The early signs in futures trading suggest a cautious start for Wall Street next week, with the S&P 500 likely to consolidate after reaching another record in the previous session, driven by major tech players.

The trajectory ahead hinges on the performance of the “Magnificent 7” – Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla – in achieving robust revenue growth in 2024, according to David Kostin, chief U.S. equity strategist at Goldman Sachs.

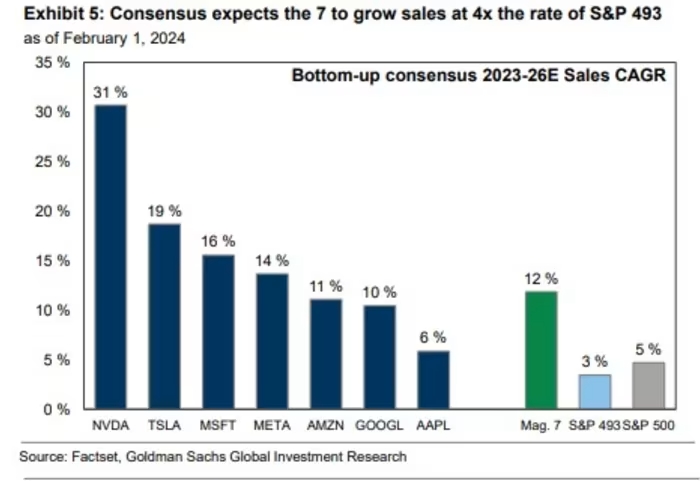

While factors such as hedge fund positioning, antitrust lawsuits, and macroeconomic shifts may influence these stocks, Kostin emphasizes that the key driver will be the sales growth of these seven companies. Analysts anticipate a collective sales growth of 12% CAGR through 2026 for the Magnificent 7, outpacing the 3% CAGR for the rest of the S&P 500.

The expected expansion of margins, particularly a 256 basis points increase over the next three years, sets the stage for higher profits, surpassing the rest of the market.

However, it’s crucial to note that the Magnificent 7 are not uniform in their trajectories. Variances exist, such as Nvidia’s projected 31% annual sales growth compared to Apple’s 6%, and recent downward adjustments in Tesla’s sales forecasts.

Concerns about the seemingly elevated valuations of big tech are addressed by Kostin, who argues that the current 63% P/E premium is notably lower than the peak premium of 103% in 2021. Additionally, these stocks exhibit lower valuations than during the Tech Bubble in 2000.

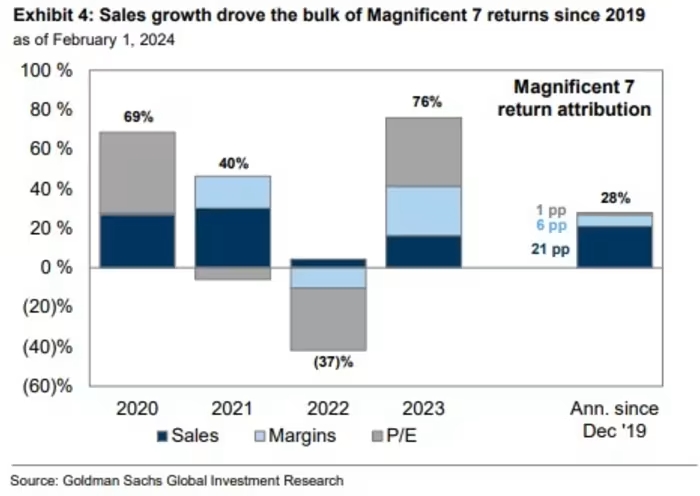

Goldman emphasizes that the surge in big tech is not solely driven by valuation multiples but is substantiated by improved earnings. Over the past few years, the Magnificent 7 delivered a 28% annualized return, with 27 percentage points attributed to earnings growth, underscoring the group’s fundamental strength.

Big tech’s appeal also lies in its newfound resistance to interest rate fluctuations. Despite historically benefiting from falling yields, the sector outperformed even in a high bond yield environment due to robust balance sheets and elevated margins.

However, Goldman’s optimistic outlook concludes with a cautionary note, drawing parallels to past periods of tech exuberance. Investors are warned against placing blind faith in consensus estimates, as historical instances show significant deviations between forecasted and actual performance, leading to underperformance compared to the broader market.