click the magnifying glass icon. Type in MES to search for the Micro E-min S&P 500 Futures. MES should be listed. Select the row containing the MES. Click OK.

- Adjust the chart settings as needed and click OK. Typically, we use a 5-min chart with no more than 30 days of data (set via “days to load”).

- An MES chart should appear containing candles/data. Continue to customize the chart as desired, i.e. add indicators, etc.

Yes, the free NinjaTrader Continuum (CQG) data feed supports these Micro markets. If you need assistance getting live Micro E-mini data, visit the Simulator page.

After opening a chart, compare the activity with the non-Micro chart. The price action seen on the MES is identical to the ES.

It would be wise to check in with your broker regarding any additional fees or costs associated with Micro trading.

We hope you have a fun and prosperous experience!

Our trading courses and software with Micro E-minis...

Yes, our trading methods work with these Micro markets! No additional indicator configuration or downloads are required. See all of our courses and software.

Look at this great long Atlas Line trade! The Long signal in the bottom-left corresponds with the entry. The entry is exactly where the arrow is pointing. Long and Short Atlas Line signals occur when there are two consecutive closing bars on either side of the Atlas Line. Later, we saw some great Atlas Line Strength signals as well. On average, expect two to four trades daily.

With the Trade Scalper, the goal is winning many small trades. It’s a fast, “in-and-out” trading style. Long and short signals appear of either the regular or “Double Wick” type. Small arrows further guide your trading. Because of the small amounts associated with these Mini markets and the smaller scalping profit goals, you may want to use more contracts.

The ATO (At the Open) 2 focuses on finding winning moves soon after the market opens. Here, we have a great short signal. If you look closely, you will see this is the same morning as shown in the previous Trade Scalper chart. See how the methods compliment one another? On average, the ATO 2 produces one to two trades daily. Again, the goal is to capture the main morning move.