NDR Analysts Warn: Monday’s Market Shock Could Linger for Weeks

Following the S&P 500’s steepest drop in nearly two years on Monday, a rebound on Tuesday and a choppy Wednesday left investors uncertain about the path ahead. Ed Clissold, chief U.S. strategist, and Thanh Nguyen, senior quantitative analyst at Ned Davis Research, cautioned in a Wednesday note that while a retest of Monday’s lows is likely, the market could recover in the coming weeks if a recession is avoided.

“The markets could feel the effects of Monday’s shock for several weeks. However, fundamentals do not align with a major bear market at this time,” they wrote.

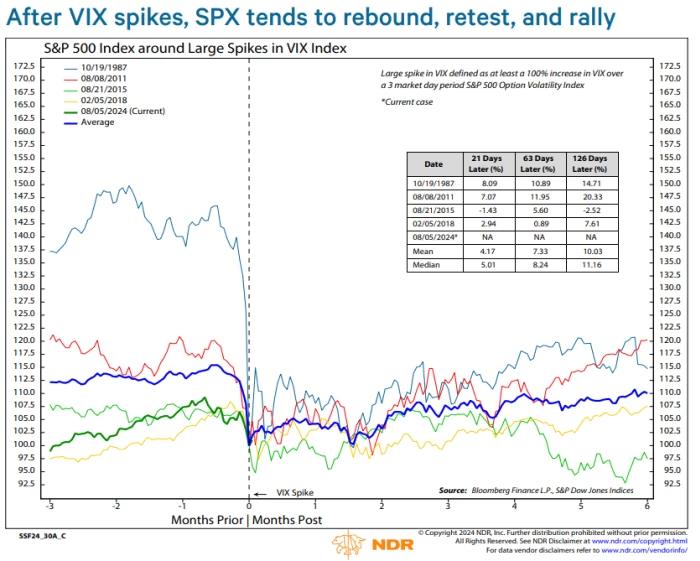

The analysts highlighted the recent spike in the Cboe Volatility Index (VIX), often dubbed Wall Street’s “fear gauge,” which more than doubled over three days — a rare occurrence that has only happened four times before. Historically, these volatility shocks have led to initial tumbles, followed by rebounds and subsequent retests of the lows.

Monday’s 3% drop left the market oversold, triggering a four-step recovery process: oversold, rally, retest, and breadth thrusts.

The market began its rebound on Tuesday but faltered by Wednesday afternoon. Clissold and Nguyen warned that the retest phase could be tense, emphasizing that fewer stocks hitting new lows than during the initial selloff is crucial for a successful recovery.

Despite the volatility, they maintained that as long as underlying fundamentals stay strong, the stock market is likely to resume its uptrend after completing this four-step process.