It’s widely acknowledged that Treasury yields often dictate the rhythm of the stock market.

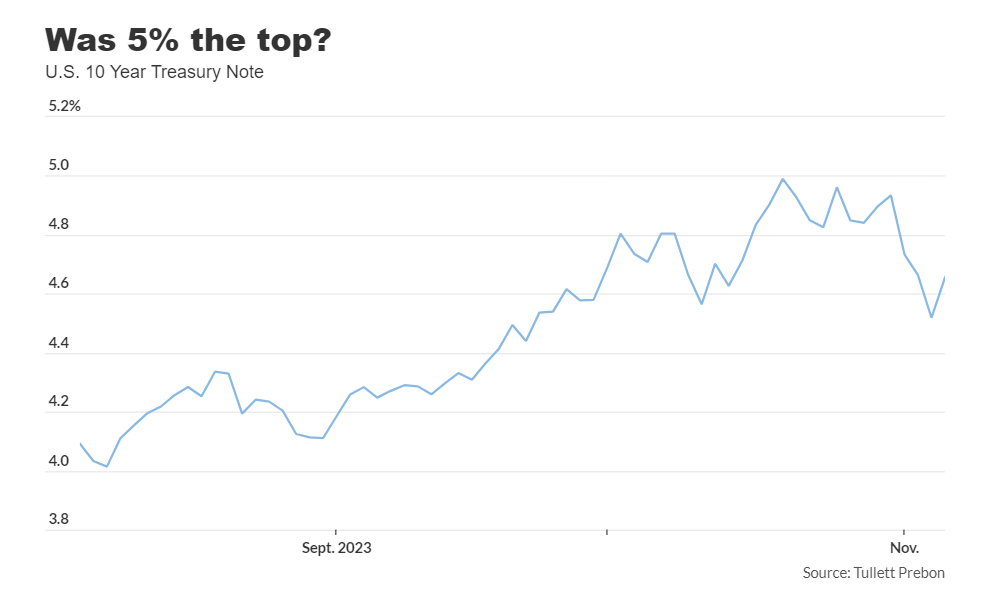

The recent surge in yields took the blame for a market downturn, sending the S&P 500 slipping over 10% from its late July high, settling in correction territory by the end of last month.

However, there was a significant reversal last week. Yields on 10-year and 30-year Treasury notes experienced their most substantial drop since March. This prompted a surge in stocks, marking the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite with their most significant weekly gains in 2023.

Closing at 4,358.34, the S&P 500 ended the week on a high note.

The ongoing debate among investors revolves around whether yields have peaked, which generally move in the opposite direction to Treasury prices. The looming question remains: will a definitive peak in yields signal the resurgence of the 2023 stock market rally?

As with most market-related matters, the outcome depends heavily on context.

Analysts at U.K.-based Matrix Trade articulated this uncertainty, suggesting that yields could reach a peak for various reasons, but not all would bode well for stocks.

A positive scenario for stocks envisions a robust economy as inflation recedes, ultimately allowing the Federal Reserve to reduce interest rates without triggering a wave of 1970s-style inflation. However, they consider this scenario unlikely but not impossible without a substantial increase in unemployment.

Conversely, a recession could result in yields and stocks declining together, as witnessed in 2000-2002 and 2007-2009.

Economists have faced challenges in predicting the economy’s path, highlighting the inconsistency in their predictions. The Matrix Trade analysts emphasized the difficulty in timing signals such as the inversion of the yield curve, usually a reliable indicator of an impending recession but with uncertain timing.

To refine this signal, they suggest combining it with unemployment claims, anticipating that once first-time claims exceed 250,000, there might be no turning back.

While the future of the stock market remains uncertain, the analysts assert that identifying the peak in yields will be more straightforward.

They designate the 4.33%-4.43% range as a significant inflection point for the 10-year Treasury note. Holding within this range suggests potential for the 10-year yield to rise beyond 5%; however, if it breaks, it could indicate the end of the rally.

The analysts also suggest a broader correction, anticipating a decline to 2.5% to 3% for the 10-year yield, which could signal economic pressure, potentially implying an upcoming recession.

In summary, if stocks fail to continue the current optimistic rally and instead face challenges, hitting around 4,103 again early next year might be a possibility.