Markets Gain Ground Despite Recession Worries Amid Trump Tariffs and Trade Talk

Treasury Secretary Scott Bessent said Tuesday that President Donald Trump was making headway on trade agreements and tax legislation, offering some relief to Wall Street as a turbulent April comes to a close.

Renewed optimism around potential trade deals, tax cuts, and deregulation has helped lift the S&P 500 index, which notched its longest winning streak since November.

Still, Trump’s imposition of new tariffs on April 2 — followed by a partial pause on April 8 — has unsettled global trading partners and darkened sentiment among U.S. businesses and households. These moves triggered sharp declines in equities and reignited concerns that the U.S. economy might slip into recession, despite some progress on trade during the administration’s 90-day pause on new tariffs.

“We shifted our baseline to expect a recession starting April 9,” said Luke Tilley, chief economist at Wilmington Trust Investment Advisors. His firm is particularly worried that even if the most recent tariffs are rolled back, overall tariff levels on U.S. imports would remain high by historical standards.

Given that outlook, Wilmington Trust now sees a 60% chance of a recession within the next year, though it anticipates any downturn would be relatively short and mild. Other analysts have projected even higher odds of a contraction.

So why have stocks been rising? Some investors are encouraged by signs that Trump may pivot toward more pro-growth initiatives. Additionally, there’s a belief that markets may have already priced in much of the potential damage from a mild recession.

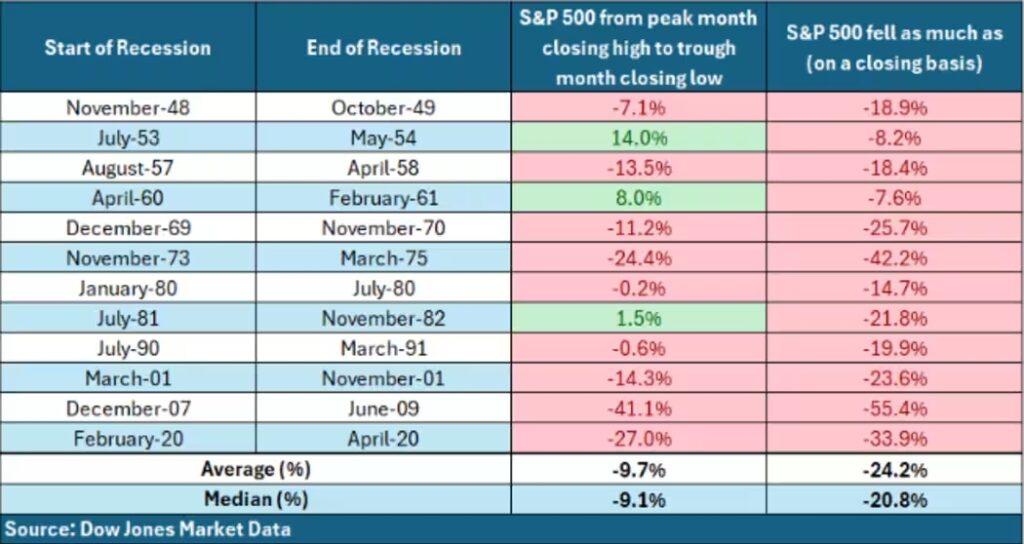

Tilley noted that in past downturns over the last 80 years, the S&P 500 has typically declined by about 20% on a median basis. Those losses have been less severe when viewed month to month.

From its February 19 peak, the S&P 500 fell 18.9% by April 8, closing at 4,982.77, according to Dow Jones Market Data. The intraday decline, including April 7, reached 21.3%.

More importantly, Tilley pointed out that stock markets have historically recovered fairly quickly — with a median rebound time of about 11 months from bottom to peak.

“A lot of investors are keeping that in mind,” Tilley said. “Despite rising recession risks, more people seem willing to ride out the short-term volatility.”

A Rocky First 100 Days

The S&P 500 has dropped 7.3% during Trump’s first 100 days in office — the steepest slide since the beginning of Richard Nixon’s second term in 1973.

While that may indicate the worst of the equity selloff has passed, Tilley warned that American consumers are unlikely to absorb even modest tariff increases without economic consequences.

Back in March, Treasury Secretary Bessent cautioned investors to begin “detoxing” from the effects of pandemic-era stimulus, following two consecutive years of 20%-plus stock market returns.

