Interest-Rate Volatility Shows Signs of Normalization, Says J.P. Morgan’s Phil Camporeale

Investors appear to be less anxious about rising interest rates, though significant market risks remain on the horizon.

“The biggest risk is that inflation makes an unwelcome return in the second half of this year,” said Phil Camporeale, portfolio manager for J.P. Morgan Asset Management’s global allocation strategy, in a phone interview. He warned that inflation could not only remain sticky but also accelerate due to wage growth or price increases in sectors like lodging and dining.

On Friday, U.S. stocks tumbled, with the Dow Jones Industrial Average experiencing its worst week since October. Investors analyzed economic data, including a consumer survey indicating increased inflation expectations driven by concerns over tariffs. The upcoming week will provide fresh inflation data from the Federal Reserve’s preferred measure, the personal-consumption expenditures (PCE) price index.

Recently, stock markets have found relief as rate volatility has eased to levels last seen in early 2022—before the Fed embarked on its aggressive rate-hiking cycle. “Nothing worries equity investors more than interest-rate volatility,” Camporeale noted. However, with inflation slowing significantly, prompting the Fed to recalibrate its monetary policy with rate cuts last year, rate volatility appears to be stabilizing.

So far in 2025, the Fed has maintained its benchmark rate, having paused rate cuts in January. “The central bank is on the back burner now,” said Camporeale. “Nobody is calling for the Fed to take immediate action.” He highlighted a shift in investor focus from the Fed’s next move to fundamental drivers of the equity market.

While markets seem to accept inflation running slightly above the Fed’s 2% target, investors remain wary of a potential resurgence. The University of Michigan’s latest survey indicated that tariff-related developments have heightened inflation concerns. “Consumers are clearly bracing for a resurgence in inflation,” said Joanne Hsu, director of the survey. “If these concerns persist, they could pose challenges for policymakers.”

Investors will closely watch the Fed’s favored PCE gauge, due for release on February 28. Meanwhile, some analysts believe the Fed may have reached a point where it opts to do nothing for a while. “Bond-market volatility is no longer the key issue,” said Sameer Samana, head of global equities and real assets at Wells Fargo Investment Institute. He pointed to the ICE BofAML MOVE Index, a measure of bond-market volatility, which has dropped to its lowest level in three years despite a brief uptick on Friday. Over the past six months, the MOVE Index has declined nearly 18%.

Despite last week’s market selloff, the S&P 500 remains close to its all-time high from February 19. The index closed Friday at 6,013.13—just 2.1% below its record. Notably, the current bull market has broadened beyond technology stocks, with financials playing a key role. While the S&P 500’s technology sector has dipped 0.3% year-to-date, financials have gained 4.8%, according to FactSet data.

Investors will also be watching Nvidia’s quarterly earnings report on February 26. “It’s a significant shift from a market dominated by tech to one where financials and other sectors are driving gains,” said Samana.

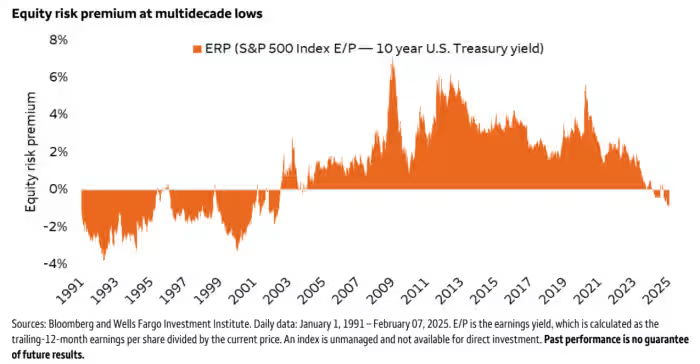

Equity Risk Premium at Historic Lows

The U.S. stock market’s equity risk premium has fallen to multidecade lows, according to a Wells Fargo Investment Institute report. “Stocks aren’t as attractive as they were last year,” said Samana. However, he still sees the S&P 500 as more appealing than bonds, especially with the 10-year Treasury yield hovering around 4.5%.

On Friday, the yield on the 10-year Treasury note fell 8 basis points to 4.419%, its lowest level since mid-December. “There’s little incentive to buy a 10-year Treasury when a money-market fund offers a similar yield without the duration risk,” said Camporeale.

Camporeale remains overweight on equities, favoring U.S. stocks. He has been reducing exposure to core bonds, including Treasurys, in favor of high-yield corporate credit and equities. Following the U.S. presidential election in November, he added value and midcap stocks to his portfolio. Looking ahead, he anticipates “low-double-digit returns” for the S&P 500 this year.