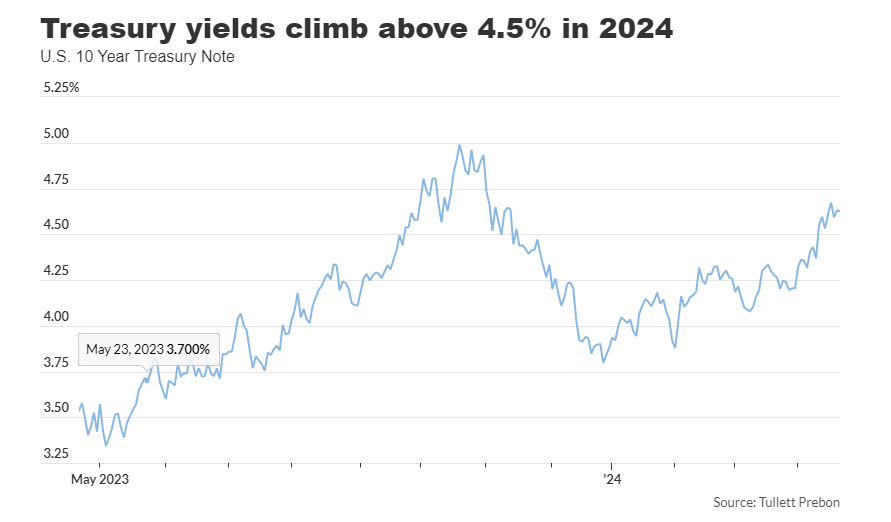

Bob Elliott, CIO of Unlimited Funds, emphasizes the challenge posed by the recent increase in commodity prices for the Federal Reserve. The surge in bond yields this month reflects concerns about sustained inflationary pressures amidst a buoyant economy, marking a significant setback for the ongoing bullish trend in the U.S. stock market.

The S&P 500 is currently experiencing its most substantial monthly decline since December 2022, with April’s downturn erasing nearly half of the year’s earlier gains. Despite this setback, the index remains within 5.5% of its record high achieved on March 28.

Elliott notes that while investors correctly gauged the strength of U.S. economic growth, the issue now is that this optimism is already reflected in stock prices. Consequently, bond yields are playing catch-up, causing disruption in the market.

The recent acceleration in Treasury bond yields, particularly in April, has rattled U.S. stocks. However, Elliott suggests that these long-term rates may need to rise even further to temper demand in the economy. Only then will the Federal Reserve be sufficiently assured that inflation is trending towards its 2% target.

Elliott observes that current financial conditions favor continued economic expansion, with strong indicators suggesting robust first-quarter GDP growth. Despite the Fed’s efforts to curb inflation through monetary tightening, the economy has displayed resilience.

Looking ahead, investors await the Bureau of Economic Analysis’ estimate of first-quarter GDP growth, scheduled for release on April 25. Recent data, including low initial jobless claims, signal a stable labor market and indicate ongoing economic growth.

However, concerns persist regarding inflation, fueled by rising commodity prices. This includes notable increases in industrial metals, precious metals, agricultural commodities, and oil. The impact of rising oil prices on consumer gasoline costs underscores the broader economic implications.

Traders in the federal-funds futures market anticipate potential rate cuts by the Fed, although expectations have moderated compared to earlier in the year. The prevailing macroeconomic data suggests limited Fed intervention, barring significant disinflationary pressures or adverse labor market conditions.

Despite recent declines, the stock market remains susceptible to volatility, particularly in the technology sector, as evidenced by the Nasdaq Composite’s extended losing streak. Overall, the market landscape reflects a delicate balance between economic growth, inflationary pressures, and monetary policy considerations.