U.S. stock futures are edging higher as traders await the Federal Reserve’s decision and Chairman Powell’s comments. Meanwhile, oil prices have pulled back from their recent 10-month highs, and Treasury yields have eased from multi-year peaks.

Current Stock Futures:

- S&P 500 futures (ES00) are up by 10 points, or 0.2%, reaching 4,500.

- Dow Jones Industrial Average futures (YM00) have risen by 101 points, or 0.3%, to reach 34,918.

- Nasdaq 100 futures (NQ00) have gained 29 points, or 0.2%, reaching 15,406.

Tuesday’s Market Performance:

- The Dow Jones Industrial Average (DJIA) dipped by 107 points, or 0.31%, closing at 34,518.

- The S&P 500 (SPX) saw a decline of 10 points, or 0.22%, closing at 4,444.

- The Nasdaq Composite (COMP) dropped by 32 points, or 0.23%, settling at 13,678.

Market Outlook:

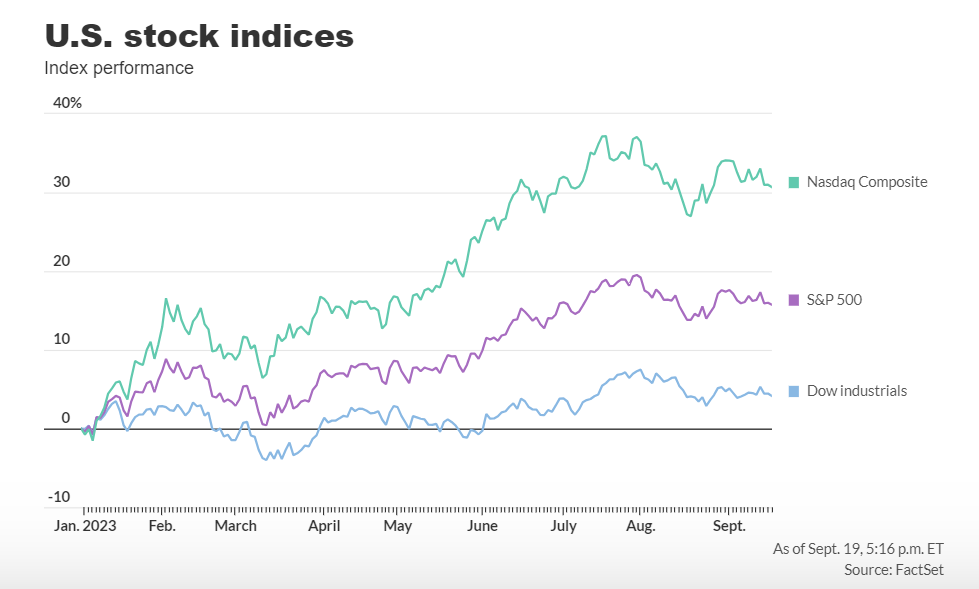

U.S. markets are exhibiting subdued activity as traders brace themselves ahead of the Federal Open Market Committee’s policy decision, scheduled for 2 p.m. Eastern time. The S&P 500 has surged by 17.3% this year, partly due to expectations that the Fed’s monetary tightening will conclude without significant harm to the economy.

Tom Lee, Head of Research at Fundstrat Global Advisors, notes, “Investors are naturally apprehensive that Wednesday’s FOMC press conference could unleash a push higher in interest rates, and a commensurate sell-off in stocks.”

Traders are pricing in a 99% chance that the Federal Reserve will keep rates unchanged in the 5.25%-5.50% range, according to the CME FedWatch Tool. However, there is a 29% chance of a 25-basis-point rate hike to a range of 5.50%-5.75% at the next meeting in November.

Recent robust U.S. economic data and rising oil prices this week have raised concerns about persistent inflationary pressures, potentially requiring the central bank to maintain higher borrowing costs for an extended period.

Thierry Wizman, global FX and interest rates strategist at Macquarie, suggests that the spike in oil prices might make the FOMC more hesitant to signal a dovish stance. Traders will closely watch the Fed’s “dot plot” forecast for its policy interest rates, released at 2 p.m., as well as Chair Jerome Powell’s press conference at 2:30 p.m., for any market-moving news.

Stephen Innes, managing partner at SPI Asset Management, points out that yields on 10-year U.S. Treasuries are reaching new cycle highs, and investors appear inclined to maintain their long positions in the dollar, signaling a hawkish direction.

Matthew Raskin, strategist at Deutsche Bank, notes that traders will focus on the Fed’s economic projections and the “dot plot,” with potential shifts indicating a higher-for-longer stance. Analyzing the degree of changes and Powell’s characterization of these shifts will be key in deciphering their impact on the market.

Companies in Focus:

- Instacart (CART) shares are down by 4% in premarket trading following their IPO, which saw them finish up by 12%.

- General Mills Inc. (GIS) has gained 1% after reporting fiscal first-quarter results that exceeded expectations, with a stable supply chain and resilient consumers despite inflation concerns.

- Coty Inc. (COTY) has jumped 4.6% in premarket trading after raising guidance for fiscal 2024, driven by strength in its prestige fragrance business.