No ‘Powell Put’ Likely as Fed Maintains Caution, Says Economist

Investors hoping for a Federal Reserve safety net may be disappointed this week, as Fed Chair Jerome Powell is unlikely to signal any market-friendly interventions when policymakers meet.

“The upside risks to inflation suggest that, despite recent stock market weakness, there is little chance of a ‘Powell put’ in the coming days,” said Stephen Brown, deputy chief U.S. economist at Capital Economics.

A “Powell put” refers to the idea that the Fed might step in with rate cuts or other supportive measures if markets experience a sharp decline. This concept has been around since the 1987 market crash, when then-Fed Chair Alan Greenspan swiftly cut interest rates. However, Powell appears committed to a wait-and-see approach, prioritizing inflation control over short-term market swings.

Last week, former President Donald Trump made it clear that investors shouldn’t expect a “Trump put” either. In a television interview, he dismissed concerns that his tariff policies could trigger a recession, emphasizing that long-term economic gains outweigh short-term volatility. As a result, investors reassessed expectations that he might ease trade tensions to support markets.

Markets have struggled under this uncertainty. The S&P 500 logged its fourth consecutive weekly decline, while the Nasdaq Composite fell into correction territory. The Dow Jones Industrial Average and small-cap Russell 2000 also approached key technical thresholds before staging a rebound on Friday—coincidentally, a day when Trump remained silent on trade matters.

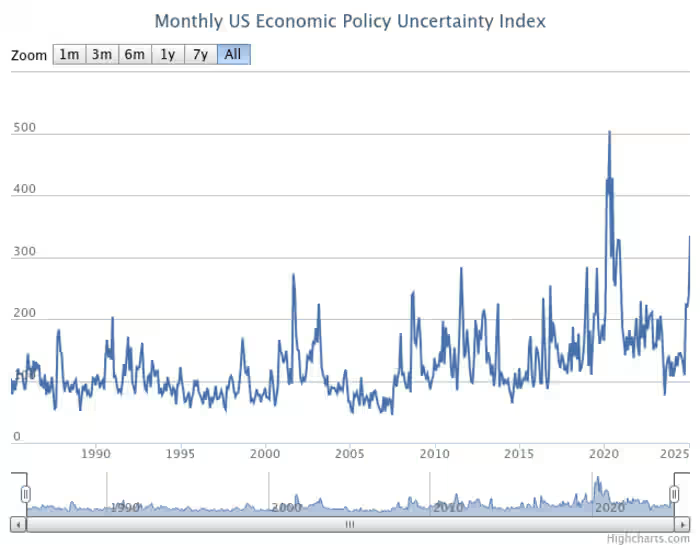

The bigger concern for investors isn’t immediate economic damage but the growing uncertainty surrounding tariffs and other policies. Businesses, facing unpredictable shifts in trade strategy, are hesitant to invest, hire, or expand—raising fears of an eventual slowdown.

“The uncertainty in policymaking is more damaging than the tariffs themselves,” said Kevin Gordon, senior investment strategist at Charles Schwab. “Companies can adjust to tariffs if they know what they are. The problem is the lack of consistency.”

This policy-driven uncertainty is weighing on sentiment. The University of Michigan’s consumer confidence index fell to a 29-month low in March, reflecting growing concerns over the economic outlook. Meanwhile, market participants are pricing in three potential rate cuts in 2025, anticipating slower growth.

However, Powell and his colleagues face the same uncertainty as investors. The Fed’s dual mandate—balancing inflation control with full employment—complicates decision-making. Rising inflation, coupled with policy-induced job losses, limits the central bank’s ability to act decisively.

Given this backdrop, Powell is likely to maintain his cautious stance. Earlier this month, he emphasized that sentiment indicators aren’t always reliable predictors of economic activity, reinforcing the Fed’s patience in assessing the evolving landscape.

For investors, the takeaway is clear: focus on quality. Companies with strong balance sheets, consistent earnings, and low volatility have outperformed even in recent market downturns. In times of uncertainty, resilience matters more than ever.