Early Tuesday, U.S. bond yields experienced a decline as traders closely monitored a slew of economic indicators and remarks from Federal Reserve officials anticipated over the next few days.

Here’s what’s happening:

- The yield on the 2-year Treasury note (BX:TMUBMUSD02Y) dropped by 2.2 basis points to 4.691%. Remember, yields move inversely to prices.

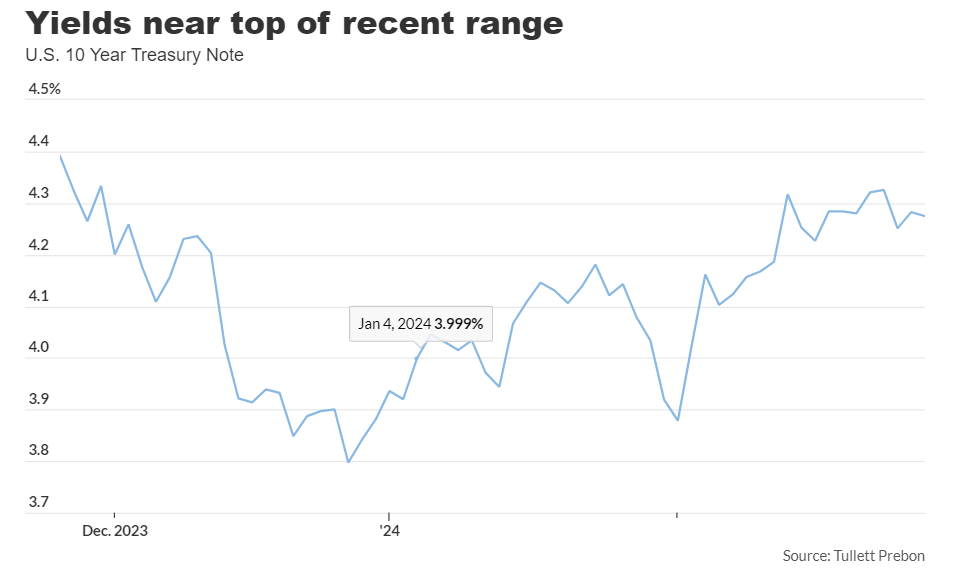

- The yield on the 10-year Treasury note (BX:TMUBMUSD10Y) decreased by 1.6 basis points to 4.267%.

- The yield on the 30-year Treasury note (BX:TMUBMUSD30Y) saw a slight dip of 1 basis point to 4.387%.

What’s prompting these shifts in the market:

Benchmark Treasury yields edged lower, moving away from the upper end of their three-month range, as investors awaited pivotal data that could shape the Federal Reserve’s monetary policy outlook.

Of particular importance is the impending release of the personal consumption expenditure price index on Thursday. This index holds significance as the Fed’s preferred measure of inflation, potentially influencing the possibility of a rate adjustment as early as May.

Prior to that, Tuesday’s economic calendar includes the release of durable goods orders for January at 8:30 a.m. Eastern, followed by the S&P Case-Shiller home price index for December at 9 a.m., and February’s consumer confidence data at 10 a.m.

Fed Vice Chair for Supervision Michael Barr is scheduled to deliver remarks at 9:05 a.m., followed by a series of comments from his colleagues throughout Wednesday, Thursday, and Friday.

Currently, market sentiment indicates a 97.5% probability that the Fed will maintain interest rates within the range of 5.25% to 5.50% at its upcoming meeting on March 20th, according to the CME FedWatch tool.

Analysts’ perspectives:

The economics team at Deutsche Bank, led by Amy Yang, highlighted recent remarks from Fed officials cautioning against financial conditions becoming excessively loose, which could exacerbate inflationary pressures.

They noted, “[…] the easing of financial conditions since the fall has also increased the probability that year-ahead inflation remains above 2.5% from 30% to 40%.”

In summary, the prevailing signals from the Fed suggest a reduced likelihood of rate cuts before June. However, Deutsche Bank’s outlook maintains the expectation of 100 basis points of cuts in 2024, commencing at the June meeting, contingent upon renewed evidence supporting the trajectory of inflation.