Fiscal Stimulus: A Key to Sustainable Gains in China’s Market Recovery

Chinese stocks are showing signs of revival, driven by a major artificial intelligence (AI) breakthrough that could attract up to $200 billion in investor inflows this year. Goldman Sachs strategists, led by Kinger Lau, recently raised their target for China’s CSI 300 index from 4,600 to 4,700, implying a 19% potential price return.

According to Goldman’s estimates, widespread AI adoption could boost Chinese earnings per share by 2.5% annually over the next decade. This growth potential, alongside a renewed sense of investor confidence, could raise the fair value of Chinese equities by 15-20% and fuel significant capital inflows.

Despite these optimistic projections, analysts remain cautious. They emphasize that while AI advancements could enhance China’s economic trajectory, robust fiscal stimulus is necessary to address deep-seated macroeconomic challenges and sustain equity gains. Specifically, policymakers must implement measures to counter tariff-related headwinds, stimulate domestic demand, curb deflationary pressures, and correct macroeconomic imbalances—all of which are essential for supporting corporate earnings and prolonging the market rally.

The CSI 300 returned 14% last year after three consecutive years of losses, whereas the S&P 500 gained 23% in the same period. Meanwhile, the Hang Seng Tech Index, which houses many of China’s top AI and tech companies, has climbed 23% year-to-date, with an ETF tracking the index gaining 19% in 2024—the first positive return in four years.

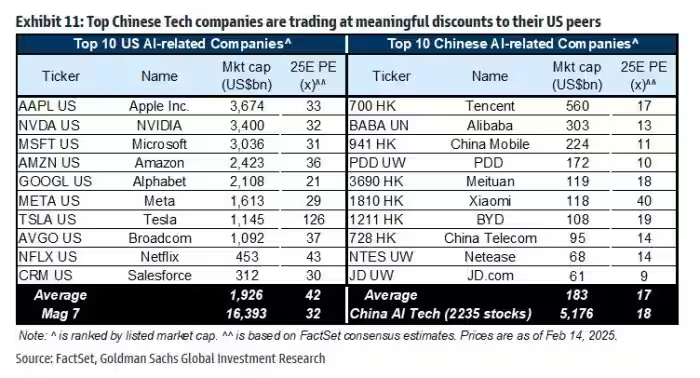

Goldman Sachs sees strong potential for later-cycle AI beneficiaries, favoring companies in data and cloud computing, software, and applications as AI monetization and practical use cases expand. Their analysis highlights a valuation gap between U.S. and Chinese AI stocks, contrasting major firms like Apple and Tencent.

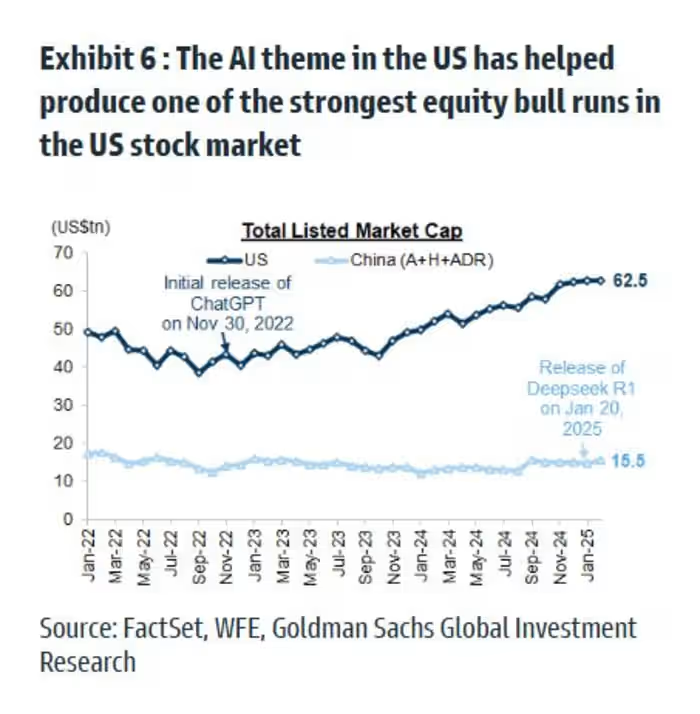

Since the launch of ChatGPT in late 2022, U.S. stocks have surged by 50%, adding $13 trillion in market capitalization. U.S. and global investors have poured $660 billion into U.S. equities over the past year, fueling double-digit gains in the S&P 500 and Nasdaq Composite and generating over $10 trillion in market value.

Optimism surrounding DeepSeek is now driving notable inflows into Chinese stocks. If Chinese firms can grow their market cap by $3 trillion in the next year, AI-related investments could contribute up to $200 billion in global net buying, potentially reversing the underweight positioning of Chinese equities among asset managers.

However, Goldman Sachs warns of risks to China’s AI-driven growth, including regulatory concerns, data privacy issues, national security considerations, disinflationary pressures, and potential Western tech export restrictions. While these risks are currently overshadowed by the excitement surrounding AI advancements, they remain critical factors for investors to monitor moving forward.