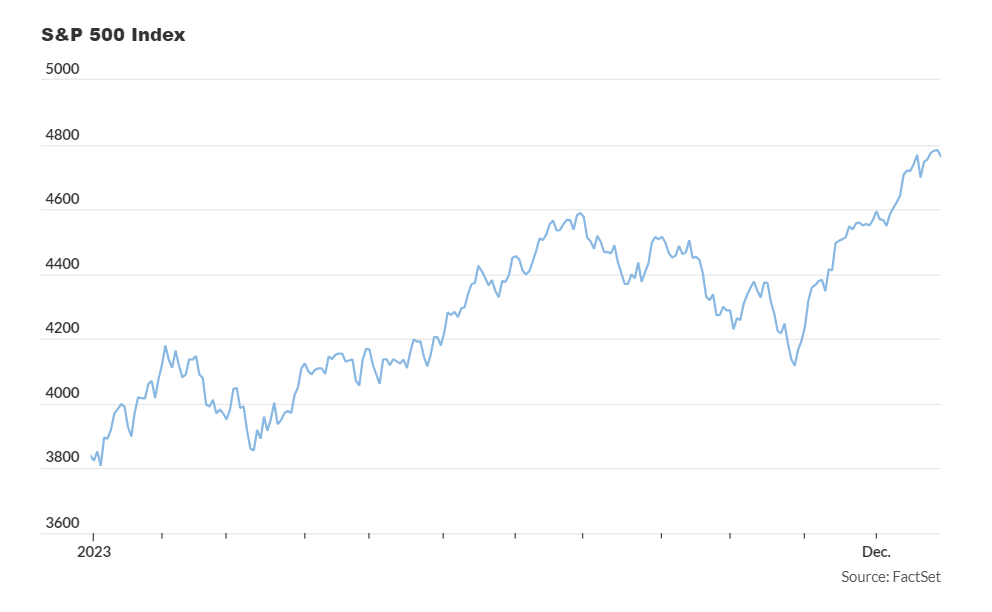

Concerns loom over the U.S. stock market‘s robust performance in late 2023 as the Dow and S&P 500 reach record highs, prompting worries about a potential post-New Year’s Eve downturn in January 2024. Various factors contribute to the apprehension, ranging from overbought conditions and heightened bullish sentiment to a low VIX and impending inflation reports, as highlighted by Wall Street analysts.

After a remarkable 24% surge in the S&P 500 throughout 2023, portfolio managers and strategists caution against a potential reversal of the “January effect” as investors seek to secure profits. Multiple risk factors are identified, including:

- Overbought Conditions: The 14-day relative strength index (RSI) on the S&P 500 signals overbought conditions, reaching a level of 82.4 on Dec. 19, its highest since 2020. Though it has slightly receded, maintaining an RSI around 70 indicates vulnerability to a market correction.

- Extreme Bullish Sentiment: Investors’ sentiment has shifted dramatically from bearish to bullish within two months, according to the American Association of Individual Investors’ weekly sentiment survey. Elevated bullish sentiment, reaching 53%, raises concerns as historically, stretched sentiments have often preceded market turns.

- Low VIX: The Cboe Volatility Index (VIX), considered a “fear gauge,” dropped below 12 in December, suggesting low expected volatility. Some analysts interpret this as a reason for worry, emphasizing the importance of monitoring the VIX closely as a rise in volatility could trigger profit-taking.

- Inflation Concerns: The upcoming U.S. inflation report in January adds to investor anxiety, with expectations of core CPI rising over 0.3% in December. The impact of inflation on stocks may not be as favorable as in the past, potentially leading to market turbulence.

- Earnings Season Uncertainty: While the “earnings recession” ended in the third quarter, doubts arise about whether companies can meet the high expectations for 2024. Analysts anticipate an 11.7% increase in S&P 500 aggregate earnings for 2024, reflecting optimism that some fear might be excessive.

- Geopolitical and Political Risks: Various political and geopolitical events, such as Taiwan’s presidential election, U.S. debt-ceiling concerns, the start of the 2024 Republican presidential primaries, and ongoing conflicts in Gaza and Ukraine, pose additional threats to market stability.

- “Buy the Rumor, Sell the News” Dynamic: Wall Street professionals express concern about the possibility of a market downturn following anticipated Federal Reserve interest rate cuts. The notion that investors have already factored in aggressive rate cuts could lead to profit-taking and hinder further market advances unless the central bank exceeds expectations.

In summary, as Wall Street reflects on the positive momentum of late 2023, analysts warn of potential pitfalls in January 2024, urging vigilance in monitoring various indicators and events that could impact market dynamics.