Investors are facing the possibility of the Federal Reserve maintaining higher interest rates for a longer period, causing a surge in Treasury yields that is leading the S&P 500 index to experience its largest monthly decline in 2023.

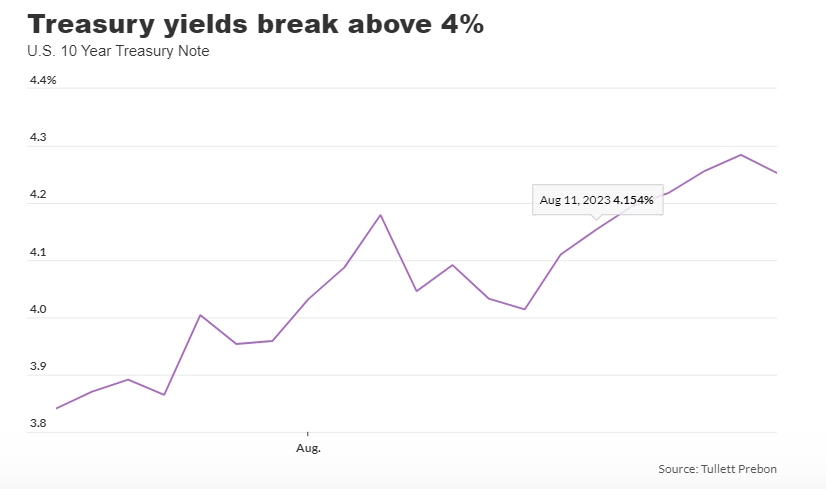

Scott Chronert, a U.S. equity strategist at Citigroup, explained in a phone interview that the yield on the 10-year Treasury note surpassed the trading range of 3.5% – 4% in August. This affected stock market valuations negatively as it increased. Chronert stated that this development disrupts the previously established pattern that had been followed throughout the year.

Investors in the U.S. stock market are experiencing a decline in performance this month due to anticipation of Federal Reserve Chair Jerome Powell’s remarks at the Jackson Hole Economic Symposium in Wyoming, which are scheduled for Friday. Additionally, they are grappling with an increase in yields during August and keeping an eye on the potential impact of China’s economic struggles, being the world’s second largest economy.

Investors were surprised this month when the yield on the 10-year treasury note BX:TMUBMUSD10Y, which had been rising, reached its highest level since 2007, even though the Federal Reserve had been reducing the rate at which it increases interest rates due to the declining inflation in the United States.

Rick Rieder, the chief investment officer of global fixed income at BlackRock and head of the asset manager’s global allocation investment team, expressed irony in the fact that rates have been increasing while inflation has been decreasing significantly over the past three and six months, according to moving averages of the consumer-price index. This statement was made by Rieder during a phone interview.

According to Dow Jones Market Data, the U.S. stock market closed mostly in decline on Friday. The S&P 500 index had a third consecutive week of losses and is currently down 4.8% in August, which is its largest monthly decline since December, as shown by FactSet data.

The Nasdaq Composite COMP and Dow Jones Industrial Average DJIA both ended the week with losses on Friday. Like the S&P 500, the Nasdaq, which is known for its focus on technology stocks, experienced three consecutive weeks of decline.

Rieder noted that there is a worry amongst investors in the stock market that the robustness of the American economy might lead the Federal Reserve to further tighten its monetary policy. This concern, in conjunction with a higher quantity of U.S. Treasurys being circulated, seems to be having a negative impact on stocks.

Rieder mentioned that a large number of Treasury bills are being issued and the liquidity is being drained, which he believes is beginning to have an impact. These Treasury bills are U.S. government debt that matures within a few months and have recently been generating a yield of over 5%.

Scott Wren, a senior global market strategist at Wells Fargo Investment Institute, stated in a phone conversation that earlier this year, his company withdrew a portion of their funds from the stock market, particularly reducing their investments in technology stocks. Instead, they opted to invest in Treasury bills. By doing so, he emphasized that the company is now positioned to invest in instances when the stock market experiences declines. Wells Fargo predicts that the S&P 500 index will reach a value of 4,100 by the end of 2023.

According to Dow Jones Market Data, the S&P 500 concluded Friday at a value of 4,369.71, marking a decrease of 8.9% from its highest closing point in January 2022.

According to Wren, the Federal Reserve has not yet finished raising interest rates in order to control persistent core inflation. Chair Jerome Powell might use the Jackson Hole meeting as an opportunity to indicate to the market that the central bank is not currently considering lowering rates.

According to Wren, Powell may persist in expressing a strong stance by reiterating that the Federal Reserve could potentially increase its benchmark rate to lower inflation and reach its target of 2%.

Chair Powell has been arranged to give a speech during the Jackson Hole gathering on August 25.

David Kelly, the chief global strategist at J.P. Morgan Asset Management, stated in a phone interview that currently, the U.S. economy is performing exceptionally well. He further expressed his belief that inflation can decrease significantly without leading to a recession.

A concern among investors has been that the Federal Reserve, by persistently increasing interest rates following last year’s rapid hikes implemented to control high inflation, may potentially initiate an economic downturn.

According to Kelly, if there are no significant problems with the economy, it is unlikely that we will see a decrease in interest rates by the end of this year.

However, Kelly expects that the Federal Reserve might gradually start lowering interest rates in the spring of 2024 if inflation continues to decrease and reach 2%. He mentioned that if the labor market starts displaying signs of an imminent recession, such as consecutive monthly declines in nonfarm payroll employment reports, the central bank would likely speed up the rate cuts.

In the meantime, 10-year Treasury yields have experienced a continuous increase for five weeks in a row, which is the longest period of consecutive gains since March. According to Dow Jones Market Data, the yields reached 4.251% at the close of Friday. However, the rate slightly declined on Friday after reaching the highest level since November 2007 on August 17, based on 3 p.m. Eastern Time levels.

According to Rieder from BlackRock, the increase in interest rates can be attributed to several factors. These include a higher availability of U.S. government debt, the influence of the Bank of Japan adjusting its yield-curve control to allow its own 10-year yields to go up, and Treasury bills offering attractive rates of about 5.5% without any credit or duration risk.

Kelly stated that although the economy of the United States is thriving, China’s economy is struggling. The property industry in China has been experiencing difficulties and there is concern among investors that the country’s slowing economy might eventually lead to a recession.

Citi’s Chronert suggests that if the Chinese economy slows down, it may reduce the demand for commodities. This could result in a deflationary impact that could benefit companies by lowering their costs. However, he also warned that a decline in the Chinese economy could negatively affect the profits of American manufacturers and retailers who are doing business in the country.

On the other hand, according to Chronert, the financial outlook for U.S. companies in the second half of this year appears to be positive.

Investors are closely observing Powell as he attempts to find a balance between preventing the U.S. economy from slowing down too much and keeping inflation in check by implementing a policy rate that may be seen as limiting. In the previous month, the Federal Reserve increased its benchmark rate to a range of 5.25% to 5.5%, reaching the highest point it has been in 22 years.

Chronert expressed concern if he signals that the current level of inflation needs to rise considerably in order to reach his desired target.