The significance of the number of rate cuts pales in comparison to whether the economy avoids recession, according to a strategist.

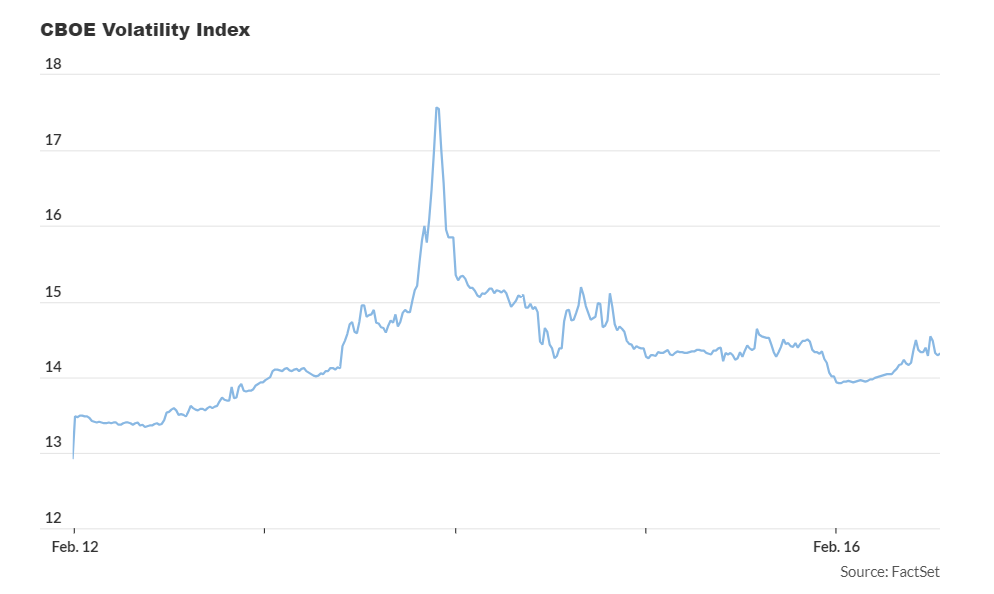

The recent market turbulence, marked by sharp one-day declines followed by swift recoveries, prompts analysis into the driving forces behind the ongoing bull market, which has propelled the S&P 500 and Dow industrials to numerous record highs in 2024.

The scenario unfolded with Tuesday’s release of the January consumer-price index exceeding expectations, prompting a reassessment of forecasts for potential Federal Reserve rate cuts, possibly up to six quarter-point reductions starting as early as March or May.

However, over the subsequent two days, stocks largely recouped their losses, with the S&P 500 closing Thursday at its 11th record high of the year.

Tim Hayes, chief global investment strategist at Ned Davis Research, contends that the delay in rate cuts doesn’t spell disaster as feared initially. He distinguishes between doubts about the timing of bullish events, such as rate cuts, and concerns about bearish developments like resurgent inflation or economic contraction.

While Tuesday saw significant market declines, with the Dow dropping over 500 points and the S&P 500 and Nasdaq also experiencing losses, the following two days witnessed rebounds. Thursday’s gains were partly attributed to a weaker-than-anticipated January retail sales report, which alleviated concerns about a potential inflation resurgence driven by a surging economy.

However, Friday brought another inflationary jolt with a hotter-than-expected reading from the January producer-price index, resulting in slight market retreats for the week.

Chris Zaccarelli, chief investment officer at the Independent Investor Alliance, emphasizes that the investment outlook hinges on maintaining economic expansion without slipping into recession, rather than the exact number of Fed rate cuts.

The recent volatility in response to economic data underscores the cautious market sentiment, with uncertainty prevailing until further data releases establish a clearer trend.

Mark Arbeter, president of Arbeter Investments, expresses frustration at the market’s tendency for short-lived declines followed by swift recoveries, signaling a persistent upward trend.

While technical indicators suggest a potential downside correction, major indexes remain in uptrends, with specific support levels providing guidance for potential future movements.