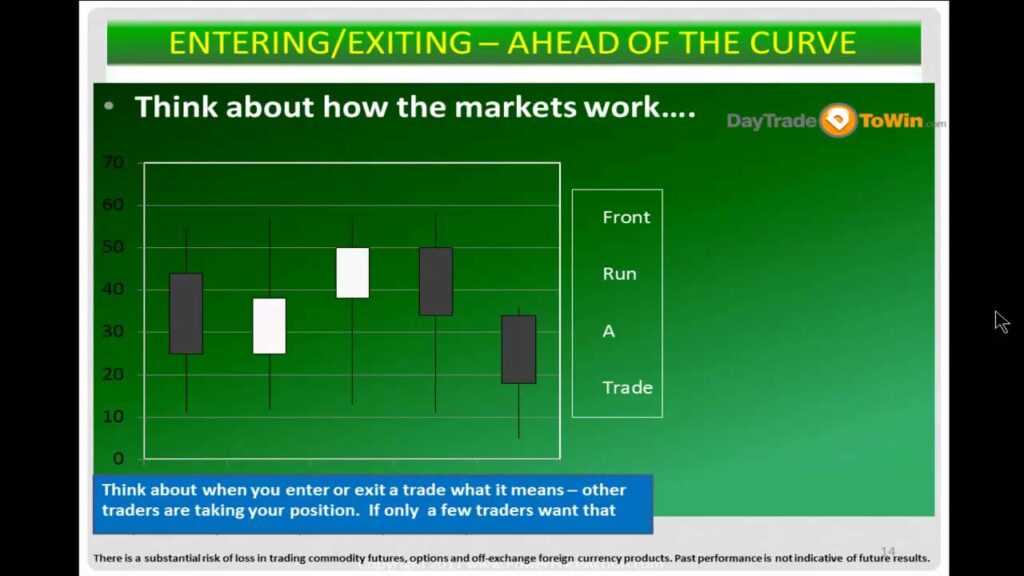

DTI Webinar – Trading Price Action with John Paul

Yesterday, John took part in an educational webinar event hosted by DTI. The video above shows John’s presentation, where he covered the benefits of price action trading. He also discussed how most traders think, front running trades, essential tools and chart configurations, stop and entry placement, problems with using indicators, exact trading setups, and how […]

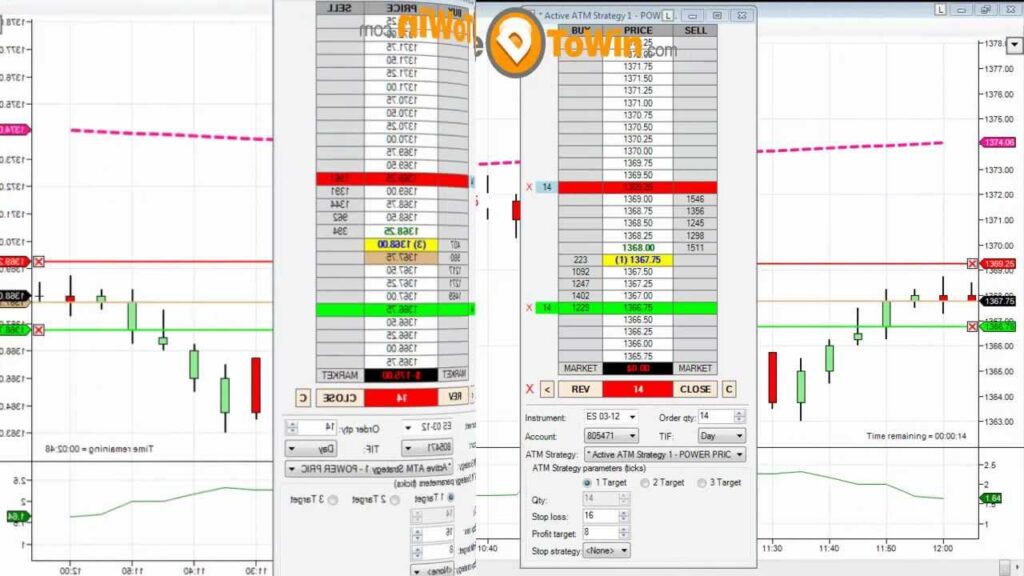

Using NinjaTrader’s ATM Strategy

How many times have you had price hit your profit target without anything happening? Probably over and over again on the same trade, right? And to make matters worse, price then runs away from you, so you’ve lost out on the trade entirely. Yes, it happens to everyone. It’s not just bad luck. Trading is […]

Are You a Setup Trader?

What type of trader are you? I was asked this question recently and the first answer that came to mind was “I’m a setup trader.” Now this phrase may be confusing, but it really explains how I look at trading the markets. I teach traders how to identify specific setups in order to validate trades. […]

The Gold Fix – An Example of Market Manipulation

Most of you who follow my blog know that I consider to price action as the best way to trade. I also bring to light how the markets are artificially manipulated in one way or another. In the Private Mentorship Program, I demonstrate a way to capitalize on this manipulation – the “RoadMap Trade.” It’s […]

Yesterday’s Webinar – Live Opportunities Spotted by Atlas Line

In case you missed it, here is yesterday’s price action webinar. With many traders in attendance, John shared his live NinjaTrader charts while explaining how the Atlas Line software works. For those of you who are new to Day Trade to Win, the Atlas Line is software that plots a line on your charts and […]

E-Mini Recap – Three Days of Atlas Line Trading

Here’s a trading video showing today’s Atlas Line short trade. Prepare to be held in suspense – the outcome is shown at the end of the video. In between, John describes three consecutive days trading the E-Mini S&P using the Atlas Line software. You’ll also hear John identify Strength and Pullback trades. These unique setups […]

Trading Reminder – Today is Contract Rollover Day

Traders – you should already know what today (March 8, 2012) is. Contract rollover day! Yes, this is the day when we (traders of equity futures contracts) switch to the next contract session – in this case, June. We always roll over the first or second Thursday or Friday of the expiring contract month. These […]

Live Leap Year Trade – E-Mini S&P

Here’s a video of a live trade John took yesterday on the E-Mini using the Atlas Line. Note that the trade setup in use is called a Pullback, the rules of which are taught in the live training that’s included with purchase. John uses the ATR (Average True Range) to indicate the profit target and […]

Backup Plan When the E-Mini Won’t Work

The E-Mini S&P is a great market to trade – unless it’s slow. Well, it’s been slow. There are numerous videos that I’ve created detailing when to just say NO to trading the E-Mini under undesirable conditions. What is considered slow? I use a 5-Min chart in conjunction with the ATR (Average True Range) set […]

Live Price Action Webinar from February 3, 2012

John Paul once again proves that successful day trading can be easy. The video starts with showing you how to take advantage of the large bullish news event candle at around 8:30 a.m. US/Eastern. A common mistake is made when trying to interpret the news as either positive or negative, then entering based on your […]