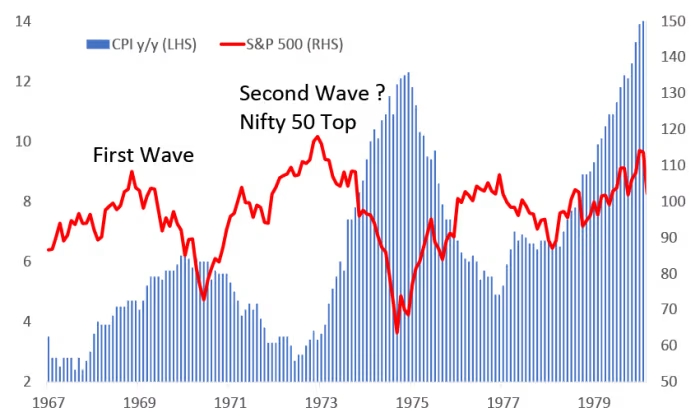

Equities faced challenges while bonds shone during the tumultuous waves of inflation in the 1970s.

Currently, investors seem enamored with a “Goldilocks” scenario, but a team of Wall Street quantitative strategists suggests keeping an eye out for a potential return to the conditions reminiscent of the disco era.

In a recent note, J.P. Morgan analysts, led by renowned strategist Marko Kolanovic, warned of a possible shift in market sentiment away from the current Goldilocks narrative towards a scenario akin to the stagflation of the 1970s, which could have significant implications for asset allocation.

The 1970s were characterized by persistent high inflation, marked by three distinct waves linked to geopolitical events such as the Vietnam War and conflicts in the Middle East, which led to oil embargoes, energy crises, and disruptions in shipping. These events, coupled with rising government deficits, created an environment where equities saw minimal nominal gains from 1967 to 1980, while bonds and credit instruments outperformed significantly.

The analysts draw parallels between the geopolitical landscape of the 1970s and current tensions in Eastern Europe, the Middle East, and the South China Sea. They highlight the recent energy crisis and shipping disruptions in the Red Sea as indicators of potential parallels to past events.

The analysts caution that the escalation of tensions, particularly with China, could exacerbate inflationary pressures and trigger a market downturn. Additionally, they note that fiscal deficits are unsustainable, raising concerns about the potential for a shift in the macroeconomic backdrop from the peace dividend era of the late 1980s to 2000s to a period characterized by conflict-driven inflation.

In such a scenario, investors would likely favor fixed-income assets over equities, seeking higher yields to offset the effects of stagflation. Historically, during the 1970s, bonds significantly outperformed equities, with yields averaging above 7%, making any yield pickup crucial for long-term portfolio performance.

Despite these warnings, current market trends show stocks rallying into 2024, with major indices reaching new milestones. However, investors remain cautious, as evidenced by their reaction to the Federal Reserve’s policy meeting minutes, indicating a readiness to reassess market dynamics in light of evolving economic conditions.