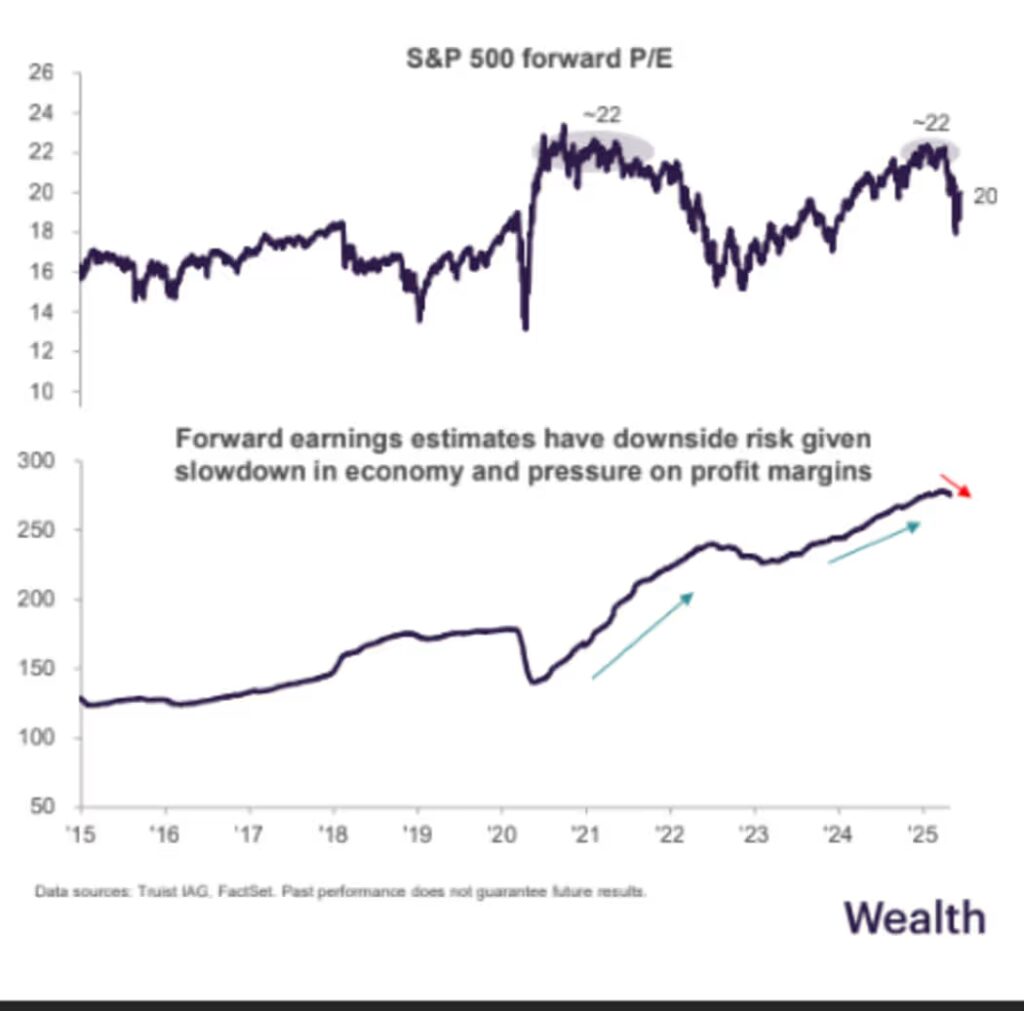

The sharp market decline in 2025 has been largely driven by policy uncertainty coming from the White House. One lens for evaluating market direction is through price-to-earnings (P/E) ratios.

At the end of last year, the S&P 500 traded at a P/E ratio of 22x, buoyed by hopes for growth-focused Trump policies. But that multiple dipped below 20x after China’s DeepSeek raised concerns over more cost-efficient AI applications — coupled with Trump’s new tariffs.

“It’s difficult to see markets returning to a 22x multiple anytime soon, given the current environment of weakening economic data, earnings pressure, and persistent policy uncertainty,” said Keith Lerner, chief market strategist at Truist Advisory Services, in a client note Tuesday.

Despite the murky backdrop, markets closed higher Tuesday: the Dow rose 300 points (0.8%), while the S&P 500 and Nasdaq each advanced 0.6%, according to FactSet.