It might seem like the wrong time to talk about retirement optimism, especially when the stock market is experiencing significant turbulence. Forget Your 401(k) Statement—Focus on These Promising Retirement Trends Instead

On a recent day of market declines, David Stinnett, Vanguard’s head of strategic retirement consulting, remained upbeat about retirement savings trends. Despite ongoing concerns about inflation, tariffs, federal job losses, and sluggish GDP growth, Stinnett highlighted encouraging signs among retirement savers.

“You can have double-digit negative-return years, high inflation, and high unemployment — all of which we’ve experienced in the past five or six years — yet people are still making steady progress in their investing habits, participation levels, and savings rates,” Stinnett said. “Market volatility this week doesn’t concern me in this context at all.”

The Power of Consistency Financial advisers often urge clients to stay the course during market fluctuations — and the data supports this advice. Vanguard’s early look at the 2024 “How America Saves” report, based on five million participants in the company’s ecosystem, showcases how American workers are consistently building toward retirement while addressing vulnerabilities within the system.

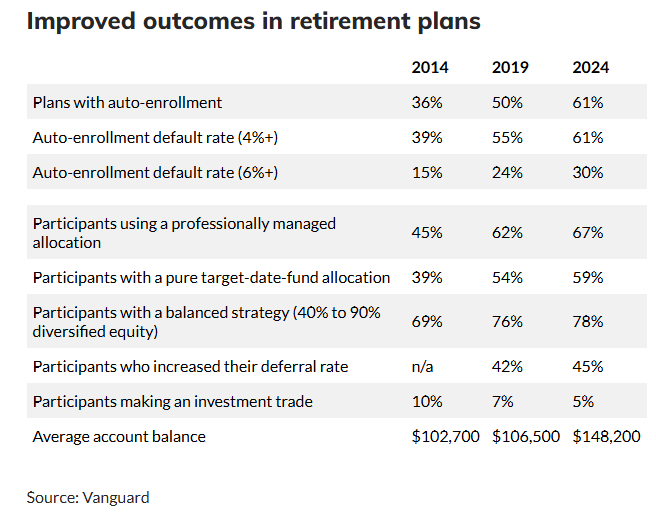

One key improvement is the rise of auto-enrollment features in retirement plans. A decade ago, only 36% of plans automatically enrolled employees. Today, that number has climbed to 61%, helping more lower-income workers start saving. Default contribution rates have also improved, with more companies enrolling workers at 4% and an increasing number starting at 6%. Additionally, 45% of participants increased their savings rates in 2024.

Challenges Still Remain Despite this progress, the retirement savings journey remains far from perfect. Many workers no longer follow linear career paths with steady savings growth. Instead, job changes often reset their contributions to lower default rates, hindering long-term savings growth. “We need to ensure the 401(k) system is smarter, so savings levels continue instead of restarting,” Stinnett explained.

Balancing Growth with Hardship Withdrawals On a positive note, average account balances rose 10% in 2024 to $148,200, while median balances increased 8% to $38,176. However, hardship withdrawals also rose — though only 5% of participants made such withdrawals. Stinnett attributed the uptick to regulatory changes making withdrawals easier and the increased participation of lower-income workers. While the trend bears watching, Stinnett doesn’t believe it threatens overall retirement readiness.

A Positive Outlook Despite economic uncertainty, Stinnett remains optimistic. “We have a voluntary retirement system, unlike many other countries, and employers, policymakers, and record keepers are constantly adopting best practices. The system is gradually improving, even through market ups and downs. That’s a very good message.”

By focusing on the bigger picture and the steady progress of retirement savers, it’s clear that long-term strategies and consistent contributions can weather even the most volatile markets.